- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

If You Like EPS Growth Then Check Out PC Connection (NASDAQ:CNXN) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like PC Connection (NASDAQ:CNXN), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for PC Connection

How Quickly Is PC Connection Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. PC Connection managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

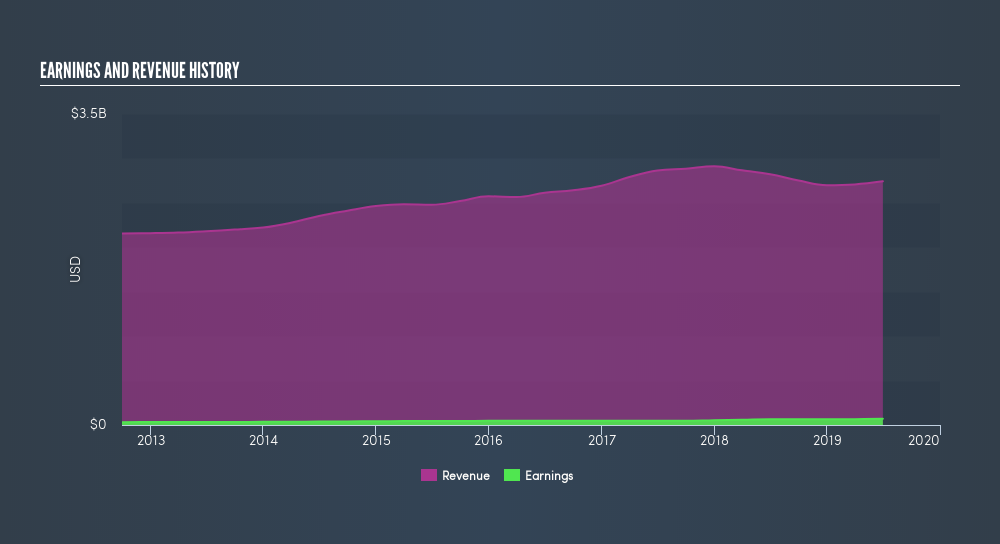

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). PC Connection's EBIT margins are flat but, of some concern, its revenue is actually down. And that does make me a little more cautious of the stock.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of PC Connection's forecast profits?

Are PC Connection Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own PC Connection shares worth a considerable sum. To be specific, they have US$36m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 3.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add PC Connection To Your Watchlist?

One positive for PC Connection is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if PC Connection is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives