- United States

- /

- Communications

- /

- NasdaqGM:CMBM

Slammed 42% Cambium Networks Corporation (NASDAQ:CMBM) Screens Well Here But There Might Be A Catch

The Cambium Networks Corporation (NASDAQ:CMBM) share price has softened a substantial 42% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 82% loss during that time.

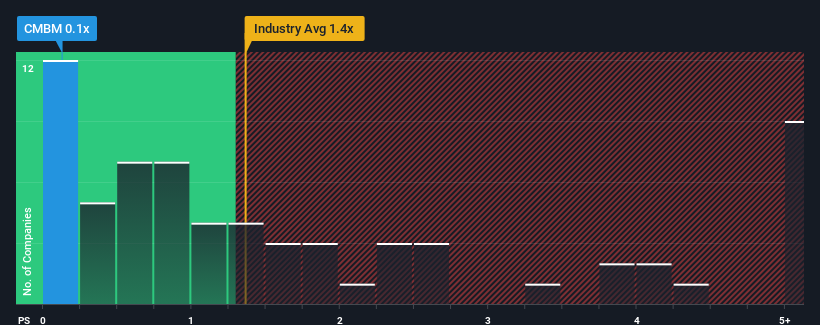

Following the heavy fall in price, it would be understandable if you think Cambium Networks is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Communications industry have P/S ratios above 1.5x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cambium Networks

How Cambium Networks Has Been Performing

Cambium Networks hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cambium Networks.Is There Any Revenue Growth Forecasted For Cambium Networks?

Cambium Networks' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 35%. The last three years don't look nice either as the company has shrunk revenue by 49% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Cambium Networks' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The southerly movements of Cambium Networks' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Cambium Networks' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Cambium Networks (1 is significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Cambium Networks, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CMBM

Cambium Networks

Designs, develops, and manufactures fixed wireless, fiber broadband, and enterprise networking infrastructure solutions in North America, Europe, the Middle East, Africa, the Caribbean and Latin America, and the Asia Pacific.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success