- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Is Cognex's (CGNX) Rising Investment a Sign of Stronger Market Position or Margin Risk?

Reviewed by Sasha Jovanovic

- Earlier this month, Cognex reported quarterly revenues that surpassed analyst expectations and provided upbeat guidance for the next quarter, but fell short of its full-year earnings per share outlook amid ongoing investments to defend its market position.

- While Cognex’s revenue performance highlights steady demand, its increased spending and pressured margins reveal a balancing act between growth and profitability as it strives to outpace competitors.

- Given Cognex's margin pressures from increased investment, we will examine how this shapes the company's updated investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Cognex Investment Narrative Recap

To own Cognex, an investor must have conviction in the company's ability to defend and expand its leadership in machine vision through innovation, particularly as it invests heavily to stay ahead of intense competition. The latest quarterly results, with revenues exceeding expectations but a trimmed full-year EPS outlook, do not materially change the main short-term catalyst: Cognex’s ability to monetize new AI-powered offerings while managing the immediate challenge of shrinking margins due to increased R&D commitments.

Among recent developments, Cognex’s announcement of a new executive team stands out. This leadership transition, with a focus on AI and market expansion, is directly relevant to how investors assess progress on the company’s aggressive innovation strategy and whether these changes can accelerate adoption of higher-value products without further pressuring profitability.

However, despite these optimistic steps, investors should also be aware that growing competition and the risk of ongoing commoditization in machine vision hardware could undermine pricing power and...

Read the full narrative on Cognex (it's free!)

Cognex's outlook anticipates $1.2 billion in revenue and $241.2 million in earnings by 2028. This scenario assumes a 10.2% annual revenue growth rate and an earnings increase of $119.1 million from the current $122.1 million.

Uncover how Cognex's forecasts yield a $48.00 fair value, in line with its current price.

Exploring Other Perspectives

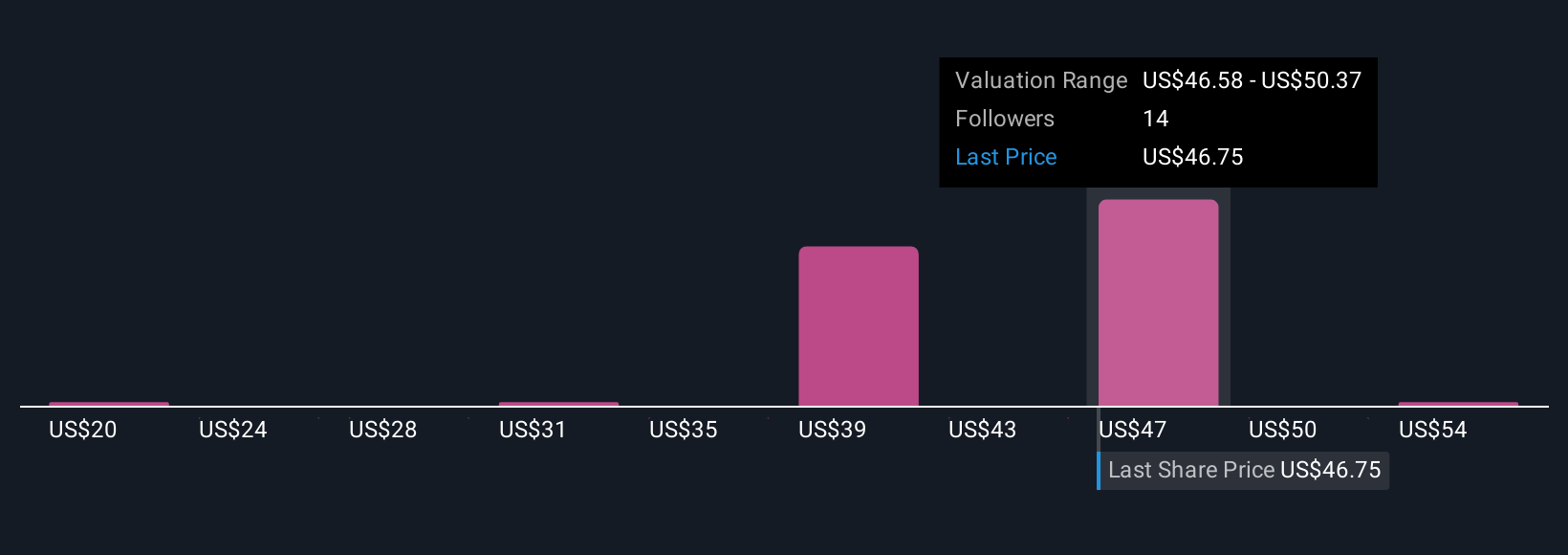

Five Simply Wall St Community members produced fair value estimates ranging widely from US$20 to US$57.97 per share. With such diverse viewpoints, consider how Cognex’s stepped-up investment has improved innovation but also brought fresh risks to margins, and see how your outlook compares.

Explore 5 other fair value estimates on Cognex - why the stock might be worth less than half the current price!

Build Your Own Cognex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognex research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cognex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognex's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives