- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Should Cisco Systems’ (CSCO) AI-Powered Cybersecurity Launch in Toronto Shape Investor Expectations?

Reviewed by Sasha Jovanovic

- Earlier this week, Cisco launched its AI-Powered Security Operations Centre (SOC) showcase at the Toronto Innovation Centre, offering Canadian organizations an interactive environment to experience advanced, AI-driven cybersecurity technologies in action.

- This initiative highlights the rising need for digital resilience, as Cisco’s own research shows the vast majority of Canadian organizations have faced AI-related cyber incidents in the past year while critical cybersecurity skill gaps persist.

- We’ll examine how Cisco’s focus on immersive, AI-driven cybersecurity innovation could influence its investment narrative and long-term growth outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cisco Systems Investment Narrative Recap

To be a Cisco shareholder today, you need to believe the company can harness rising AI infrastructure and enterprise digitization trends into recurring revenue, while keeping up with fast-evolving cybersecurity needs and fending off cloud-native and low-cost competitors. The AI-Powered Security Operations Centre (SOC) launch in Toronto highlights Cisco’s push to address persistent cybersecurity skill gaps and the ongoing wave of AI-driven threats. However, on its own, this event has limited direct impact on the most important short-term catalyst, increased customer adoption of Cisco's security and software solutions, and does not materially change Cisco’s biggest risk: lagging security revenue growth versus targets, which could constrain future earnings and margins.

Among recent announcements, the October partnership with NetApp to integrate the NetApp AFX architecture and Cisco Nexus switches for AI workloads is particularly relevant. This deal reinforces Cisco’s critical role in enabling scalable, enterprise-grade AI adoption and supports the catalyst of strong AI-driven infrastructure demand, a key driver of Cisco’s growth narrative this year.

Yet, as Cisco continues pushing to grow its higher-margin security and software businesses, investors should also be aware that, in contrast to the upbeat story, ongoing margin pressures from aggressive competition and a shift toward cloud-based solutions mean ...

Read the full narrative on Cisco Systems (it's free!)

Cisco Systems' narrative projects $65.2 billion revenue and $14.0 billion earnings by 2028. This requires 4.8% annual revenue growth and a $3.8 billion earnings increase from $10.2 billion today.

Uncover how Cisco Systems' forecasts yield a $75.81 fair value, a 7% upside to its current price.

Exploring Other Perspectives

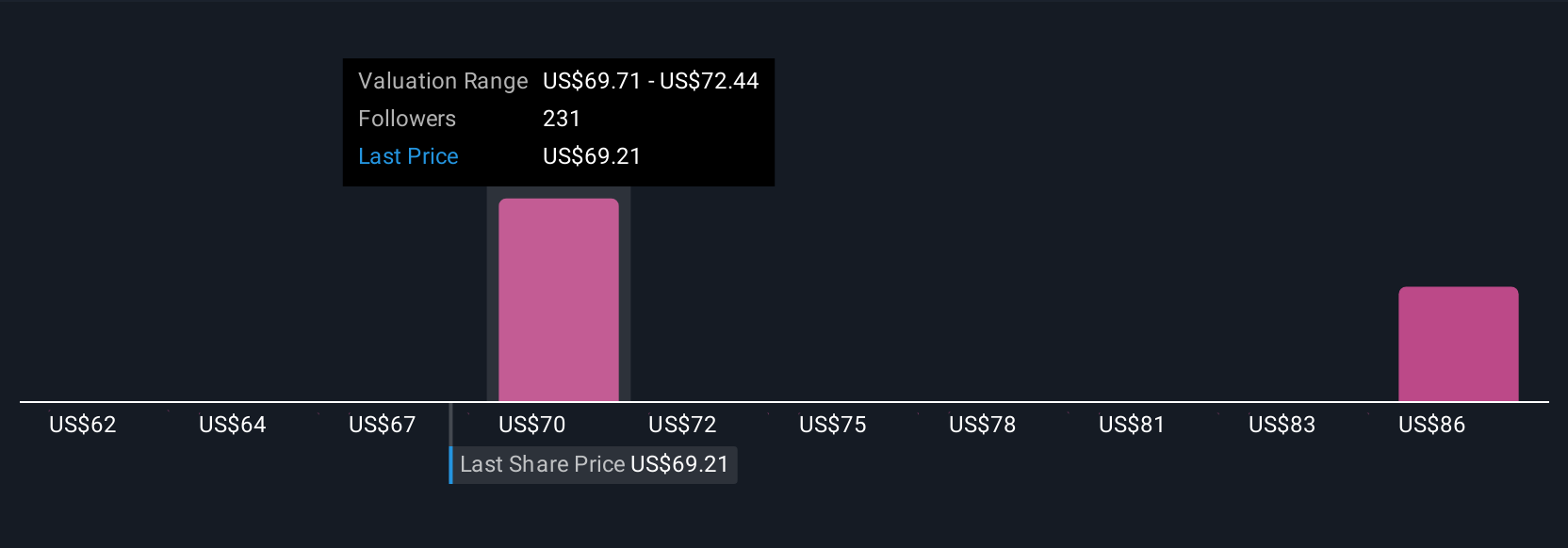

Nine Simply Wall St Community estimates range from US$60.75 to US$75.81 per share, reflecting substantial variety in growth assumptions. While many expect AI-driven demand to boost recurring revenue, you should consider how competition and market shifts could shape Cisco’s performance, explore several viewpoints to inform your own opinion.

Explore 9 other fair value estimates on Cisco Systems - why the stock might be worth as much as 7% more than the current price!

Build Your Own Cisco Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cisco Systems research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cisco Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cisco Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion