- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEVA

Aeva Technologies (AEVA) Is Up 23.5% After Daimler Truck Deal and Nuclear Site Validation Has The Bull Case Changed?

Reviewed by Simply Wall St

- In the past week, Aeva Technologies announced an expanded partnership with Daimler Truck North America to ramp up production of its innovative 4D LiDAR technology for use in autonomous Freightliner Cascadia trucks, while also receiving validation from Sandia National Laboratories for deployment at U.S. nuclear reactor sites.

- These developments highlight Aeva's progress in both automotive and critical infrastructure applications, signaling broader market opportunities for its proprietary sensing technology.

- We’ll take a closer look at how Aeva’s expansion into nuclear facility security shapes the company’s investment narrative and growth outlook.

What Is Aeva Technologies' Investment Narrative?

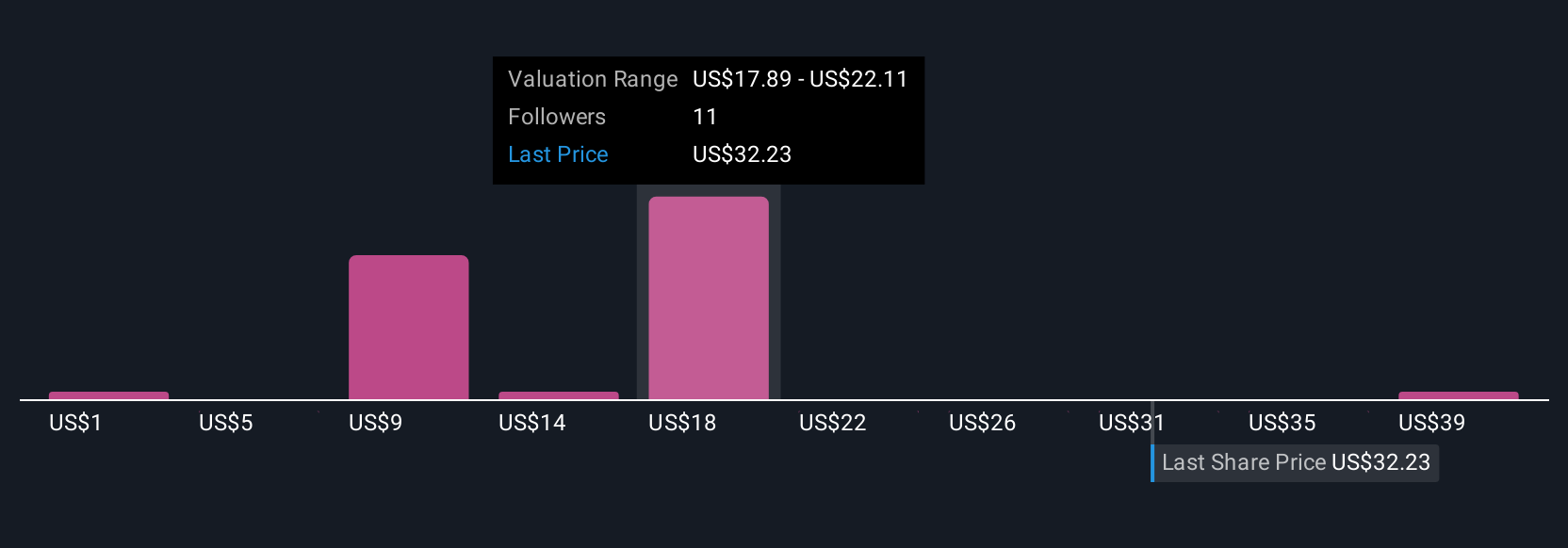

For Aeva Technologies, the underlying investment idea hinges on belief in the adoption of its 4D LiDAR across not just automotive, but also critical infrastructure and industrial markets. The expanded partnership with Daimler Truck North America and testing at U.S. nuclear sites mark clear progress toward commercializing its technology at scale, potentially shifting near-term catalysts from simple tech validation to real sales contracts and manufacturing milestones. With Daimler’s backing, Aeva is set to ramp up production capacity, providing a clearer path to market penetration in autonomous vehicles, and the Sandia Labs news opens a gateway to critical infrastructure, reducing doubts about product-market fit beyond mobility. Still, recent share price surges and a very high valuation versus peers make profitability hurdles and execution risk the big question marks, even as new customers and longer-term contracts become more central to the story.

By contrast, surging valuations may shine a light on risk if growth or funding disappoints.

Aeva Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Build Your Own Aeva Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeva Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aeva Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeva Technologies' overall financial health at a glance.

No Opportunity In Aeva Technologies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEVA

Aeva Technologies

Engages in the design, development, manufacture, and sale of LiDAR sensing systems, and related perception and autonomy-enabling software solutions in North America, Europe, the Middle East, Africa, and Asia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives