- United States

- /

- Tech Hardware

- /

- NasdaqGM:CAN

Assessing Canaan (NasdaqGM:CAN) Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Canaan.

After tumbling sharply over the past year, Canaan’s share price has lately shown bursts of volatility. An impressive 63% gain over the last 90 days suggests that either risk appetite is returning or bargain hunters are wading in, even though the one-year total shareholder return remains modestly negative. Whether this momentum lasts is the question savvy investors are asking now.

If this surge in action has you scanning for fresh opportunities, it might be the perfect moment to broaden your search and check out fast growing stocks with high insider ownership.

With recent gains outpacing long-term performance, investors may be wondering if Canaan is currently undervalued given its fundamentals, or if the market has already factored in all future growth prospects. Could this be a real buying opportunity?

Most Popular Narrative: 60% Undervalued

Canaan's most followed valuation narrative sees fair value far above the recent close, with analysts believing the company's prospects justify a much higher price target. This sharp contrast sets up a deeper look into the factors behind this bullish view.

Broadening geographic reach and manufacturing sites reduces geopolitical risk while positioning for stable growth in regions with supportive regulations and energy advantages. Advancing ASICs, service offerings, and AI-related initiatives enhances product differentiation, revenue diversification, and margin resilience amid evolving mining and computing markets.

Want to know why analysts are betting on a future rerating? The foundation is a projected transformation in earnings, margins, and multi-market expansion. See which numbers make this narrative so compelling and what could fuel a dramatic stock revaluation if those targets are hit.

Result: Fair Value of $2.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on Bitcoin mining and unpredictable global regulations could quickly undermine Canaan's bullish case and challenge its long-term growth outlook.

Find out about the key risks to this Canaan narrative.

Another View: Looking at Sales Multiples

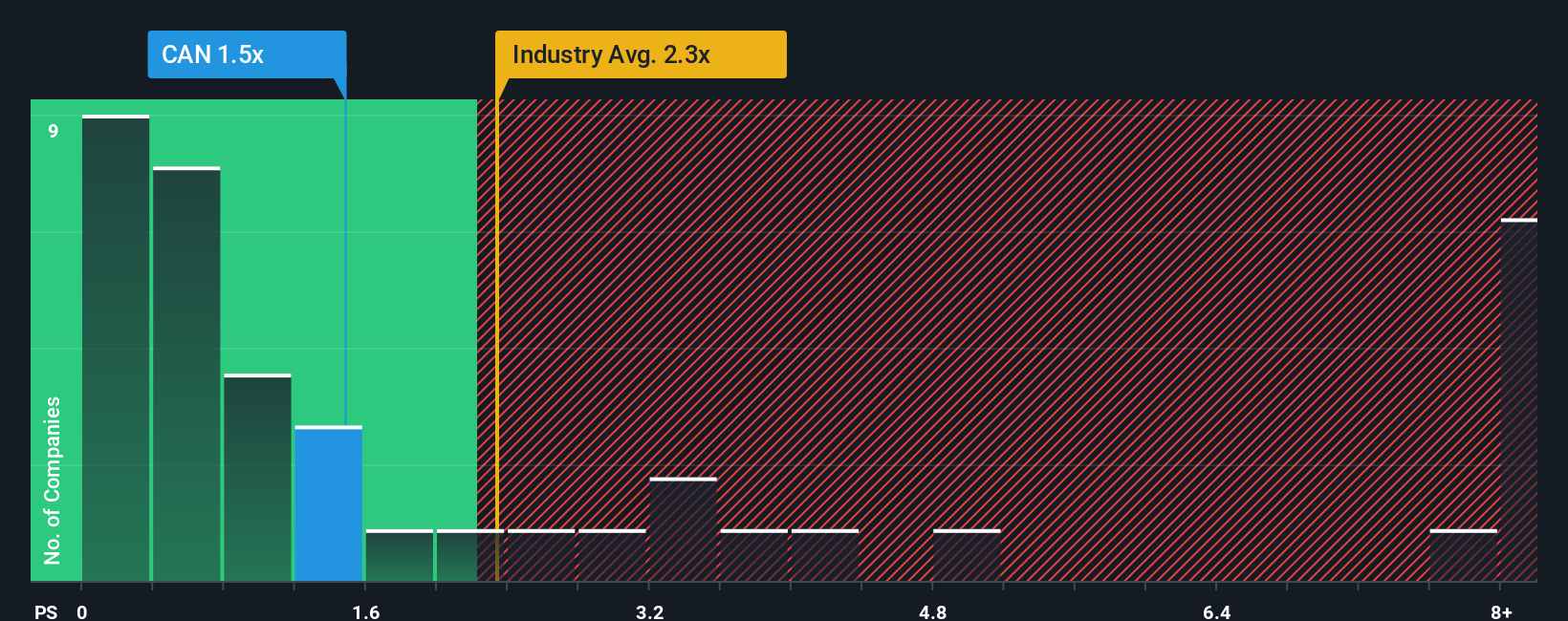

While the analyst narrative and price target suggest Canaan is deeply undervalued, a quick scan of its price-to-sales ratio (1.6x) paints a more complex story. This ratio is higher than the peer average of 0.7x and also sits above the fair ratio of 1.1x. That means, from a market multiples angle, Canaan actually looks a bit expensive by current standards. Does this raise a yellow flag about relying too much on growth forecasts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canaan Narrative

Keep in mind, you can always take a hands-on approach and shape your own outlook on Canaan’s story using the available data in just a few minutes. Do it your way.

A great starting point for your Canaan research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you’re serious about finding your next opportunity, don’t wait on the sidelines. Uncover unique market angles that thousands of investors are already tracking with these targeted selections:

- Harvest additional yield and cash flow by tapping into these 16 dividend stocks with yields > 3% with robust payouts and reliable business models.

- Ignite your portfolio’s future with these 25 AI penny stocks focused on innovations in machine learning, automation, and digital transformation.

- Position yourself at the forefront of fintech by checking out these 82 cryptocurrency and blockchain stocks leading new paths in decentralized finance and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CAN

Canaan

Engages in the research and development, design, and sale of integrated circuits (IC), and lease of final mining equipment by integrating IC products for bitcoin mining and related components in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives