- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Is Surging Sales and Narrowed Losses Reshaping the Investment Case for Applied Optoelectronics (AAOI)?

Reviewed by Simply Wall St

- Applied Optoelectronics recently reported its second quarter 2025 results, revealing a sharp increase in sales to US$102.95 million and a significantly smaller net loss of US$9.1 million compared to the previous year, while also announcing a new three-year US$35 million credit facility and projecting third quarter revenue between US$115 million and US$127 million.

- An important insight is that the company’s combination of higher revenues, reduced losses, and bolstered financial flexibility may reflect strengthened operational momentum and improved business outlook.

- We’ll examine how Applied Optoelectronics’ stronger sales growth and narrowed losses affect the company’s longer-term investment narrative and industry positioning.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Applied Optoelectronics Investment Narrative Recap

To be a shareholder in Applied Optoelectronics, you need to believe that the company’s rapid sales growth in high-speed optical components and margin improvement initiatives can outweigh ongoing risks tied to customer concentration and reliance on heavy capital expenditure. The recent Q2 results, showing sharply higher revenue and narrowed losses, directly reinforce the importance of maintaining top-line momentum, but do little to ease the immediate risk that any significant order reduction from their two largest customers could swiftly impact overall performance.

The announcement of a new US$35 million revolving credit facility stands out as most relevant here. While this boosts financial flexibility at a time of expanded capital needs and higher receivables, it does not directly address the fundamental risk of customer concentration, which remains a key variable in the short term as revenue guidance rises.

Yet, investors should also weigh how concentrated revenue streams still leave the company vulnerable if one key customer were to...

Read the full narrative on Applied Optoelectronics (it's free!)

Applied Optoelectronics' narrative projects $1.4 billion revenue and $206.4 million earnings by 2028. This requires 57.4% yearly revenue growth and a $362.1 million earnings increase from the current earnings of -$155.7 million.

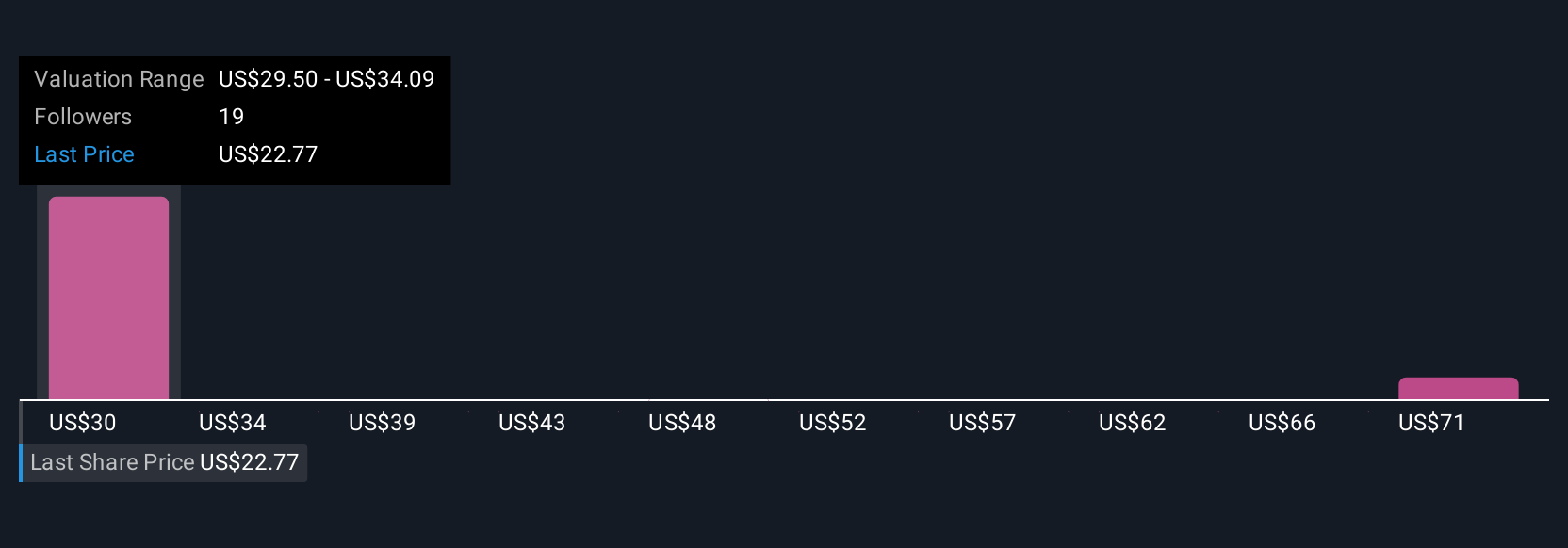

Uncover how Applied Optoelectronics' forecasts yield a $29.50 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from US$29.50 to US$75.38, with views clustered across multiple price buckets. Many see significant upside, but thin customer diversification continues to shape forward expectations and invites you to explore several alternative viewpoints.

Explore 6 other fair value estimates on Applied Optoelectronics - why the stock might be worth over 3x more than the current price!

Build Your Own Applied Optoelectronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Applied Optoelectronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Optoelectronics' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives