- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

Did Data Center and AI-Focused Growth Just Shift PC Connection's (CNXN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, PC Connection (NASDAQ:CNXN) reported its fifth consecutive quarter of year-over-year net sales growth, driven by increased customer investments in data center upgrades and the transition to Windows 11.

- An interesting takeaway from this update is the company’s strong customer pipeline in advanced technologies such as AI and edge computing, which could benefit from ongoing enterprise IT modernization initiatives.

- We'll now explore how this continued momentum in data center and technology investments could influence PC Connection's broader investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PC Connection Investment Narrative Recap

For PC Connection shareholders, the key story is the company’s ability to capitalize on ongoing IT refresh cycles, especially as organizations upgrade data centers and migrate to Windows 11. The recent announcement of a fifth straight quarter of net sales growth reinforces confidence in these trends, though the short term remains most sensitive to potential margin compression from increasing hardware commoditization. For now, the risk of gross margin deterioration due to shifting business mix remains present but hasn't materially changed following the latest results.

Among recent announcements, PC Connection’s consistent quarterly dividend, with the latest declaration at US$0.15 per share, stands out. This regular payout reflects stability and may appeal to investors seeking predictable returns, especially as the company works to capture new opportunities in advanced technologies that are driving its current growth momentum.

Yet, in contrast to revenue strength, investors should be mindful that PC Connection’s gross margin is not immune to pressure from shifting product lines and...

Read the full narrative on PC Connection (it's free!)

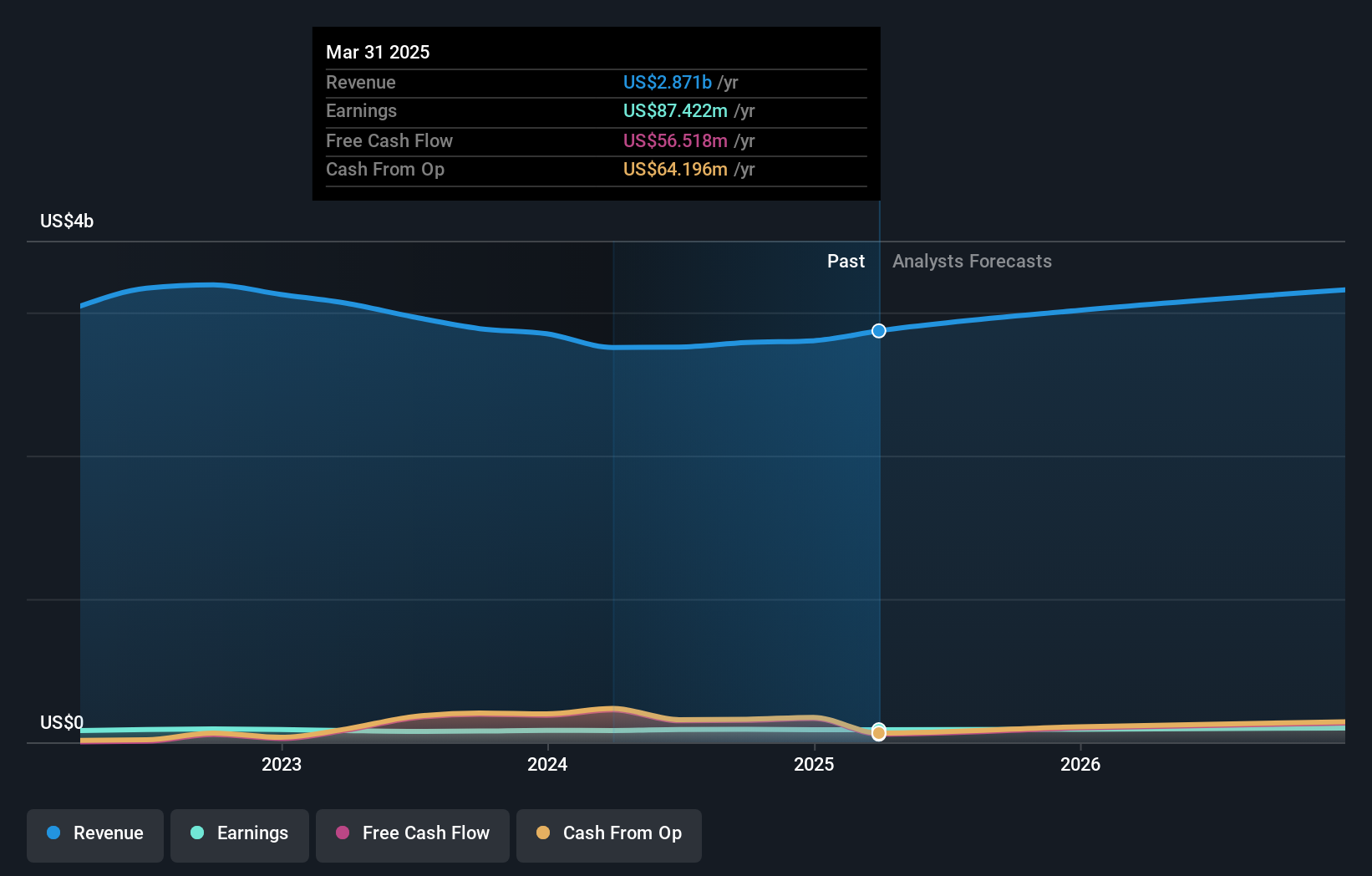

PC Connection's narrative projects $3.4 billion revenue and $116.0 million earnings by 2028. This requires 5.4% yearly revenue growth and a $30.0 million earnings increase from $86.0 million today.

Uncover how PC Connection's forecasts yield a $76.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Three distinct fair value estimates from the Simply Wall St Community range from US$65.56 to US$97.04 per share. While community outlooks differ significantly, many will be closely watching how the strong AI and modernization pipeline translates into future earnings and resilience.

Explore 3 other fair value estimates on PC Connection - why the stock might be worth as much as 64% more than the current price!

Build Your Own PC Connection Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PC Connection research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PC Connection research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PC Connection's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026