- United States

- /

- Communications

- /

- NasdaqGS:EXTR

Investors Who Bought Extreme Networks (NASDAQ:EXTR) Shares Three Years Ago Are Now Up 81%

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the Extreme Networks, Inc. (NASDAQ:EXTR) share price is up 81% in the last three years, clearly besting than the market return of around 38% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 34%.

Check out our latest analysis for Extreme Networks

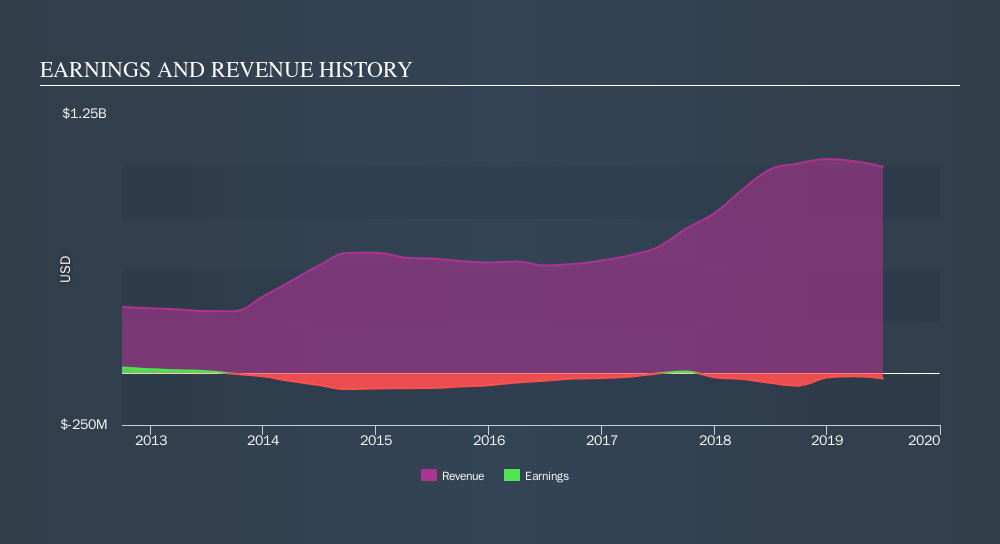

Because Extreme Networks is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Extreme Networks's revenue trended up 27% each year over three years. That's much better than most loss-making companies. While the compound gain of 22% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Extreme Networks. If the company is trending towards profitability then it could be very interesting.

If you are thinking of buying or selling Extreme Networks stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Extreme Networks shareholders have received a total shareholder return of 34% over the last year. That's better than the annualised return of 9.8% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Extreme Networks it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EXTR

Extreme Networks

Provides software-driven networking solutions worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives