- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Cognex (CGNX): Evaluating the Stock’s Valuation After Its Recent Pullback

Reviewed by Simply Wall St

See our latest analysis for Cognex.

After a strong run earlier in the year, Cognex’s share price has cooled off recently, sliding 12.7% over the past month and trimming its year-to-date gain to just under 7%. Taking a step back, the total shareholder return over the last twelve months remains negative at -7.1%, reflecting ongoing challenges and some shifting sentiment around growth potential.

If you’re curious about discovering what’s next in the broader tech space, it might be a good time to check out the full range of opportunities with our See the full list for free.

With the stock’s recent pullback and analysts still targeting a significantly higher price, investors are left wondering whether Cognex is trading at a discount or if the market has already factored in all the anticipated growth ahead.

Most Popular Narrative: 21.9% Undervalued

The most widely followed narrative puts Cognex’s fair value at $48.90, well above its last closing price of $38.18. This perceived gap is fueling debate among investors and putting a spotlight on what is driving the optimism.

Ongoing investments in R&D and a robust technology roadmap (including deeper AI integration and product ecosystem expansion) enhance Cognex's technology leadership. This supports pricing power and sustained earnings growth.

Want to know why so many believe the company could seriously rerate? Analysts see ambitious targets for both revenue growth and margin expansion. The narrative points to breakthrough innovations and industry-defying financial assumptions. Curious which bold projections underlie that fair value? Dive into the details behind this valuation.

Result: Fair Value of $48.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and ongoing pricing pressures in key end markets could still challenge Cognex’s growth story and threaten margin improvement in the future.

Find out about the key risks to this Cognex narrative.

Another View: What Do Earnings Multiples Say?

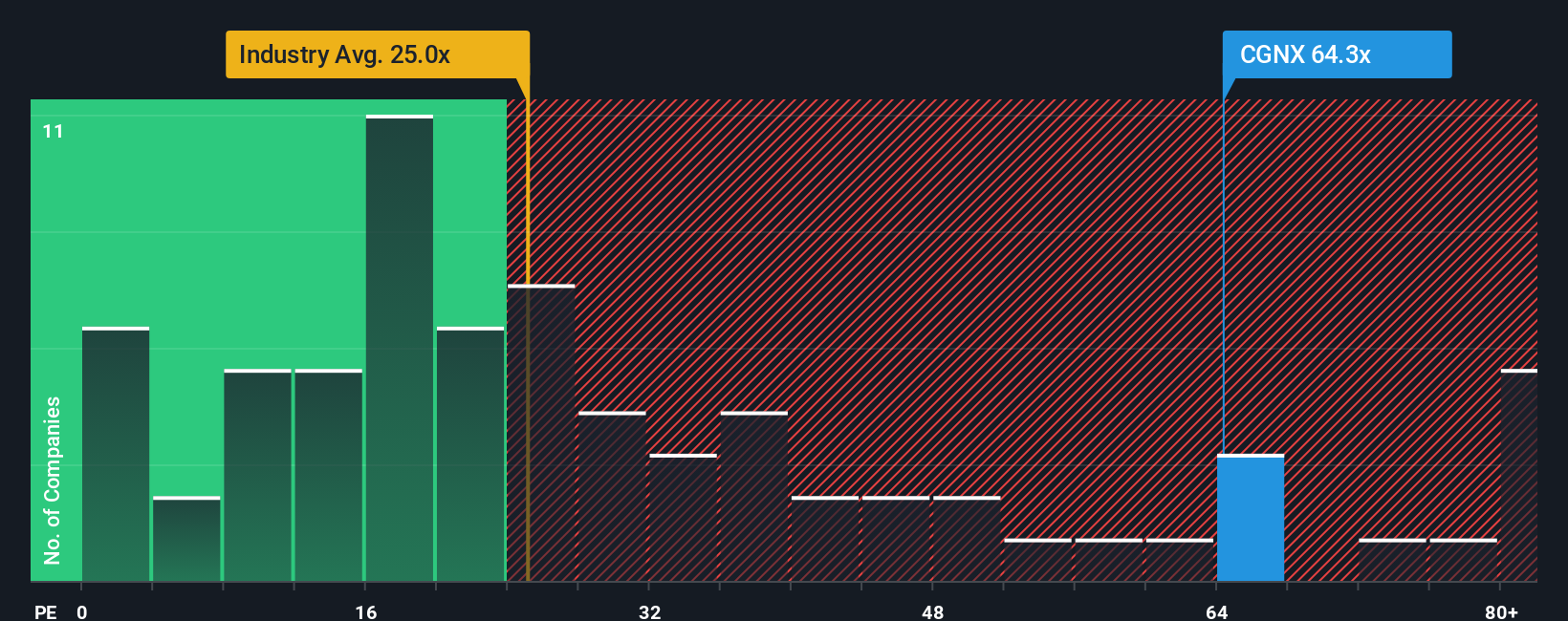

Looking beyond fair value estimates, Cognex trades at a price-to-earnings ratio of 58.1x, which is much higher than both its industry peers (32.7x) and the broader US Electronic sector average (25.2x). Even when compared with a fair ratio of 35.1x, current pricing sets a high bar. Does this premium present a valuation risk or signal confidence that the business will outperform?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you have a different perspective or want to take a hands-on approach, you can quickly shape your own interpretation of Cognex's outlook. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cognex.

Looking for More Investment Ideas?

Broaden your investing playbook with top opportunities others are snapping up right now. These screens could reveal the next standout performer for your portfolio.

- Tap into rising trends by targeting innovation leaders among these 27 AI penny stocks making waves with artificial intelligence breakthroughs.

- Uncover potential bargains by seeing which businesses are trading below intrinsic value with these 878 undervalued stocks based on cash flows.

- Lock in powerful passive income by handpicking reliable payers from these 14 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives