- United States

- /

- Software

- /

- NYSE:ZETA

Zeta Global Holdings (NYSE:ZETA) Stock Rises 15% Over Past Month

Reviewed by Simply Wall St

Zeta Global Holdings (NYSE:ZETA) recently experienced a significant executive change with the retirement of its co-founder John Sculley, while also launching the innovative 'Zeta Answers', an AI-powered marketing framework. Over the past month, Zeta's stock saw a notable rise of 15%, aligning with an overall bullish trend in the market, where major indices hit new highs. The announcements regarding leadership changes and product innovation could have added momentum to the upward market movements, supplementing the positive investor sentiment and broader tech sector gains.

You should learn about the 1 possible red flag we've spotted with Zeta Global Holdings.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

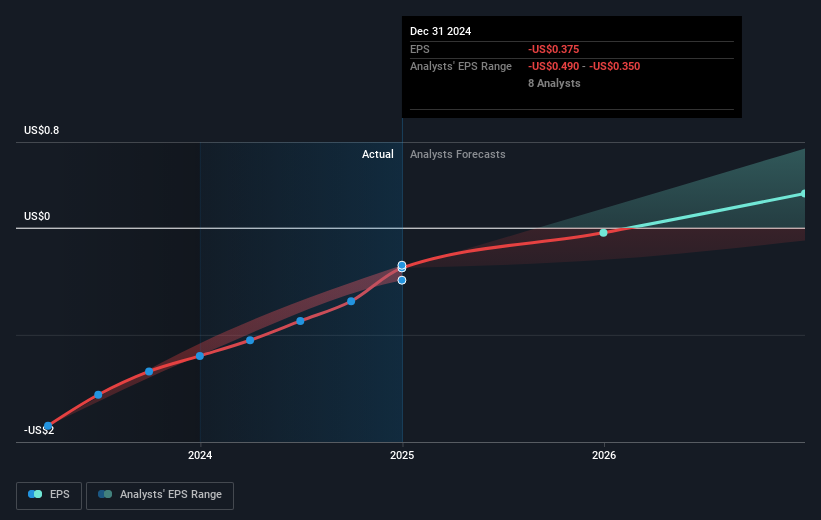

The recent executive transition and launch of 'Zeta Answers' are pivotal developments for Zeta Global Holdings. These changes may fortify Zeta's AI-driven growth strategy, enhancing potential revenue streams as the new marketing framework aligns with evolving industry trends. The leadership shift could offer fresh perspectives, potentially advancing the company’s strategic initiatives through its One Zeta initiative and acquisitions such as LiveIntent. However, these innovations come with risks, including market adoption challenges and regulatory hurdles, which may affect revenue and earnings forecasts. Analysts project growth to over $2 billion by 2028, with revenue expected to grow at 21.3% annually over the next three years.

Over a three-year span, Zeta Global's total shareholder returns increased very significantly by 253.86%. This performance offers a broader context, highlighted by the stock's 15% rise over the past month. While the stock underperformed the US Software industry, which returned 19.2% in the past year, it reflects market optimism evidenced by the broader tech sector's upward trend. Compared to the analyst consensus price target of US$30.17, the current share price of US$13.45 suggests a significant potential upside of 55.4%, contingent on meeting ambitious revenue and earnings targets. Although there is optimism about future gains, achieving a PE ratio of 73.0x by 2028, higher than the industry average, remains a challenge for Zeta amid industry and economic uncertainties.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives