- United States

- /

- Software

- /

- OTCPK:ABXX.F

Is Abaxx Technologies (ABXX.F) Leveraging German Wind Futures to Strengthen Its Position in Renewables?

Reviewed by Sasha Jovanovic

- Abaxx Technologies Inc. recently announced the upcoming launch of the Enwex German Wind (GWM) Futures, the first wind futures contract based on Enwex indices in Germany, with trading set to begin on November 14, 2025.

- This contract introduces a new tool for the renewable energy market by enabling participants to hedge weather-related volume risk in German wind power generation through a standardized, financially-settled futures product.

- We'll explore how the introduction of wind futures indexed to German renewable generation impacts Abaxx's investment narrative and industry positioning.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Abaxx Technologies' Investment Narrative?

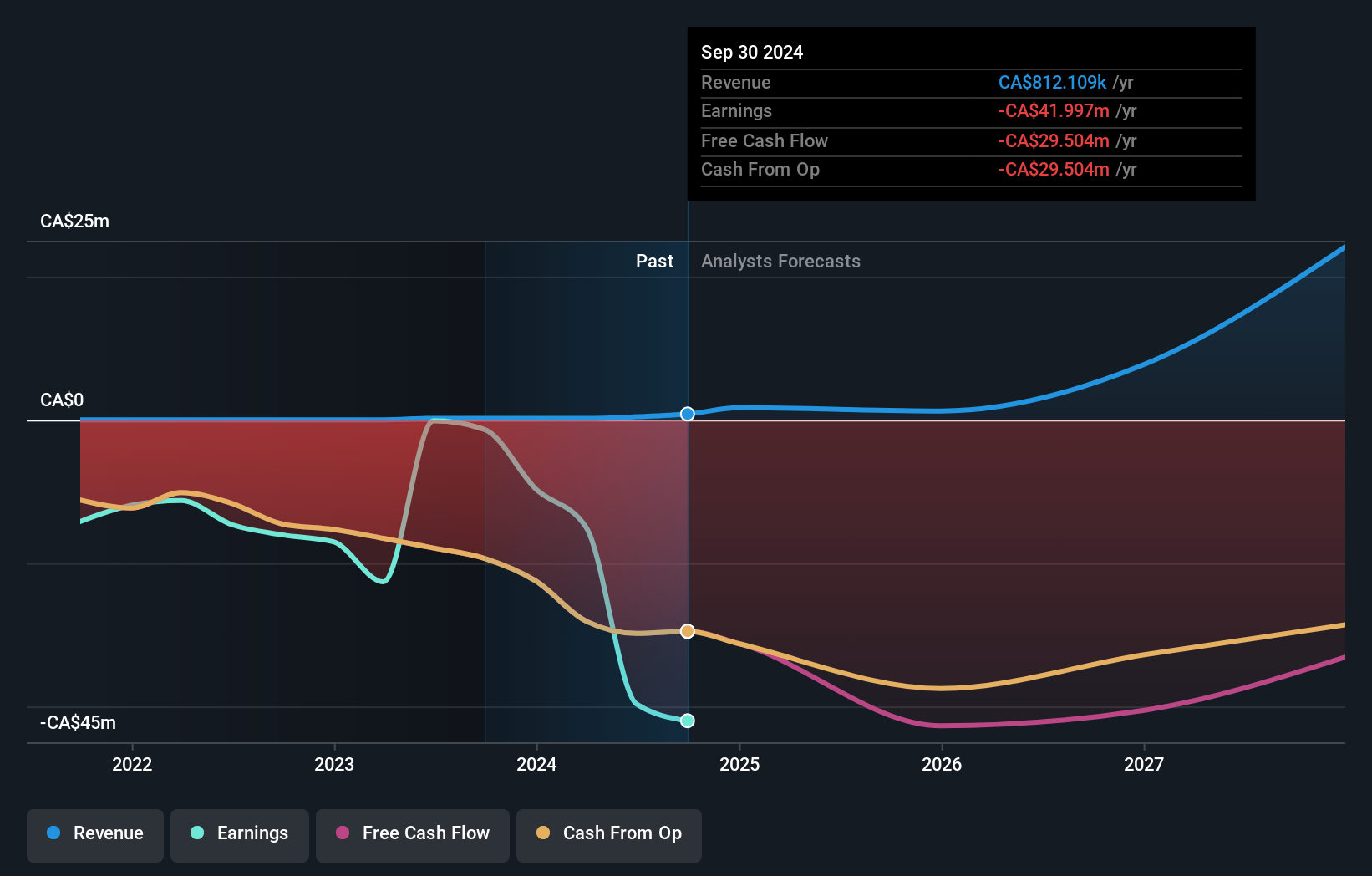

For anyone considering Abaxx Technologies, it’s fair to say the big picture hinges on believing in the company’s ability to carve out a material presence at the intersection of digital commodity exchanges and next-generation risk management. The launch of the German Wind Futures marks a significant foray into high-growth renewable energy risk products and could become a short-term catalyst if adoption gains traction, potentially broadening the client base and visibility. However, with ongoing net losses (CAD 16.78 million last quarter) and extremely modest revenue (just CA$812,109), the business remains in early, high-investment territory where surging costs, execution risks, and limited near-term earnings may continue to weigh. The wind futures launch addresses a real market need, but its material impact on revenue and profitability may take time to be felt, and does little to immediately offset core risks like persistent unprofitability, high valuation, and volatile share price movements.

On the flip side, high valuation relative to peers and persistent losses are risks not to ignore.

Despite retreating, Abaxx Technologies' shares might still be trading 9% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Abaxx Technologies - why the stock might be worth as much as 10% more than the current price!

Build Your Own Abaxx Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abaxx Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Abaxx Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abaxx Technologies' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ABXX.F

Abaxx Technologies

Engages in developing software tools which enable commodity traders and finance professionals to communicate, trade, and transact in Canada.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives