- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

A Closer Look at Cognex (CGNX) Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Cognex (CGNX) has caught the interest of investors in recent weeks, with its stock climbing roughly 13% in the past week and up 35% over the past 3 months. This move is drawing attention to its valuation and growth story.

See our latest analysis for Cognex.

Cognex’s 12.9% jump in share price return over the past week builds on an impressive 90-day momentum of 35%. This suggests that investor enthusiasm is returning after a long lull. However, from a broader perspective, its one-year total shareholder return stands at just 14%, indicating that the recent rally is still catching up against some longer-term underperformance.

If you’re interested in spotting other growth leaders, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares surging in a short span but not far from analyst targets, the key question is whether Cognex is now attractively undervalued, or if the recent optimism has already factored in any potential upside for investors.

Most Popular Narrative: 4.1% Undervalued

Cognex is trading slightly below the fair value estimated by the most popular narrative, with the last close price of $46.04 compared to the $48.00 fair value. There is a consensus that recent improvements in revenue growth and cost discipline could justify a modest upside for the shares.

Continued investment in research and development and sales functions is seen as reinforcing Cognex’s leadership in the machine vision industry. This is viewed as positioning the company for long-term growth.

Want to know the mechanics behind this premium valuation? This narrative leans on powerful growth projections and expects financial performance that could outpace peers. The full story reveals the bold assumptions fueling analyst optimism. Dive in now if you’re curious what’s really driving this fair value target.

Result: Fair Value of $48.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in Asia and economic uncertainty in key sectors could present challenges to Cognex’s margin gains and may slow its momentum.

Find out about the key risks to this Cognex narrative.

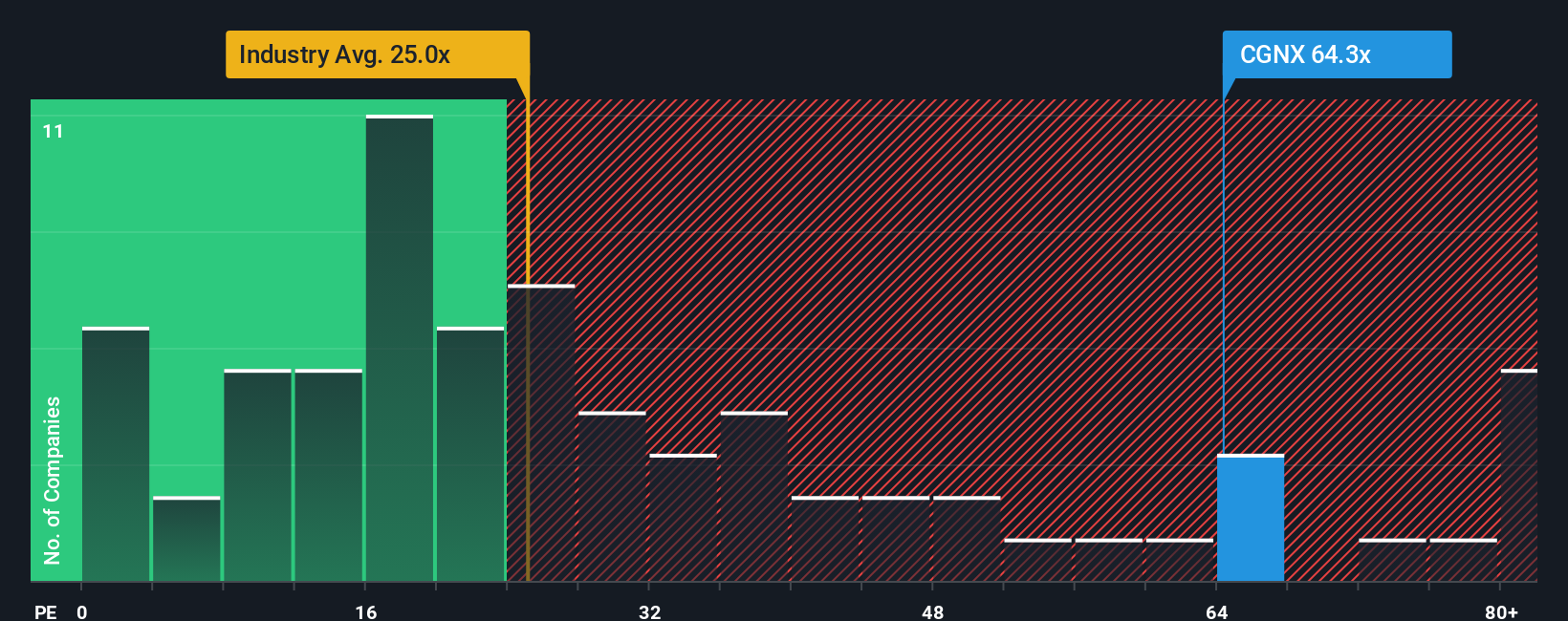

Another View: P/E Signals a Premium Risk

While analyst narratives see upside, the company’s price-to-earnings ratio stands at 63.3x, which is much higher than the US Electronic industry’s 26.2x and the peer average of 34.9x. This is also nearly double the fair ratio of 33.7x. These figures suggest investors are paying a significant premium for Cognex’s future prospects. Could current optimism be setting the bar too high, or is there justification for this valuation extending beyond the norm?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you think there is another angle to this story or want to dig into the numbers yourself, it only takes a few minutes to craft your own view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cognex.

Looking for more investment ideas?

Great stocks are only the beginning. Take charge of your next move by seeing where innovation, value, or passive income are hiding. Tap into fresh opportunities waiting beyond Cognex.

- Spot game-changers in artificial intelligence by jumping into these 24 AI penny stocks to uncover companies shaping the future of automation, data, and machine learning.

- Maximize potential for income with these 18 dividend stocks with yields > 3%, which highlights reliable companies with strong yields and prospects for consistent shareholder returns.

- Tap into value opportunities in overlooked markets by searching through these 3596 penny stocks with strong financials to find businesses with strong financials that could be poised for a breakout.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives