- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Why Applied Optoelectronics (AAOI) Is Up 18.9% After Launching AI-Driven Network Management Tools

Reviewed by Simply Wall St

- Earlier this week, Applied Optoelectronics announced the launch of four AI-powered software modules for its QuantumLink HFC Remote Management platform, providing broadband operators with advanced network telemetry, predictive diagnostics, automated controls, and real-time analytics.

- This development deepens the platform's ability to offer actionable intelligence, improve operational efficiency, and lower servicing costs for network operators by integrating machine learning, smart alarms, and automated asset tracking features.

- We'll explore how these new predictive diagnostics and automation capabilities could impact Applied Optoelectronics' long-term investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

Applied Optoelectronics Investment Narrative Recap

For shareholders in Applied Optoelectronics, the core investment thesis centers on harnessing accelerated demand for high-speed optical components, supported by technology upgrades and customer diversification across data center and broadband markets. The recent QuantumLink software suite launch boosts value for CATV operators and may reinforce Applied Optoelectronics’ relevance with its largest customer, but does not materially change the key catalyst, winning sustained large orders, and does not significantly reduce the risks tied to extreme customer concentration.

Among recent developments, the July certification of Applied Optoelectronics’ 1.8GHz amplifiers and QuantumLink software by Charter Communications stands out. This achievement directly supports the company’s growth catalyst in the cable segment, where major contracts and certification wins are critical to securing the long-term revenue pipeline.

However, despite this progress, investors should also consider how exposure to a small number of major clients could affect future results if...

Read the full narrative on Applied Optoelectronics (it's free!)

Applied Optoelectronics is projected to reach $1.3 billion in revenue and $111.0 million in earnings by 2028. This outlook requires 51.5% annual revenue growth and a $266.7 million increase in earnings from the current level of -$155.7 million.

Uncover how Applied Optoelectronics' forecasts yield a $27.20 fair value, in line with its current price.

Exploring Other Perspectives

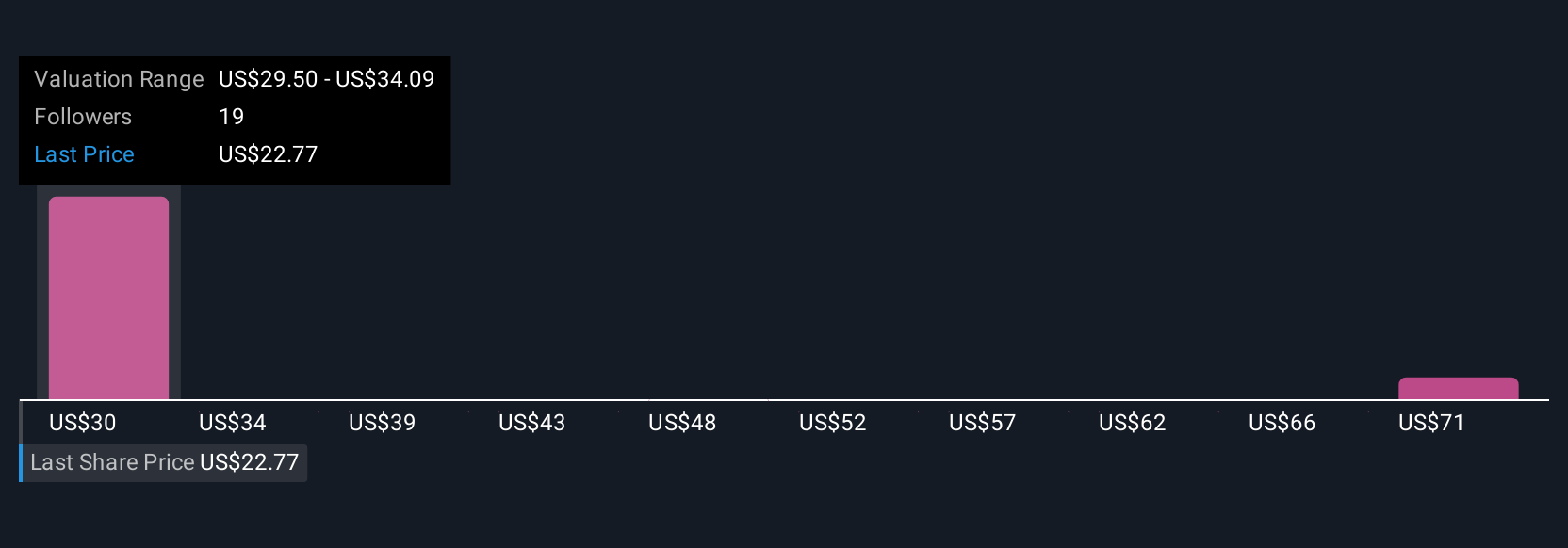

Seven members of the Simply Wall St Community estimate fair value between US$27.20 and US$75.38 per share. While many focus on growth in high-speed optical products, risks tied to customer concentration remain central to the company’s outlook, giving you a wide set of viewpoints to consider.

Explore 7 other fair value estimates on Applied Optoelectronics - why the stock might be worth just $27.20!

Build Your Own Applied Optoelectronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Applied Optoelectronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Optoelectronics' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives