- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Cisco Shares Up 29% in 2025: What Do Valuation Metrics Reveal Now?

Reviewed by Bailey Pemberton

If you have been tracking Cisco Systems lately, you are probably wondering whether now is the right moment to buy in, hang tight, or take some profits off the table. The stock has been climbing steadily, closing most recently at $70.27. In just the past week alone, Cisco shares are up 1.7%, with a 4.0% gain for the month. Year to date, returns are a healthy 18.9%, and if you zoom out to one year, the stock has soared an impressive 28.8%. Look back even further and the gains become even more staggering. The stock is up 72.7% over three years and 128.2% across five years. It is no exaggeration to say that Cisco has delivered for long-term investors.

Some of this momentum can be traced to the company’s growing focus on strengthening its networking hardware lineup and ongoing expansion into cybersecurity and software services. These changes have not only reassured existing shareholders about Cisco’s ability to adapt, but have also drawn in fresh interest from investors looking for resilient tech plays.

Now, the big question is whether Cisco’s current valuation still presents an opportunity. By our count, Cisco checks the box for being undervalued in 4 out of 6 major valuation metrics, giving it a value score of 4. That certainly puts the company in the spotlight for value-oriented investors. But what exactly does that mean, and how do these different valuation checks stack up against one another? Let’s dive into each approach, then discuss an even more effective way to make sense of Cisco’s true value.

Why Cisco Systems is lagging behind its peers

Approach 1: Cisco Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those amounts back to today's dollars. Essentially, it answers the question, "What are the future cash flows worth right now?" This approach is especially useful when analyzing established businesses with stable cash generation, such as Cisco Systems.

Currently, Cisco generates Free Cash Flow of $13.4 Billion. Analysts expect this number to reach $17.5 Billion by 2030, with incremental growth over the coming years. The near-term projections, which cover the next five years, are drawn from analyst surveys. Longer-range forecasts rely on reasonable extrapolations of past growth rates and industry expectations. In Cisco's case, Simply Wall St projects steady but moderate growth in Free Cash Flow across the next decade, reflecting the company’s strong fundamentals and disciplined capital allocation.

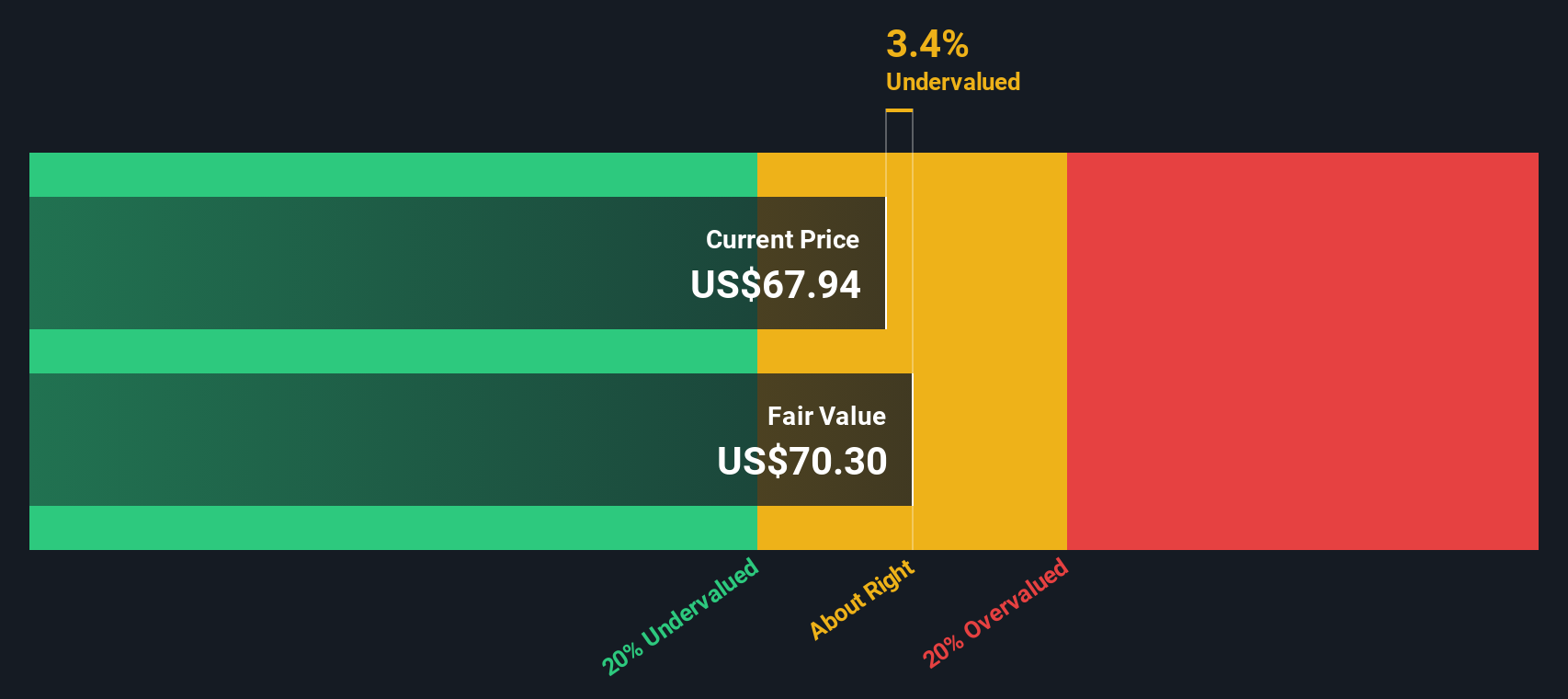

Based on this DCF model, Cisco’s intrinsic value is estimated at $70.77 per share. When compared to the most recent closing price of $70.27, the stock appears 0.7% undervalued versus its underlying cash-generation potential. For most investors, this margin is too slim to represent a meaningful discount.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Cisco Systems's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Cisco Systems Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used measure when valuing profitable companies like Cisco Systems. This metric helps investors see how much they are paying for each dollar of the company’s earnings, making it especially useful for mature businesses with a steady earnings profile.

A company’s “normal” or “fair” PE ratio is influenced by several factors. If investors expect higher growth from a company, they are typically willing to pay a higher PE. Riskier businesses or those with slower growth tend to command a lower multiple. Comparing a company’s PE to its industry can provide some context, but it does not always reflect nuances in growth potential, profitability, or risk.

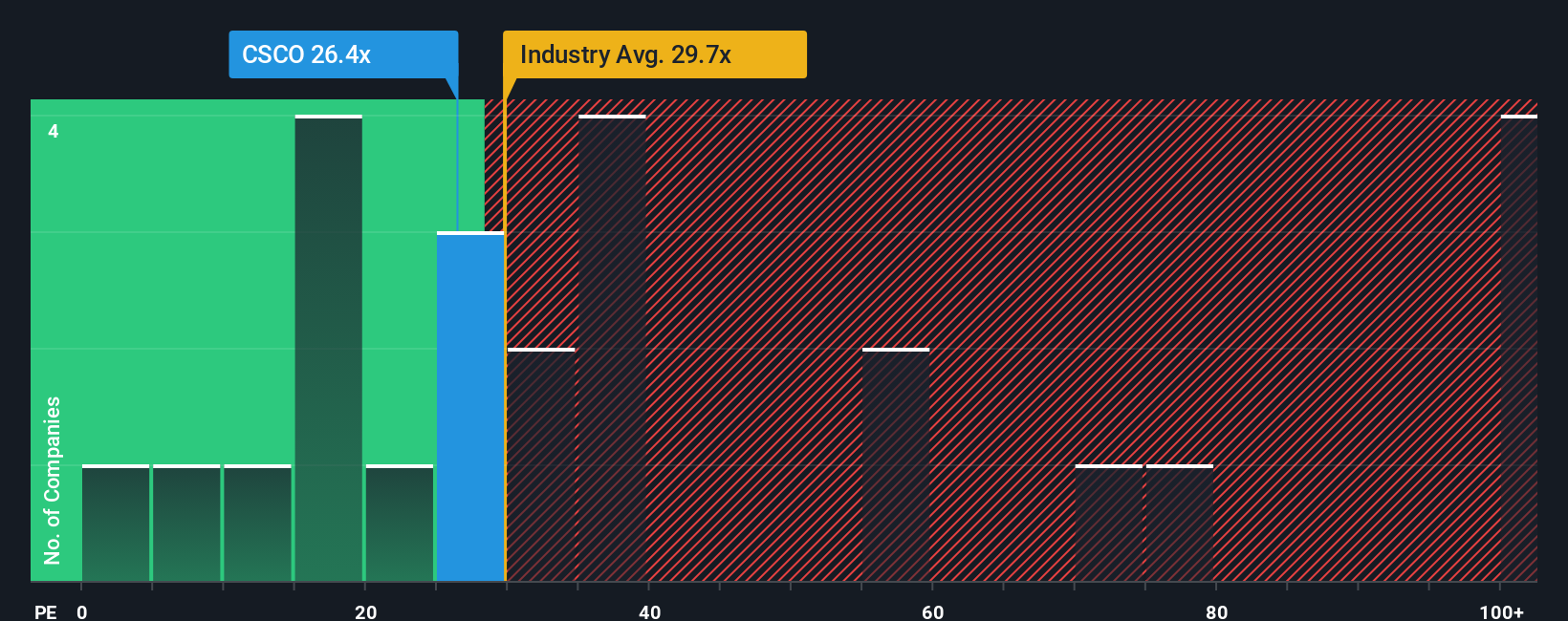

Cisco is currently trading at a PE of 27.29x. This figure sits below the peer average of 81.91x and the communications industry average of 30.67x, suggesting a more cautious pricing by the market. To provide a more tailored benchmark, Simply Wall St’s “Fair Ratio” incorporates elements such as Cisco’s expected earnings growth, profit margins, risk profile, market capitalization, and industry characteristics. The Fair Ratio for Cisco is 32.95x, which is designed to provide a more precise valuation than broad peer or industry comparisons.

With Cisco’s current PE ratio of 27.29x close to, but still below, the Fair Ratio of 32.95x, the stock appears to be trading at ABOUT RIGHT levels based on earnings and its risk-return profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cisco Systems Narrative

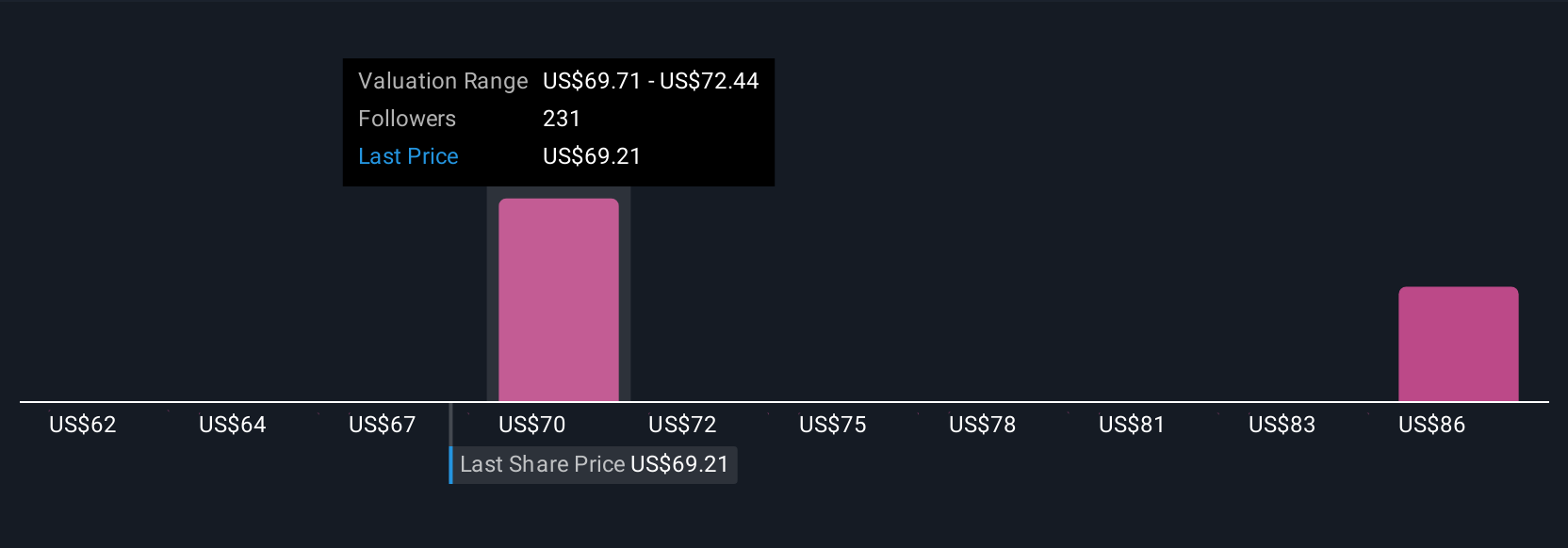

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, backed by your own assumptions around its future, such as what you think about Cisco’s growth in AI, cloud adoption, or margins, and how those translate into numbers such as future revenues, earnings, and ultimately, a fair value.

Unlike traditional metrics, Narratives connect the qualitative story you believe in with a quantitative forecast, letting you see the numbers behind your investment thesis and compare your calculated Fair Value to the actual stock price. Narratives are easy to create and update on Simply Wall St’s Community page, giving you access to a popular tool trusted by millions of investors worldwide.

Because Narratives are dynamic, they automatically update as news or results come in, keeping your fair value relevant over time. For example, some investors believe Cisco’s shift to AI-powered and recurring revenue will drive major expansion, supporting a price target as high as $87. Others are more cautious about margin pressure or competition, setting their Fair Value closer to $61. With Narratives, you can see these different perspectives, test your own, and make smarter buy or sell decisions based on the story and numbers you believe in.

Do you think there's more to the story for Cisco Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, developes, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives