- United States

- /

- Software

- /

- NYSEAM:BMNR

Bitmine Immersion Technologies (BMNR): Examining Valuation After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Bitmine Immersion Technologies (BMNR) has grabbed some attention recently as its shares posted strong gains over the past month, climbing 33%. Investors appear to be reassessing the company’s potential in the context of wider sector moves.

See our latest analysis for Bitmine Immersion Technologies.

Momentum has been building fast for Bitmine Immersion Technologies, with its share price up over 32% in the past month and an eye-popping year-to-date gain of 744%. Despite a modest dip on the latest trading day, the 1-year total shareholder return of 572% highlights how quickly sentiment can shift when investors spot growth potential in emerging tech plays.

If you’re searching for standout movers beyond crypto and blockchain, now is a great time to open your scope and discover fast growing stocks with high insider ownership

But with shares soaring and the price now just below analysts’ targets, the real question is whether Bitmine Immersion Technologies is truly undervalued or if the recent rally has already accounted for all future growth prospects.

Price-to-Book of 3670x: Is it justified?

Bitmine Immersion Technologies trades at a staggering price-to-book ratio of 3670x, far outpacing both industry and peer averages. This lofty multiple signals that the stock is extremely expensive compared to other US software companies.

The price-to-book ratio measures the market price of a company’s shares relative to its net assets. For Bitmine Immersion Technologies, such an outsized figure suggests investors have priced in immense future growth or a remarkable change in fortunes. In traditional sectors, high price-to-book multiples often reflect strong profitability or unique intangible assets. However, BMNR remains unprofitable at this stage.

Compared to the US Software industry average of 4.1x and a peer group average of 13.5x, Bitmine Immersion Technologies stands out as dramatically overvalued on this metric. Investors have bid the shares up to a level the market rarely sees, possibly signaling enthusiasm beyond what fundamentals currently support.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3670x (OVERVALUED)

However, weak profitability and a hefty premium above intrinsic value could quickly temper investor enthusiasm if growth or sentiment declines.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

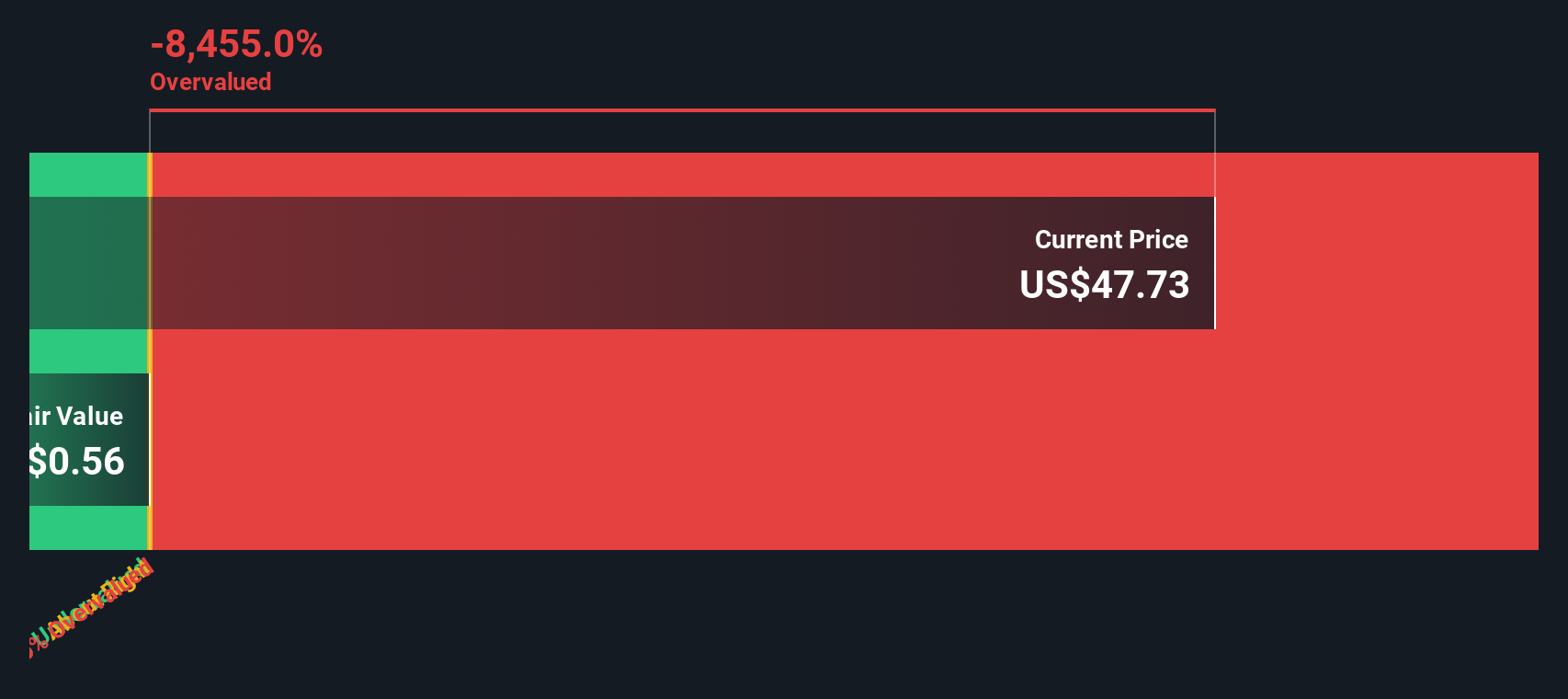

Another View: Discounted Cash Flow Perspective

Looking at Bitmine Immersion Technologies through the lens of our DCF model, the stock appears dramatically overvalued. While shares currently trade around $59.10, our DCF estimate of fair value is just $0.54. This deep disconnect calls into question whether recent optimism is running too far ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you think there’s another story behind these numbers or want to dig deeper into Bitmine Immersion Technologies yourself, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself apart from the crowd by using the Simply Wall Street Screener to uncover investment opportunities you may have overlooked. Don’t wait for the next rally to pass you by.

- Target higher yields and steady income with these 18 dividend stocks with yields > 3% yielding over 3% to see which companies offer attractive payouts.

- Tap into the forefront of medical innovation and identify early leaders by checking out these 32 healthcare AI stocks shaping the future of healthcare.

- Spot tomorrow’s tech disruptors and get ahead of the crowd with these 25 AI penny stocks tapping artificial intelligence for rapid growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion