- United States

- /

- Communications

- /

- NasdaqCM:EMKR

The EMCORE (NASDAQ:EMKR) Share Price Is Down 64% So Some Shareholders Are Wishing They Sold

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of EMCORE Corporation (NASDAQ:EMKR) have had an unfortunate run in the last three years. Unfortunately, they have held through a 64% decline in the share price in that time. And more recent buyers are having a tough time too, with a drop of 33% in the last year. It's up 2.7% in the last seven days.

See our latest analysis for EMCORE

Because EMCORE made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, EMCORE's revenue dropped 8.4% per year. That is not a good result. The share price decline of 29% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

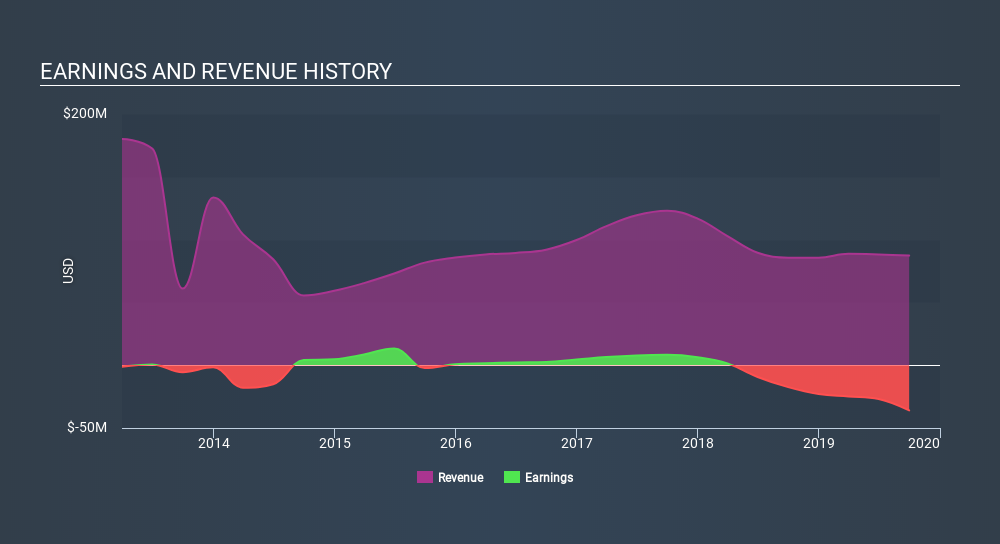

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

While share prices often depend primarily on earnings and revenue, they can be sensitive to an investment's risk level as well. For example, we've discovered 4 warning signs for EMCORE which any shareholder or potential investor should be aware of.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between EMCORE's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. EMCORE hasn't been paying dividends, but its TSR of -64% exceeds its share price return of -64%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 32% in the last year, EMCORE shareholders lost 33%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:EMKR

Emcore

Designs and manufactures fiber optic gyro, ring laser gyro, and quartz micro-electromechanical system inertial sensors and systems in the United States, Canada, Asia, Europe, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives