- United States

- /

- Tech Hardware

- /

- NasdaqGS:CRSR

Can Corsair (CRSR) Leverage Call of Duty Partnership to Strengthen Its Gaming Ecosystem Narrative?

Reviewed by Sasha Jovanovic

- Call of Duty announced an expanded collaboration with Corsair Gaming, introducing a full lineup of Black Ops 7 themed products across CORSAIR’s SCUF Gaming, Elgato, and OriginIN PC brands.

- An interesting insight is that a Corsair board director recently acquired 100,000 shares, which may signal leadership confidence to the market following recent executive updates and product launches.

- We'll examine how the expanded Call of Duty partnership could shape Corsair’s investment narrative and appeal within the console and PC gaming market.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Corsair Gaming Investment Narrative Recap

To see value as a Corsair Gaming shareholder, you need to believe that demand for branded PC and console peripherals will accelerate, driven by high-profile game releases and deepening collaborations with top franchises. While the expanded Call of Duty partnership boosts Corsair’s brand visibility and could energize short-term product sales, it does not fundamentally change the most important near-term catalyst, growth in content creation and high-end gaming market demand. The biggest risk remains uncertainty around new semiconductor tariffs, which could pressure margins and disrupt profitability if not managed carefully.

The launch of Black Ops 7 themed products across Corsair’s SCUF Gaming and Elgato brands illustrates Corsair’s focus on leveraging partnerships with industry-leading game franchises. This move ties directly to the core growth catalyst: increasing hardware adoption driven by popular gaming titles and the trend toward richer, more immersive content creation, supporting higher-margin product segments and recurring revenue opportunities.

However, in contrast, investors should be aware that potential disruptions linked to unresolved semiconductor tariffs could still...

Read the full narrative on Corsair Gaming (it's free!)

Corsair Gaming's outlook anticipates $1.9 billion in revenue and $75.7 million in earnings by 2028. This scenario depends on a 10.6% annual revenue growth rate and a $159.8 million increase in earnings from the current level of -$84.1 million.

Uncover how Corsair Gaming's forecasts yield a $10.19 fair value, a 68% upside to its current price.

Exploring Other Perspectives

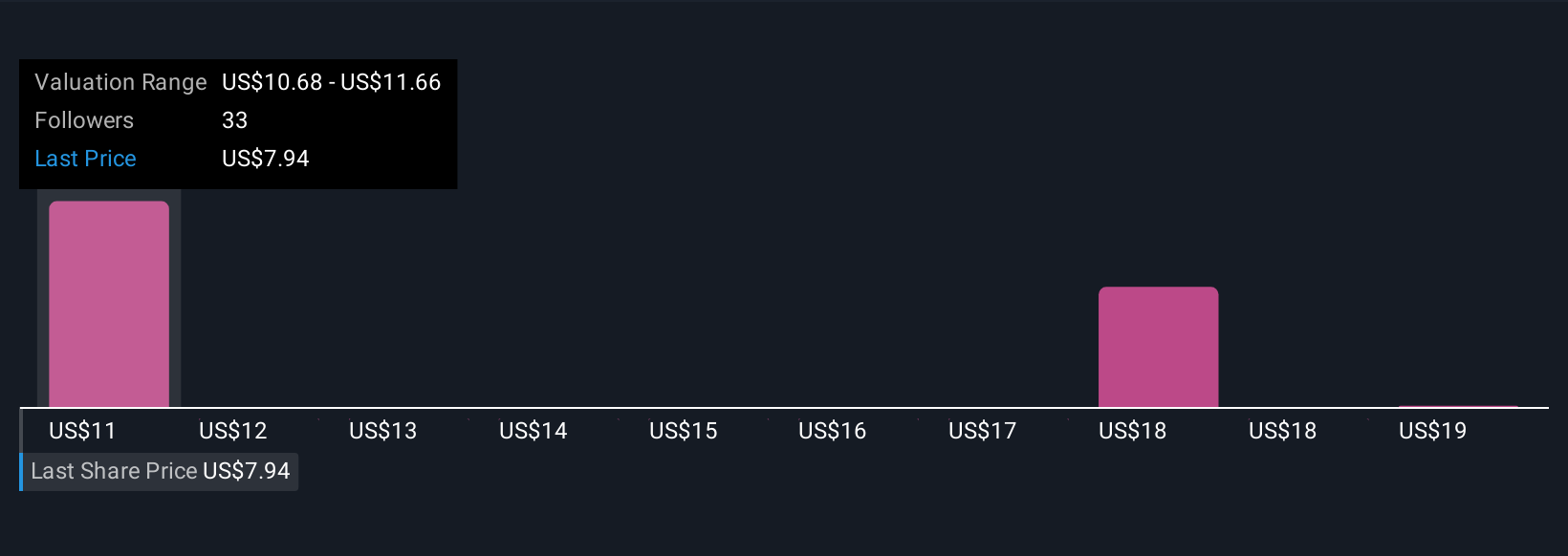

Simply Wall St Community members set fair value estimates for Corsair Gaming between US$9 and US$27.65, with seven distinct perspectives represented. With tariff risks in play for profitability, it is worth comparing these views if you want a fuller picture of the company’s outlook.

Explore 7 other fair value estimates on Corsair Gaming - why the stock might be worth just $9.00!

Build Your Own Corsair Gaming Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corsair Gaming research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Corsair Gaming research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corsair Gaming's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRSR

Corsair Gaming

Designs and sells gaming and streaming peripherals, components, and systems in Europe, the Middle East, North Africa, North America, Latin America, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives