- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

CDW (CDW): Evaluating Valuation After Recent Share Price Drop

See our latest analysis for CDW.

After months of steady trading, CDW’s share price has taken a turn with a 15.1% slide over the past month and a year-to-date decline of nearly 15%. This signals fading momentum after a rocky stretch. Over the longer term, the stock’s 1-year total shareholder return of -33.7% stands in sharp contrast to its 5-year total return of 17.7%. This highlights the difference between recent volatility and historical growth.

If you’re weighing your next move, this could be an ideal time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the stock down sharply, some analysts see significant upside potential based on price targets and valuation metrics. However, is the current weakness a true bargain, or has the market already accounted for CDW’s future prospects?

Most Popular Narrative: 29.9% Undervalued

Compared to CDW’s last close price of $145.04, the most popular valuation narrative estimates a fair value nearly 30% higher, setting the table for an intriguing debate on future upside potential.

Expansion of CDW's software, professional, and managed services capabilities, now core to both strategy and recent M&A focus, continues to elevate recurring revenue and expand margins, supporting resilient long-term earnings growth.

The path to this bullish price target depends on a shift in recurring revenue and a margin overhaul. What future margin movement and growth rate are baked into this bold narrative? Find out which assumptions are doing the heavy lifting on this fair value call. The next move may surprise you.

Result: Fair Value of $206.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pressure from lower-margin deals and uncertain government funding could quickly undercut CDW’s projected margin improvements and growth trajectory.Find out about the key risks to this CDW narrative.

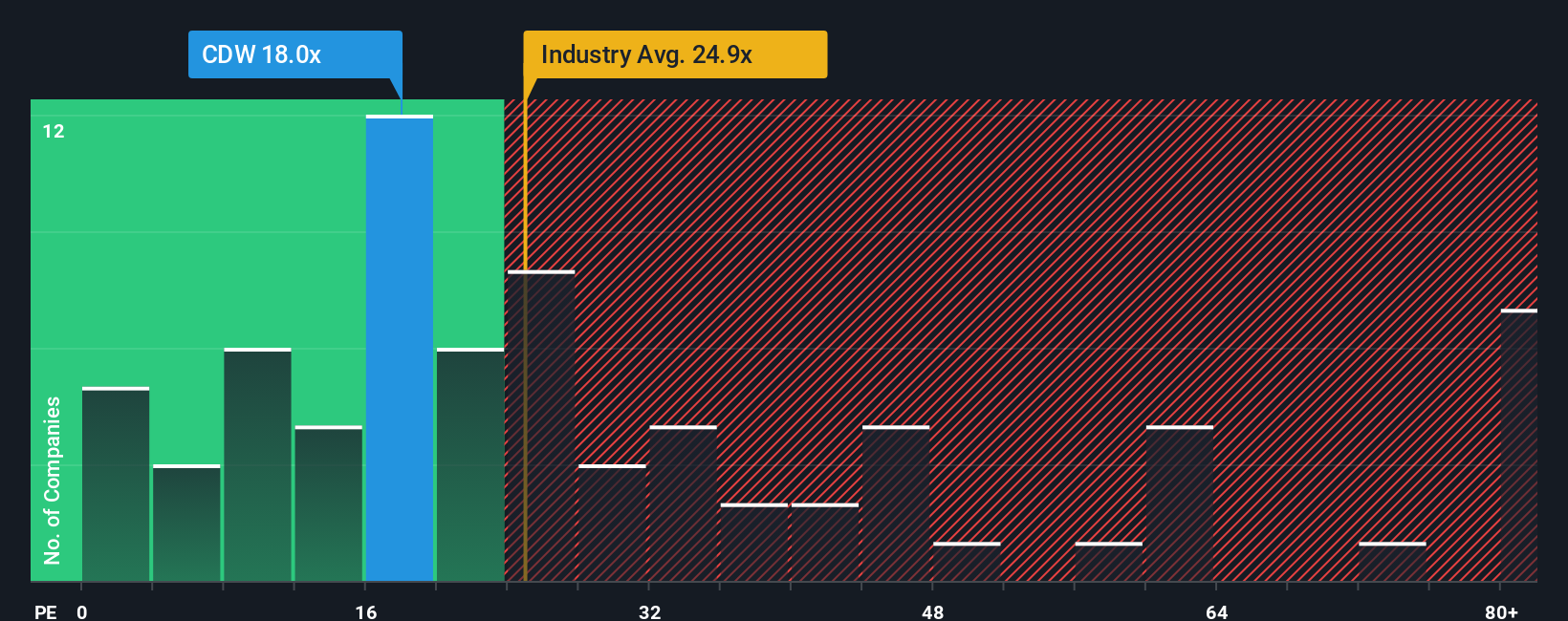

Another View: Price Multiples Paint a Mixed Picture

Taking a different angle, the market’s price-to-earnings ratio for CDW sits at 17.7x. This is higher than its peer group at 15.9x, but well below the wider US Electronic industry average of 25.5x. Interestingly, the fair ratio—where the market could logically move—is estimated at 27.1x. This suggests some potential room for upward re-rating, but also highlights valuation risk if sentiment turns. Is CDW being overlooked, or could its premium to peers become a drag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CDW Narrative

If you want to test these ideas or follow your own research path, it’s quick and easy to develop your own perspective on CDW. Do it your way with Do it your way.

A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seasoned investors never settle for a single stock story. Expand your investing toolkit and open up new potential paths to growth with these smart opportunities.

- Tap into breakthrough innovation and size up the future with these 26 quantum computing stocks.

- Supercharge your portfolio with income by checking out these 19 dividend stocks with yields > 3% offering attractive yields over 3%.

- Catalyze your returns and be early to trends by scanning these 24 AI penny stocks shaping tomorrow’s digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Santos: Undervalued After Takeover Fallout

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks