- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

Is CDW’s Ongoing Buybacks and Dividend Hike Reshaping Its Capital Allocation Story (CDW)?

Reviewed by Sasha Jovanovic

- CDW Corporation recently announced its third quarter 2025 results, reporting higher sales of US$5.74 billion but lower net income of US$291 million compared to the prior year, along with a 900,000 share repurchase and a quarterly dividend increase to US$0.630 per share.

- An interesting detail is that the company has now completed the repurchase of 55.5 million shares, about 36.9% of its outstanding stock, since 2014, highlighting a consistent long-term commitment to returning capital to shareholders.

- We'll explore how the combination of sustained share buybacks and an increased dividend could impact CDW's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

CDW Investment Narrative Recap

To be a CDW shareholder, you need to believe in the company’s ability to unlock value from secular growth in IT services, ongoing digital transformation, and disciplined capital returns. The latest news, including increased buybacks and a small dividend boost, may reinforce confidence in capital allocation but does not materially change the short-term catalyst: a potential rebound in higher-margin solutions revenue. However, it does little to mitigate the ongoing risk of margin pressure from a shift toward lower-margin hardware deals.

Among the recent announcements, the third quarter earnings report is most relevant. CDW posted year-over-year revenue growth, but net income and earnings per share were again lower than the year before, reinforcing investor concern that expanding sales from hardware and large enterprise contracts might not fully translate to improved profitability, especially as margins remain below last year’s levels. Against this backdrop, the effectiveness of CDW’s capital allocation in supporting earnings growth will remain closely scrutinized, especially as the product and customer mix continues to evolve.

By contrast, what investors should be aware of is that continued margin compression, especially if high-volume hardware sales keep outpacing services growth, could limit CDW’s...

Read the full narrative on CDW (it's free!)

CDW's outlook points to $24.3 billion in revenue and $1.3 billion in earnings by 2028. This is based on analysts projecting a 3.5% annual revenue growth rate and a $0.2 billion increase in earnings from $1.1 billion currently.

Uncover how CDW's forecasts yield a $182.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

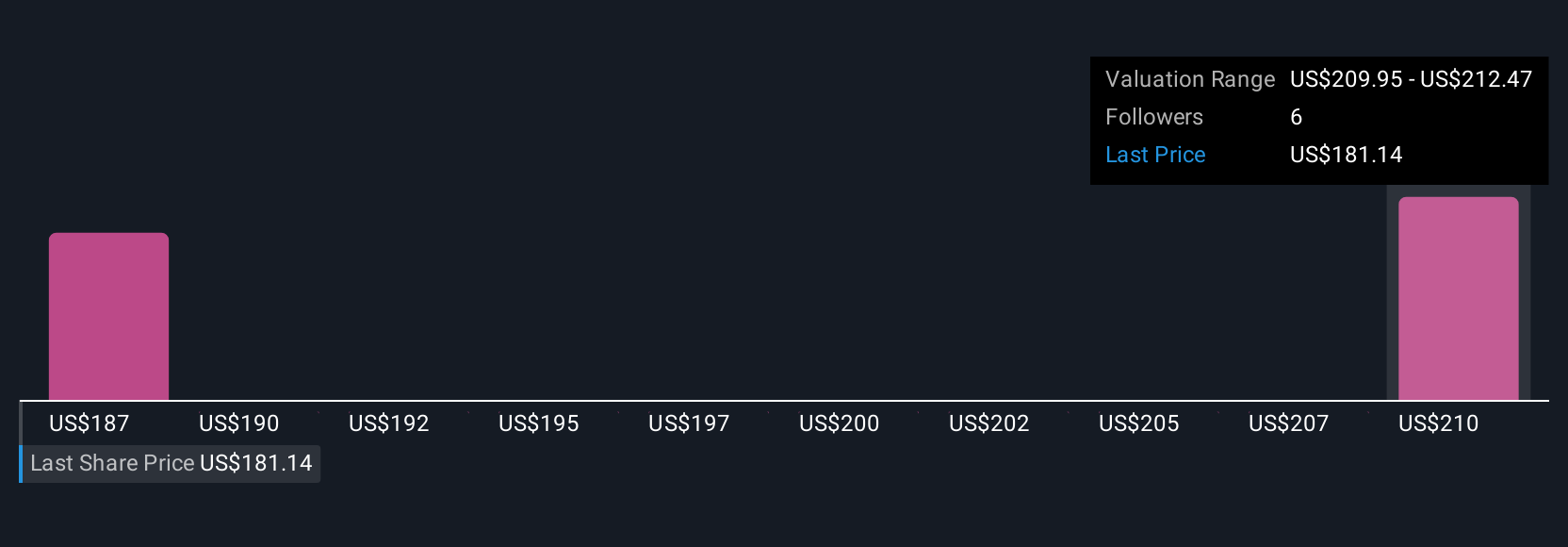

Simply Wall St Community members have shared three fair value estimates for CDW, ranging from US$180.01 to US$234.14 per share. While opinions vary widely, the persistent shift in product and customer mix toward lower-margin hardware highlights why the company’s ability to drive long-term profitability attracts such a range of forecasts and is vital for ongoing performance.

Explore 3 other fair value estimates on CDW - why the stock might be worth as much as 61% more than the current price!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives