- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Applied Optoelectronics (AAOI): Assessing Valuation After Launch of New AI-Driven QuantumLink Modules

Reviewed by Kshitija Bhandaru

Applied Optoelectronics (AAOI) grabbed the spotlight this week with a product announcement that could catch the attention of investors considering what to do next. The company introduced a suite of AI-powered and analytics-driven software modules to its QuantumLink HFC Remote Management platform, aimed at tackling the pain points of network operators. Added features such as predictive diagnostics, real-time monitoring, smarter alarms, and streamlined asset management are designed to boost network performance, increase operational efficiencies, and improve the overall broadband experience for customers. For anyone eyeing AAOI stock, this move signals management’s focus on innovation and value creation in a tech-hungry sector.

This development comes against the backdrop of significant swings in AAOI’s share price over the past year. The stock has surged more than 100% in the last 12 months, with momentum picking up in the past quarter alone. Despite a difficult start to the year, fresh technologies and strategic updates have energized the share price, hinting at renewed optimism and perhaps a shift in how growth and risk are being viewed by the market.

After such a dramatic run-up and a high-profile product push, some may question whether there is still upside left for investors or if the market has already priced in AAOI’s growth potential.

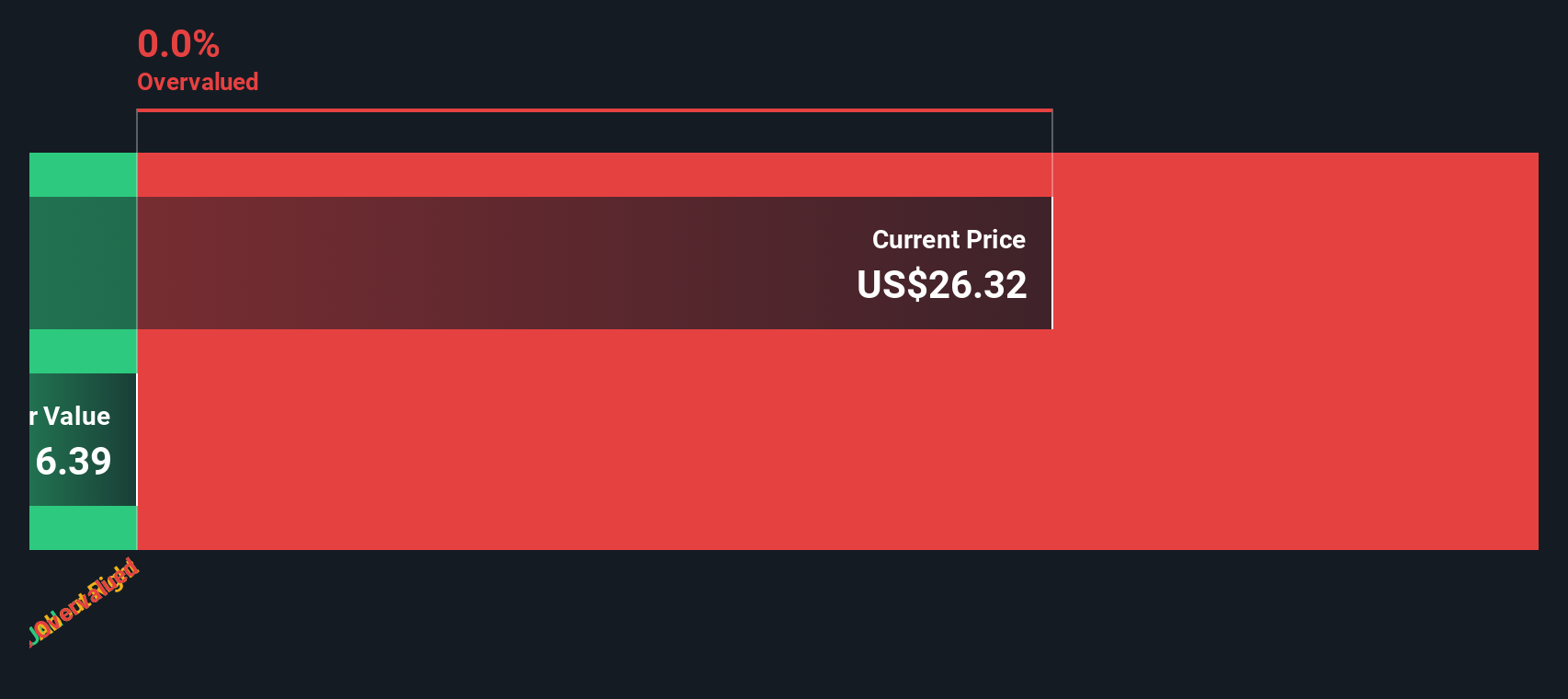

Most Popular Narrative: 6.6% Overvalued

According to the most widely followed narrative, Applied Optoelectronics is currently considered overvalued by approximately 6.6% compared to its consensus fair value estimate.

Ongoing expansion and ramp-up of domestic (U.S.) and Taiwan-based manufacturing for advanced transceivers, with capacity expected to increase more than 8x by year-end and major customers requiring U.S.-based production, provides a competitive edge and reduces tariff and supply chain risks, supporting higher future revenue visibility and potential margin stability.

Curious what’s behind this lofty price target? This fair value estimate hinges on bold projections around explosive sales growth, improving margins, and a future profit profile usually reserved for industry leaders. Want to know which financial leaps analysts are baking in to reach this valuation? The full narrative lays it bare. Discover the critical numbers that set this stock apart from its peers.

Result: Fair Value of $27.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent customer concentration and the need for major execution on cost-saving initiatives could quickly undermine these bullish forecasts.

Find out about the key risks to this Applied Optoelectronics narrative.Another View: SWS DCF Model Offers a Fresh Angle

Looking at Applied Optoelectronics through our DCF model, a different perspective emerges compared to the market-focused price target. This method weighs long-term cash flows, yet it also highlights a valuation challenge. Does the market see something deeper than discounted cash flows suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Applied Optoelectronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Applied Optoelectronics Narrative

If the current outlook does not match your own, take a hands-on approach and explore the numbers for yourself. You can build a custom story in minutes. Do it your way

A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investors never limit their search to a single opportunity. Make your next smart move with tailored tools designed to pinpoint companies leading tomorrow’s breakthroughs. You can be among the first to spot potential winners.

- Unlock hidden value by targeting potential bargains with our undervalued stocks based on cash flows and see which companies have strong cash flows yet low share prices.

- Tap into the power of disruption by tracking companies at the forefront of artificial intelligence innovation, all showcased in our AI penny stocks.

- Secure more stable income by browsing businesses recognized for robust payouts and reliable performance through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives