- United States

- /

- Software

- /

- NYSEAM:BMNR

Why BitMine Immersion Technologies (BMNR) Is Up 11.8% After Becoming Largest Ethereum Holder and Attracting Major Investors

Reviewed by Simply Wall St

- BitMine Immersion Technologies recently announced it now holds more than 833,000 Ethereum tokens in its treasury, making it the largest holder of ETH globally and the third-largest cryptocurrency treasury overall.

- This milestone has attracted leading institutional investors, including Bill Miller III and ARK’s Cathie Wood, while the company prepares to expand its Ethereum strategy through staking operations.

- We'll explore how BitMine's record-breaking Ethereum accumulation and prominent investor support influence the company's investment narrative moving forward.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bitmine Immersion Technologies' Investment Narrative?

For BitMine Immersion Technologies, the investment story rests on whether you believe in the long-term value of being the largest institutional Ethereum holder and the ability to monetize those assets effectively, especially as BitMine prepares to launch ETH staking operations. The company’s record-breaking Ethereum accumulation and fresh backing from high-profile institutional investors have generated enormous liquidity and short-term momentum, highlighted by extremely active trading and high trading volumes. The recent share buyback announcement, coupled with a major shelf registration, introduces both potential support for the share price and the risk of further dilution depending on capital-raising execution ahead. While previous analysis pointed to ongoing losses, volatility, and expanding board leadership, the influx of new funding and prominent investor support could change short-term catalysts, shifting attention to effective use of proceeds, execution of staking strategy, and management's ability to navigate growth without repeating past dilution. However, risks including continued unprofitability, volatility, and questions about governance and regulatory filings remain important for anyone watching BitMine’s next steps.

Yet, even with liquidity in the spotlight, ongoing share dilution risk cannot be ignored.

Exploring Other Perspectives

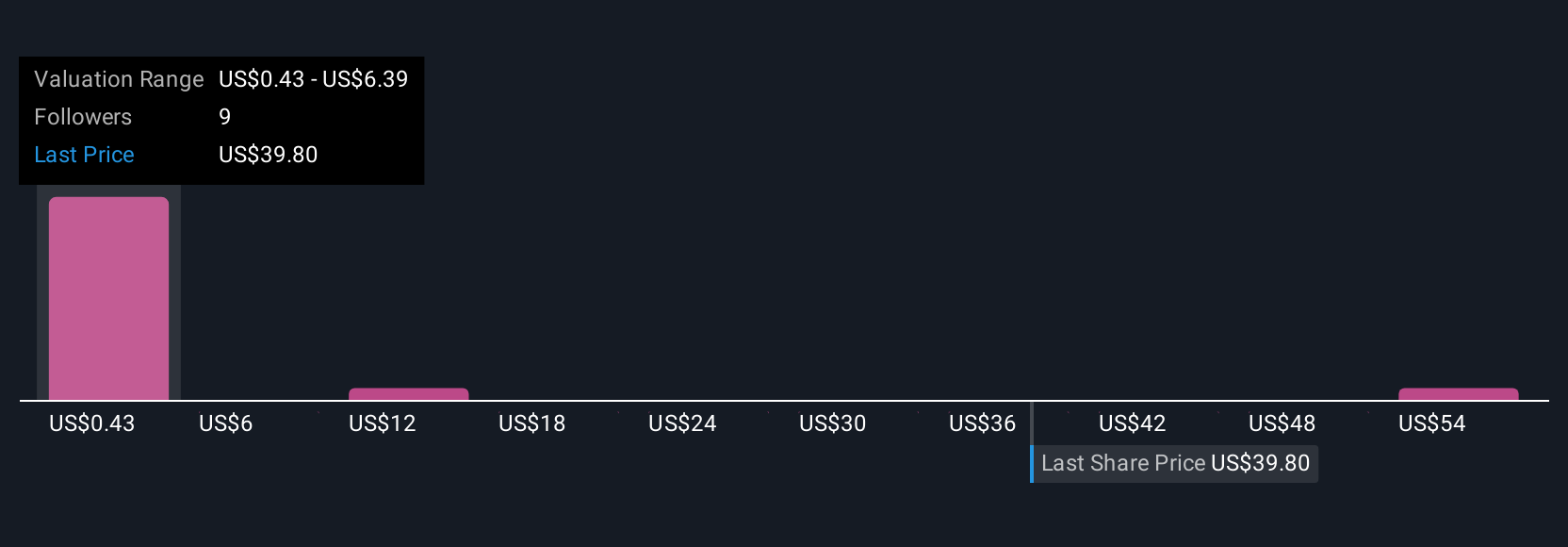

Explore 11 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth as much as 56% more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Adequate balance sheet low.

Market Insights

Community Narratives