- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Is Cisco Fairly Priced After Its Strong 2025 Run and AI Infrastructure Push?

Reviewed by Bailey Pemberton

- If you have been wondering whether Cisco Systems is still a buy after its big run, you are not alone. This article is all about what the current price really says about its value.

- Despite a minor 0.2% pullback over the last week, the stock is up 2.6% over 30 days and 32.2% year to date, adding to a 35.9% gain over 1 year and more than doubling over 5 years.

- Those gains have come as investors refocus on Cisco's role in network infrastructure and security, especially as enterprises modernize their data centers and prepare for AI driven workloads. Recent announcements around expanded cloud networking offerings and security integrations have reinforced the narrative that Cisco is positioning itself as a long term backbone of digital infrastructure. This helps explain why the stock has stayed in favor.

- Based on Simply Wall St's valuation checks, Cisco scores a 4 out of 6 on undervaluation metrics, suggesting some aspects of the market may still be underestimating it. Next we will break that down using several valuation approaches, and then finish with a more complete way of thinking about what Cisco is really worth.

Approach 1: Cisco Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects the cash Cisco Systems is expected to generate in the future and then discounts those cash flows back to what they are worth today in dollars.

Cisco currently generates about $12.9 billion in free cash flow, and analysts plus Simply Wall St projections see this rising steadily over the next decade. For example, forecast free cash flow is expected to reach around $14.5 billion in 2026 and about $21.6 billion by 2035, with later years extrapolated by Simply Wall St after analyst visibility fades.

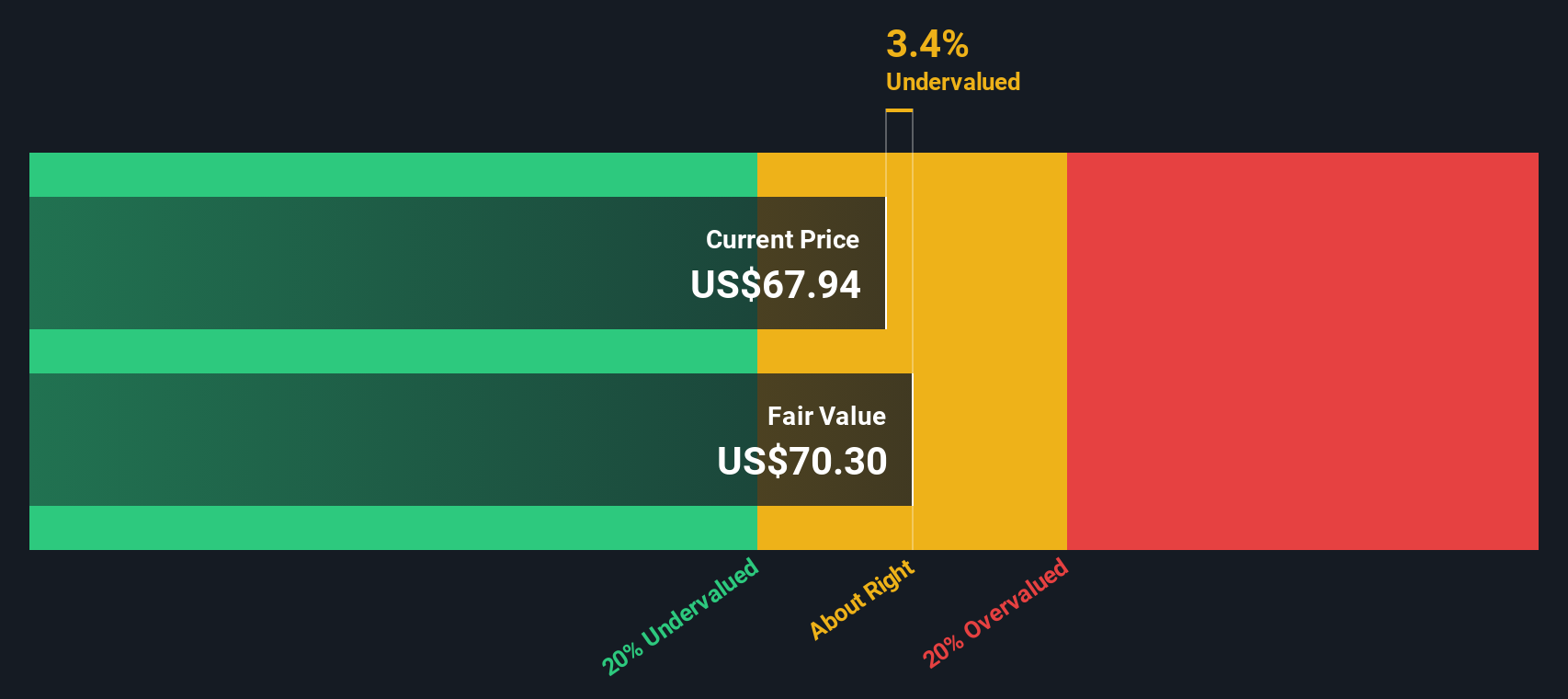

When all these projected cash flows are discounted back to today using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at about $82.02 per share. That implies Cisco is trading at roughly a 4.8% discount to its DCF fair value, suggesting the market price is close to, but slightly below, what long term cash flows justify.

Result: ABOUT RIGHT

Cisco Systems is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Cisco Systems Price vs Earnings

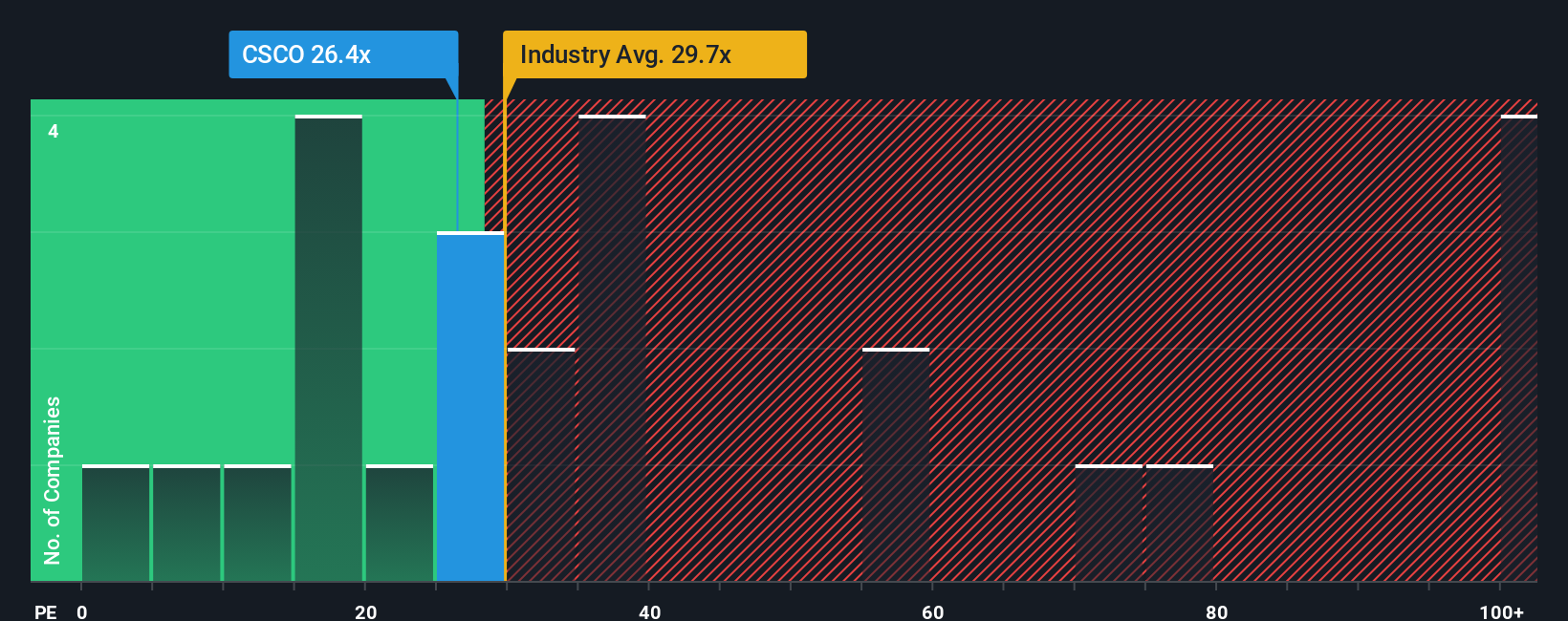

For profitable, mature companies like Cisco, the price to earnings ratio is a useful way to gauge value because it links what investors pay today to the profits the business is currently generating. A higher PE can be justified when investors expect stronger growth or see the earnings stream as relatively low risk, while slower growth or higher risk usually calls for a lower, more conservative PE.

Cisco currently trades on a PE of about 29.9x, which sits below both the Communications industry average of around 33.7x and the broader peer group near 36.0x. To go a step further, Simply Wall St calculates a Fair Ratio of 30.3x, which is the PE you might expect for Cisco given its specific mix of earnings growth, margins, industry positioning, market cap and risk profile.

This Fair Ratio is more insightful than a simple peer or industry comparison because it adjusts for Cisco's own fundamentals rather than assuming all companies deserve the same multiple. With the actual PE of 29.9x sitting very close to the 30.3x Fair Ratio, the stock looks broadly aligned with what its earnings profile justifies.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cisco Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Cisco’s future with the numbers behind it. A Narrative is your story about a company, translated into concrete assumptions for revenue growth, profit margins and valuation multiples that then roll into a clear fair value estimate. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you from story, to forecast, to fair value so you can quickly compare that fair value with Cisco’s current share price and decide whether it looks like a buy, hold, or sell. Because Narratives update dynamically as new news, earnings and guidance arrive, your view of Cisco can evolve in real time rather than staying fixed on outdated assumptions. For example, one Cisco Narrative might lean bullish, assuming faster AI driven networking growth and a fair value near the high end of analyst targets around $87, while another more cautious Narrative could focus on security and competitive risks and point closer to the low end near $61. This can help you decide which story you believe and how to act on it.

Do you think there's more to the story for Cisco Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion