- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Is Apple’s Share Price Growth Justified After Recent AI Advancements in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Apple is actually a buy right now? You're not alone. Questions about its true value often come up for both new and seasoned investors.

- Apple's share price has chalked up impressive gains lately, rising 3.9% in the past week, 5.9% in the last month, and nearly 20% over the past year.

- Recent headlines have been buzzing about Apple's advances in artificial intelligence and new product launches, fueling optimism among market watchers. At the same time, ongoing regulatory scrutiny is sparking fresh debates about future risks and opportunities for the tech giant.

- When it comes to valuation, Apple currently scores 1 out of 6 checks for being undervalued. This leaves room to dig deeper into what that really means for investors. Let's take a look at how the usual valuation methods stack up for Apple and why a better way to understand the company's worth could be even more insightful later in this article.

Apple scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Apple Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its expected future cash flows and then discounting those amounts back to today's value. This process gives investors a sense of what the company is fundamentally worth based on its ability to generate cash over time.

For Apple, the latest reported Free Cash Flow stands at $97.1 billion. Analyst estimates project steady growth in the coming years, with expected Free Cash Flow reaching about $188.9 billion by 2030. While analyst forecasts typically cover up to five years, projections beyond that are extrapolated by Simply Wall St to help estimate long-term trends.

Based on these cash flow projections and using the 2 Stage Free Cash Flow to Equity model, the DCF analysis puts Apple's intrinsic value at $219.59 per share. Compared to the current market price, this figure implies the stock is about 22.8% overvalued.

In summary, the DCF model suggests Apple's share price is running ahead of its underlying cash flow fundamentals at the moment.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Apple may be overvalued by 22.8%. Discover 853 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Apple Price vs Earnings

The Price-to-Earnings (PE) ratio is a trusted method to value mature, profitable companies like Apple. It offers a quick snapshot of how much investors are willing to pay for each dollar of Apple’s earnings, making it useful for comparing established businesses in the tech sector.

When deciding what a “normal” or “fair” PE ratio should be, growth expectations and risk play a big part. Fast-growing companies with strong outlooks often trade at higher PE ratios, while those facing uncertainty or slow growth typically command lower multiples.

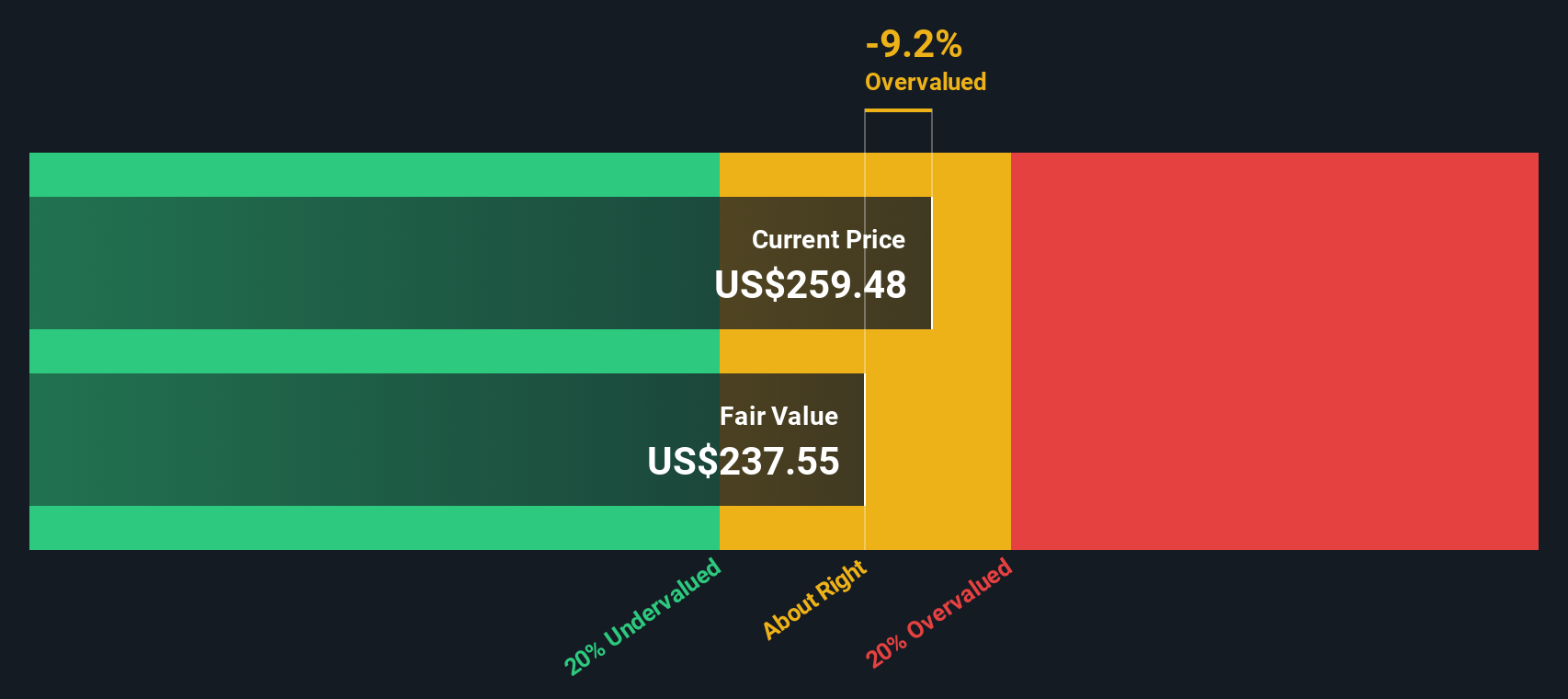

Apple trades at a PE ratio of 40.3x, which is noticeably higher than the Tech industry average of 24.6x and its peer group’s average of 34.9x. However, Simply Wall St’s proprietary Fair Ratio, which accounts for factors like Apple’s market cap, earnings growth, profit margin and industry risks, estimates that a fair PE ratio for Apple would be 42.7x. This tailored benchmark provides a more detailed picture than broad industry or peer comparisons because it factors in Apple’s unique strengths and risk profile.

With Apple’s actual PE sitting just below its Fair Ratio, the stock appears almost perfectly aligned with its intrinsic value based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apple Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives: a dynamic approach that allows investors to connect Apple’s story with their own forecasts for things like fair value, future growth, and profit margins.

A Narrative is your personal, data-backed perspective on a company. It lets you explain the “why” behind your numbers and estimates, tying the company’s real-world situation to your financial outlook and resulting in a unique fair value.

With Narratives, you can easily map Apple’s journey. For example, you can combine your view of its AI strategy, global expansion, or risks into custom forecasts and see how your price target compares to the current share price, helping you decide when to buy or sell.

Best of all, Narratives on Simply Wall St’s Community page are accessible to all investors and are updated automatically when new events or earnings come in, so your assumptions always reflect the latest information.

For instance, some investors see Apple’s fair value as much higher by focusing on AI-driven growth and resilient margins. Others are more cautious, citing tariffs or competitive risks and setting a lower price target, all using the same Narrative framework.

For Apple, however, we'll make it really easy for you with previews of two leading Apple Narratives:

Fair Value: $275.00

Apple is currently trading about 2% below this narrative's fair value.

Projected revenue growth rate: 12.78%

- Highlights Apple's resilience amid steep U.S. tariffs on China as costs threaten margins, but strategic production shifts are underway.

- Strong Q1 2025 performance, record services revenue, and analyst optimism fuel a "Moderate Buy" consensus and $251.72 to $275 price targets.

- Long-term growth is seen as driven by investments in AI and brand loyalty, with short-term volatility expected from geopolitical and supply chain challenges.

Fair Value: $207.71

Apple is currently trading about 29.9% above this narrative's fair value.

Projected revenue growth rate: 6.39%

- Warns that new EU regulations and higher manufacturing costs could erode Apple's profit margins and restrict top-line growth.

- Questions the company's emerging market strategy, noting challenges in India and South America due to high price points and tough local competition.

- Highlights service revenue reliance on the Google deal and risks from regulation, while casting skepticism on the financial payoff of Apple's mixed reality investments.

Do you think there's more to the story for Apple? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives