- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Does Apple’s Latest AI Push Justify Today’s Lofty Share Price?

Reviewed by Bailey Pemberton

- If you are wondering whether Apple's stock is still worth buying at these levels, you are not alone. This article is going to tackle that value question head on.

- Despite some recent choppiness, with the share price down about 1.7% over the last week but still up 12.2% year to date and 8.0% over the past year, investors are clearly still betting on Apple's long term growth story.

- Recent headlines have centered on Apple's push into AI features across its product ecosystem and renewed focus on services growth, with analysts debating how much of that upside is already priced in. At the same time, ongoing antitrust scrutiny and shifting regulations have kept a lid on overly optimistic expectations, adding nuance to the recent price moves.

- Right now, Apple scores just 1/6 on our valuation checks. We will walk through what traditional valuation methods say about the stock, and then finish by exploring a more holistic way to think about what Apple is really worth.

Apple scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Apple Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting its future cash flows and then discounting those back into today's dollars.

For Apple, Simply Wall St uses a 2 Stage Free Cash Flow to Equity model. The company generated about $99.9 billion in free cash flow over the last twelve months, and analysts plus modelled extensions see this rising to roughly $184.1 billion by 2030, all in dollars. The model uses detailed analyst forecasts for the next few years and then extrapolates growth further out, gradually slowing it to more sustainable levels.

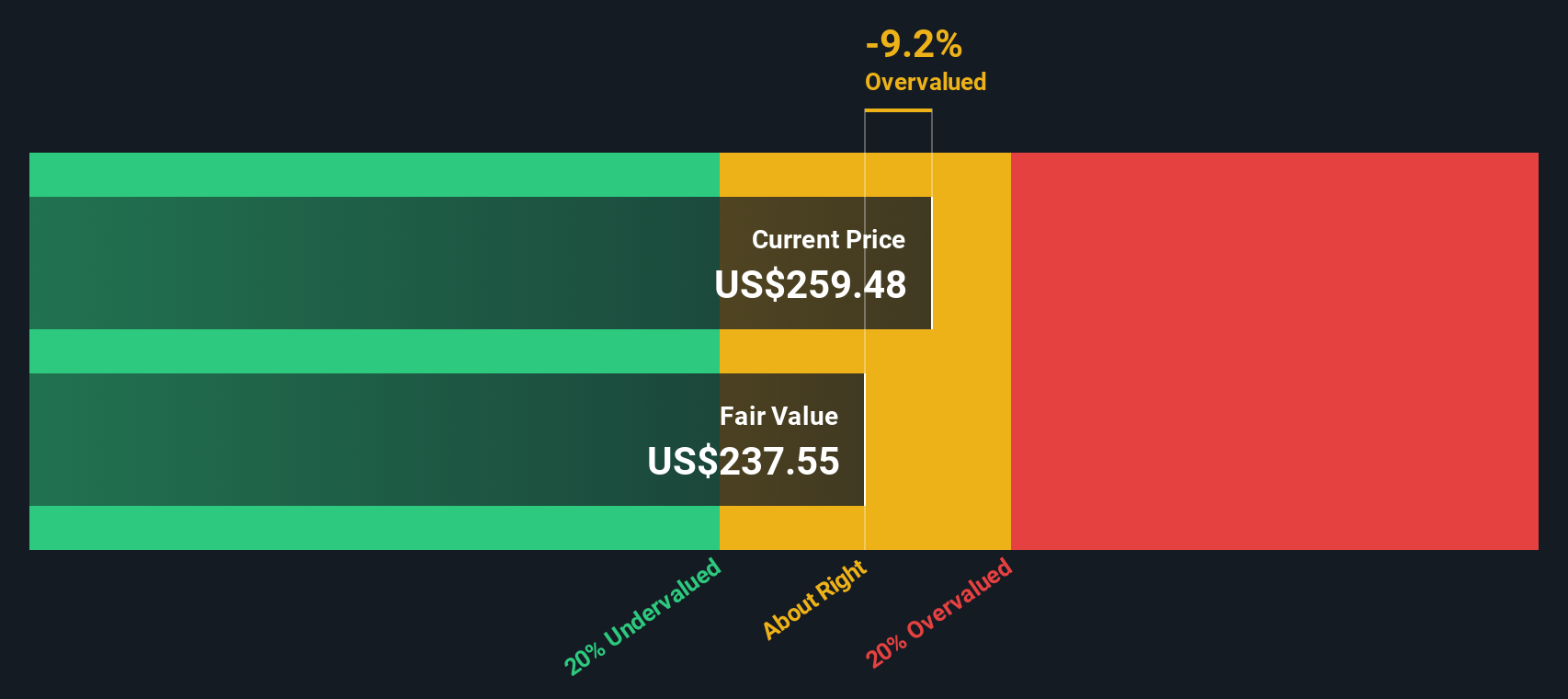

When all those future cash flows are brought back to today, the DCF model arrives at an intrinsic value of about $223.69 per share. That implies Apple is roughly 22.3% overvalued compared with its current share price, so investors are paying a premium to the model's estimate of fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Apple may be overvalued by 22.3%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Apple Price vs Earnings

For a mature, highly profitable business like Apple, the price to earnings ratio is a useful way to gauge how much investors are willing to pay for each dollar of current profit. A higher PE can be justified when a company has strong, durable growth prospects and relatively low risk, while slower or more uncertain growth tends to warrant a lower, more conservative multiple.

Apple currently trades on a PE of about 36.1x, which is well above the broader Tech industry average of roughly 22.6x and also ahead of its peer group, which sits around 33.5x. To move beyond these simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what Apple’s PE should be given its earnings growth outlook, profit margins, industry, size and risk profile. For Apple, that Fair Ratio comes out at about 38.3x. Based on this measure, and relative to its fundamentals, the market is actually assigning a slightly lower multiple than expected.

Because Apple’s actual PE is below this Fair Ratio, this multiple based view suggests the shares look modestly undervalued rather than expensive at today’s price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apple Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with concrete numbers like future revenue, earnings, margins, and an assumed fair value per share.

On Simply Wall St’s Community page, Narratives let you write down your perspective on Apple, translate that story into a financial forecast, and then automatically link it to a Fair Value estimate that you can compare to today’s share price to help inform whether it looks like a buy, hold, or sell.

Because Narratives are dynamic, they update when new information such as tariffs, AI product announcements, or fresh analyst targets appears. This means your story and fair value stay aligned with the latest data rather than becoming a static, out of date thesis.

For example, one Apple Narrative might see resilient demand, AI driven growth and margin strength supporting a fair value near $287. A more cautious Narrative, focused on slowing hardware growth and valuation risk, could land closer to $177. Both can coexist so you can see exactly how different assumptions drive different fair values.

For Apple however we will make it really easy for you with previews of two leading Apple narratives:

Fair value: $275.00 per share

Implied undervaluation vs last close: -0.2%

Forecast revenue growth: 12.78%

- Sees current weakness as driven by steep U.S. tariffs on China-assembled iPhones, with Apple actively shifting production to India and Vietnam and seeking exemptions to protect margins.

- Highlights resilient fundamentals, including Q1 2025 profits that beat expectations and record services revenue of $26.3 billion, alongside a Moderate Buy analyst consensus with a mean target of $251.72.

- Argues that Apple is positioned to benefit from AI and brand loyalty, with some analysts lifting targets to $275 and expecting long term growth once geopolitical and supply chain issues stabilize.

Fair value: $177.34 per share

Implied overvaluation vs last close: 54.3%

Forecast revenue growth: 14.68%

- Views Apple as significantly overvalued, pointing to a high P/E ratio relative to the broader market and arguing that the stock price reflects potentially unrealistic growth expectations for a maturing business.

- Emphasizes slowing hardware growth, pressure on margins from rising costs and lower-priced products, and heavy dependence on China amid increasing competition and geopolitical risk.

- Criticizes Apple’s cautious use of its large cash reserves and cautions that investor optimism may be excessive, leaving the stock vulnerable to a valuation-driven correction.

Do you think there's more to the story for Apple? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion