- United States

- /

- Communications

- /

- NasdaqGS:DGII

What Digi International (DGII)'s New IoT Connectivity Launches Signal for Its Recurring Revenue Ambitions

Reviewed by Simply Wall St

- In recent days, Digi International launched its Digi XBee® for Wi-SUN® solution and unveiled a new IEC 60601-1 compliant Digi Connect® EZ 4 serial server for medical environments, targeting mission-critical IoT connectivity across healthcare, smart city, utility, and industrial applications.

- These product introductions highlight Digi's focus on expanding secure, recurring revenue offerings with advanced cloud management and deep integration into essential infrastructure sectors.

- We'll explore how Digi's accelerated move into secure IoT solutions, particularly with the Wi-SUN® platform, impacts its longer-term investment case.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Digi International Investment Narrative Recap

To be a shareholder in Digi International, you need confidence in the company’s long-term shift to recurring revenue and secure IoT solutions, supported by continued customer adoption across mission-critical sectors. The latest product releases primarily reaffirm Digi's direction but do not materially affect the most significant near-term catalyst: sustained growth in annual recurring revenue. The primary risk remains any slowdown in recurring revenue, particularly given management's flat topline guidance for 2025.

Of recent announcements, the debut of Digi XBee for Wi-SUN stands out for its relevance to the company’s focus on secure, interoperable IoT platforms and cloud-based network management. This initiative supports Digi’s ambitions around scalable subscription offerings, aiming to generate more predictable, higher-margin revenues, a key near-term catalyst cited by management for profit expansion. Yet, even as these solutions take center stage, investors should keep in mind…

Read the full narrative on Digi International (it's free!)

Digi International's outlook anticipates revenue of $497.0 million and earnings of $72.6 million by 2028. This scenario assumes annual revenue growth of 5.7% and a $29.9 million increase in earnings from the current level of $42.7 million.

Uncover how Digi International's forecasts yield a $40.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

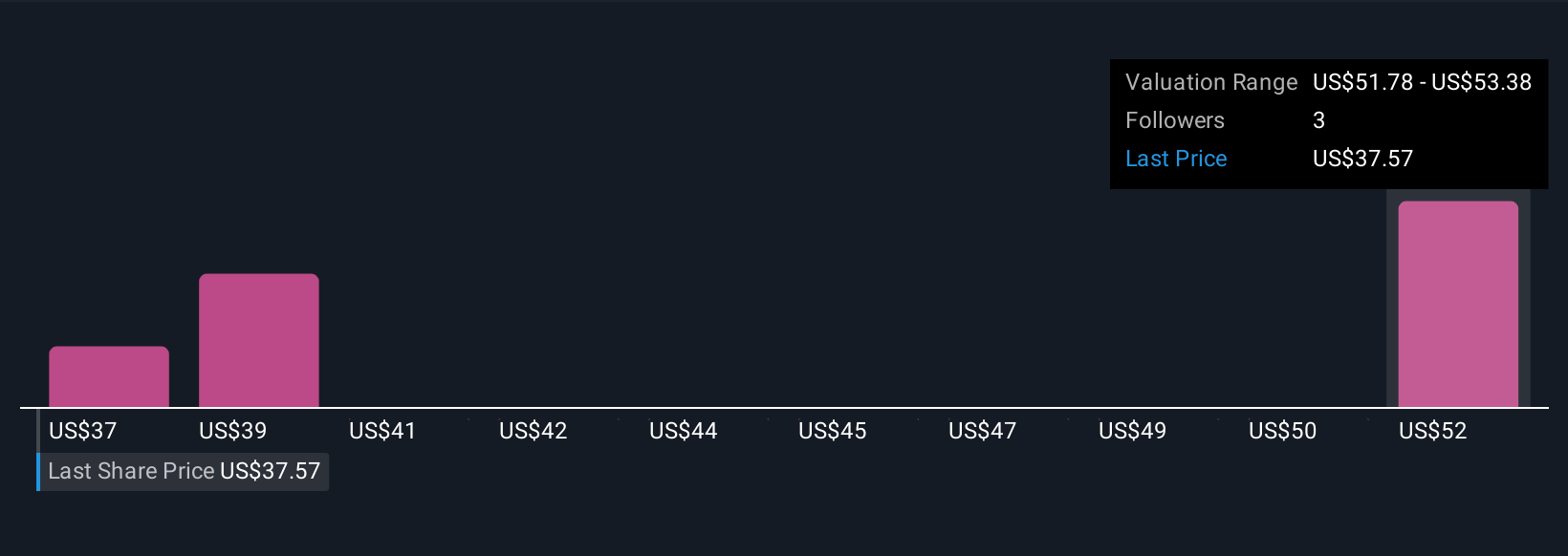

Three Simply Wall St Community members estimate Digi International’s fair value between US$36.13 and US$53.47 per share. However, as Digi’s ARR-driven model takes precedence, the possibility of hardware revenue pressure should not be overlooked; explore these diverse perspectives for a broader context.

Explore 3 other fair value estimates on Digi International - why the stock might be worth as much as 50% more than the current price!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DGII

Digi International

Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives