- United States

- /

- Communications

- /

- NasdaqGS:CRNT

Is Ceragon Networks's (NASDAQ:CRNT) Share Price Gain Of 101% Well Earned?

Ceragon Networks Ltd. (NASDAQ:CRNT) shareholders might be concerned after seeing the share price drop 24% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 101% the gain in that time. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 43% decline over the last twelve months.

See our latest analysis for Ceragon Networks

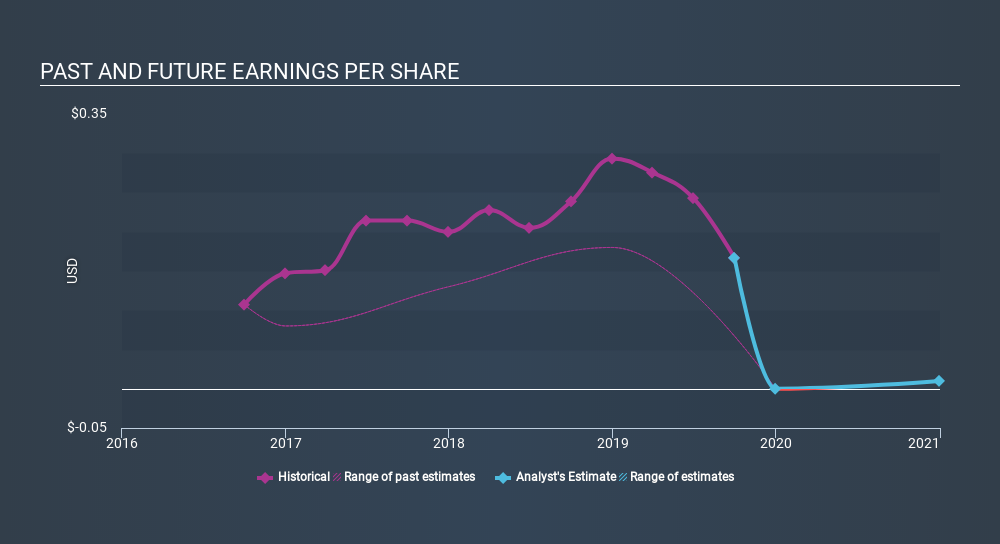

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Ceragon Networks moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. In fact, the Ceragon Networks stock price is 25% lower in the last three years. Meanwhile, EPS is up 16% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -9.2% a year for three years.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Ceragon Networks shareholders are down 43% for the year, but the market itself is up 37%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 15% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before forming an opinion on Ceragon Networks you might want to consider these 3 valuation metrics.

We will like Ceragon Networks better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CRNT

Ceragon Networks

Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives