- United States

- /

- Biotech

- /

- NasdaqGM:TLSI

3 Growth Companies With High Insider Ownership Achieving 29% Revenue Growth

Reviewed by Simply Wall St

As major stock indexes in the United States show mixed performance ahead of the Federal Reserve's anticipated interest rate decision, investors are closely monitoring how these changes might impact various sectors. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best, and achieving notable revenue growth can further highlight their potential resilience and adaptability.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's dive into some prime choices out of the screener.

CuriosityStream (CURI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CuriosityStream Inc. is a media and entertainment company that offers factual content across various platforms, with a market cap of $286.25 million.

Operations: The company generates revenue of $66.60 million from its Curiosity Stream segment, which delivers factual content through diverse channels.

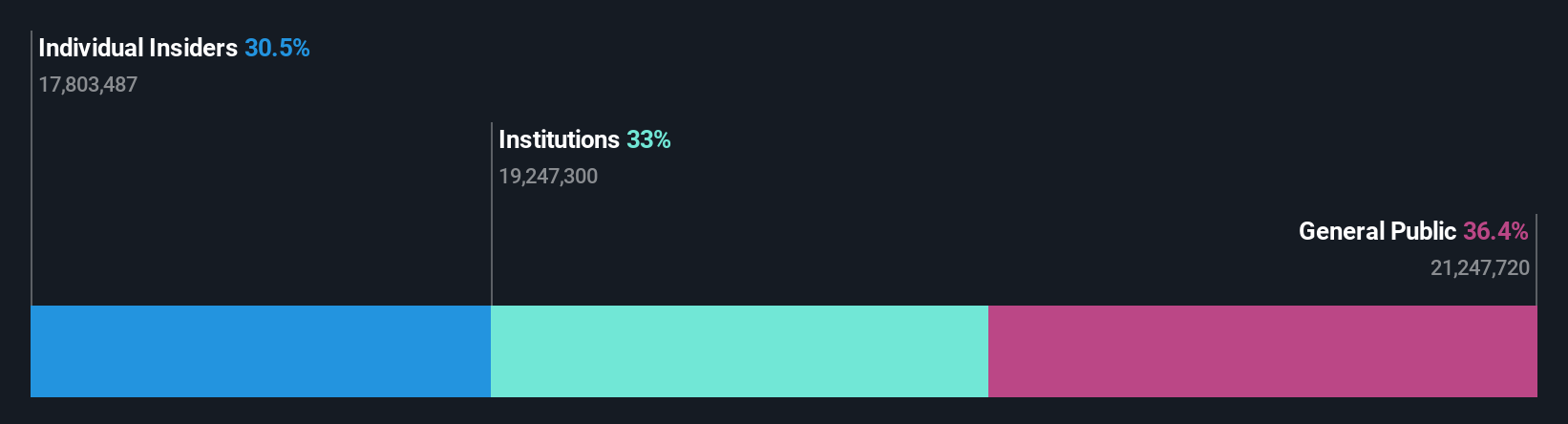

Insider Ownership: 30.5%

Revenue Growth Forecast: 12.6% p.a.

CuriosityStream has experienced a significant increase in sales, reporting US$18.36 million for Q3 2025, up from US$12.6 million the previous year, though it remains unprofitable with a net loss of US$3.74 million. Despite this, the company is expected to become profitable within three years and outpace market revenue growth at 12.6% annually. Recent strategic partnerships and infrastructure enhancements support its expansion in AI training content delivery and global media distribution channels.

- Get an in-depth perspective on CuriosityStream's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility CuriosityStream's shares may be trading at a premium.

Clearfield (CLFD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clearfield, Inc., along with its subsidiaries, designs, manufactures, and distributes fiber management, protection, and delivery products both in the United States and internationally; it has a market cap of $415.59 million.

Operations: The company generates revenue of $150.13 million from its fiber management, protection, and delivery product segments globally.

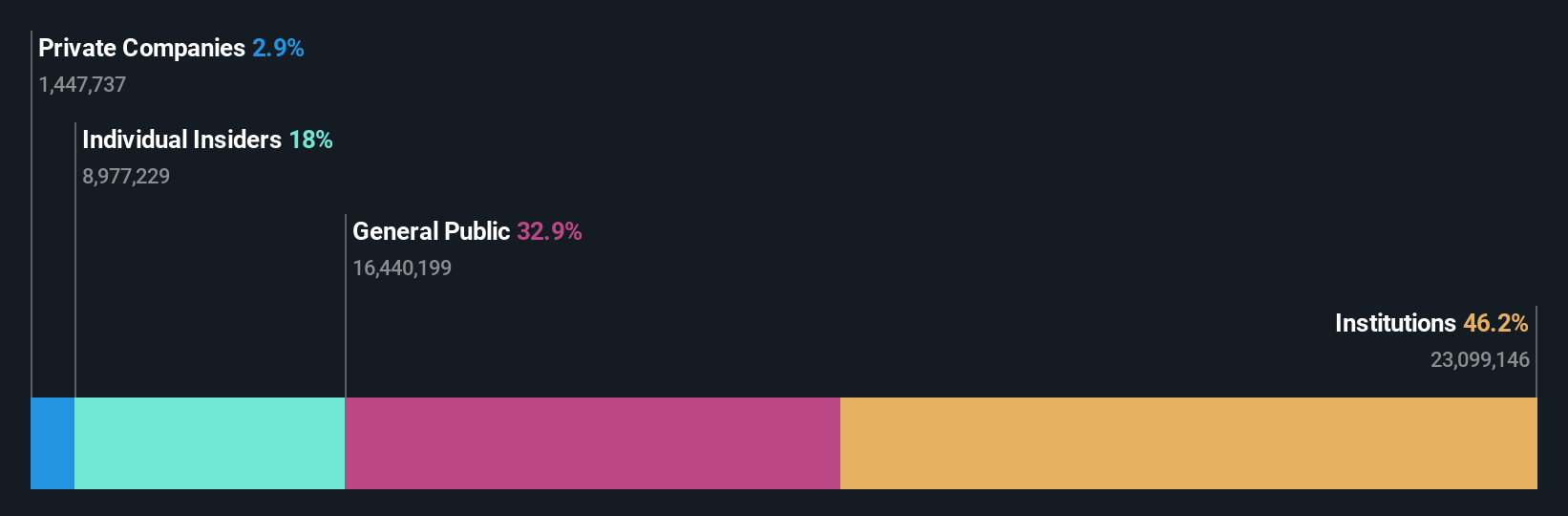

Insider Ownership: 18%

Revenue Growth Forecast: 14.3% p.a.

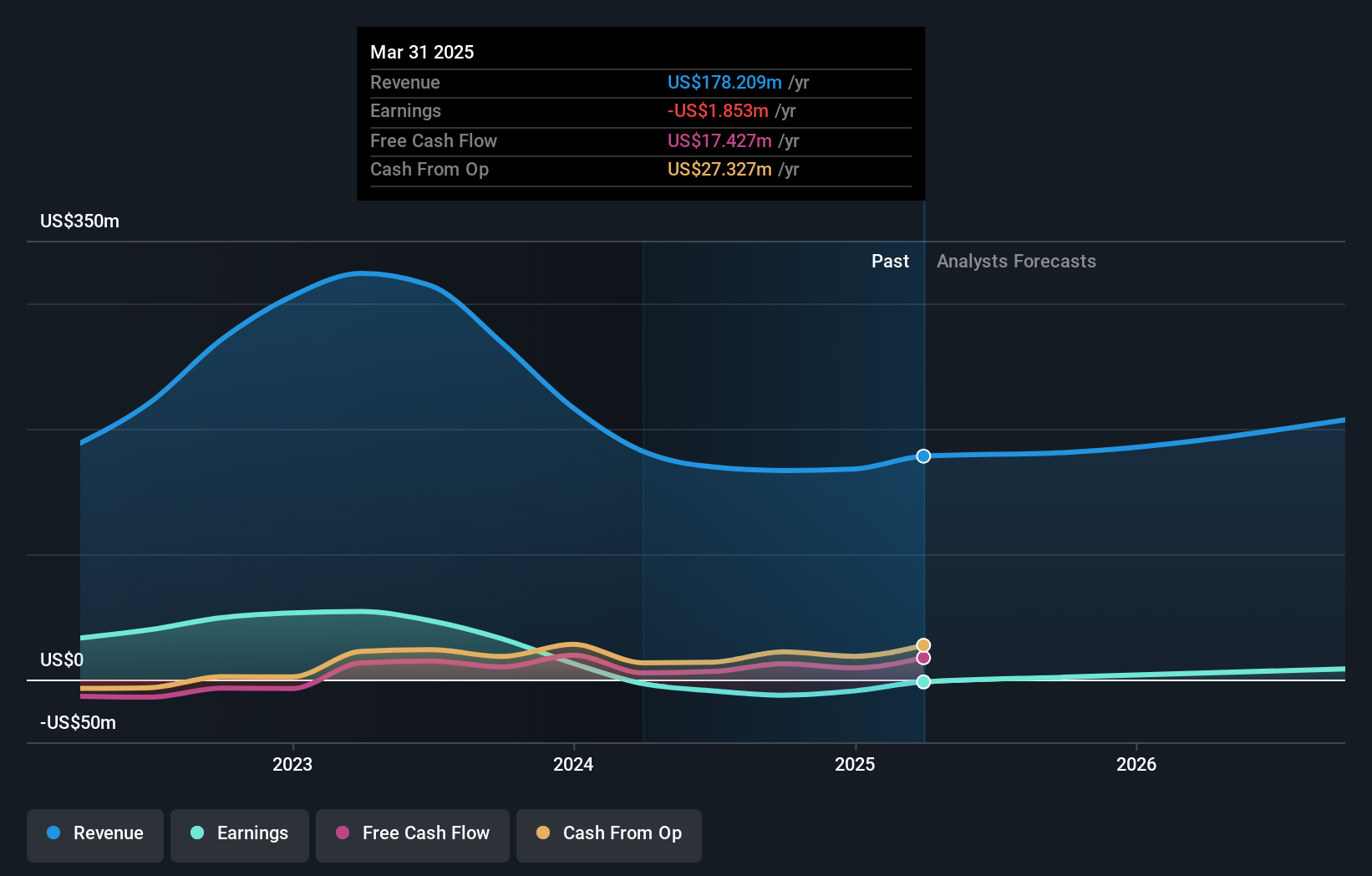

Clearfield's recent earnings report shows a positive trend, with sales increasing to US$150.13 million and net loss narrowing to US$8.05 million for the year ended September 2025. Analysts forecast significant annual earnings growth of 46.2%, outpacing the broader U.S. market, although revenue is expected to grow at a slower pace of 14.3%. The company has completed a substantial share buyback program, enhancing shareholder value, while new leadership appointments aim to drive further strategic growth initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Clearfield.

- The valuation report we've compiled suggests that Clearfield's current price could be quite moderate.

TriSalus Life Sciences (TLSI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TriSalus Life Sciences, Inc. focuses on the research, development, and commercialization of drug delivery technology and immuno-oncology therapeutics aimed at enhancing treatment outcomes for liver and pancreatic cancer patients, with a market cap of approximately $345.25 million.

Operations: The company's revenue segment is derived entirely from its drug delivery technology platform and immuno-oncology therapeutics, totaling $40.21 million.

Insider Ownership: 18%

Revenue Growth Forecast: 29.9% p.a.

TriSalus Life Sciences recently launched the TriNav XP Infusion System, enhancing its drug delivery capabilities. Despite a net loss increase to US$10.81 million in Q3 2025, sales rose to US$11.57 million from US$7.35 million year-over-year. The company reaffirmed a 50% revenue growth target for 2025, driven by TriNav's market expansion. Although shareholders faced significant dilution recently, analysts project robust annual revenue growth of 29.9%, with profitability expected within three years.

- Unlock comprehensive insights into our analysis of TriSalus Life Sciences stock in this growth report.

- Our valuation report unveils the possibility TriSalus Life Sciences' shares may be trading at a discount.

Next Steps

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 203 companies by clicking here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TriSalus Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TLSI

TriSalus Life Sciences

Engages in the research, development, and commercialization of drug delivery technology platform and immuno-oncology therapeutics to improve outcomes for patients with difficult-to-treat liver and pancreatic cancers.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion