- United States

- /

- Communications

- /

- NasdaqGS:AUDC

AudioCodes (NASDAQ:AUDC) Has Announced A Dividend Of $0.18

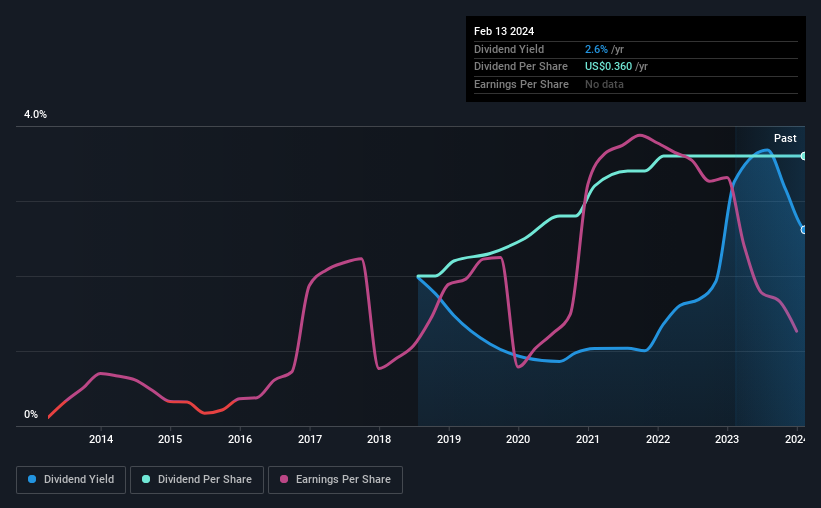

The board of AudioCodes Ltd. (NASDAQ:AUDC) has announced that it will pay a dividend on the 6th of March, with investors receiving $0.18 per share. This payment means that the dividend yield will be 2.6%, which is around the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that AudioCodes' stock price has increased by 31% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for AudioCodes

AudioCodes Doesn't Earn Enough To Cover Its Payments

We aren't too impressed by dividend yields unless they can be sustained over time. Prior to this announcement, the company was paying out 180% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Over the next year, EPS is forecast to expand by 46.8%. If the dividend continues on its recent course, the payout ratio in 12 months could be 100%, which is a bit high and could start applying pressure to the balance sheet.

AudioCodes Doesn't Have A Long Payment History

It is great to see that AudioCodes has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. Since 2018, the dividend has gone from $0.20 total annually to $0.36. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

Dividend Growth May Be Hard To Come By

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. It's not great to see that AudioCodes' earnings per share has fallen at approximately 9.6% per year over the past five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

We're Not Big Fans Of AudioCodes' Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for AudioCodes (of which 1 is potentially serious!) you should know about. Is AudioCodes not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AUDC

AudioCodes

Provides advanced communications software, products, and productivity solutions for the digital workplace worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)