- United States

- /

- Software

- /

- NYSE:ZETA

Zeta Global Holdings Corp.'s (NYSE:ZETA) Shares Leap 28% Yet They're Still Not Telling The Full Story

Zeta Global Holdings Corp. (NYSE:ZETA) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 2.4% isn't as impressive.

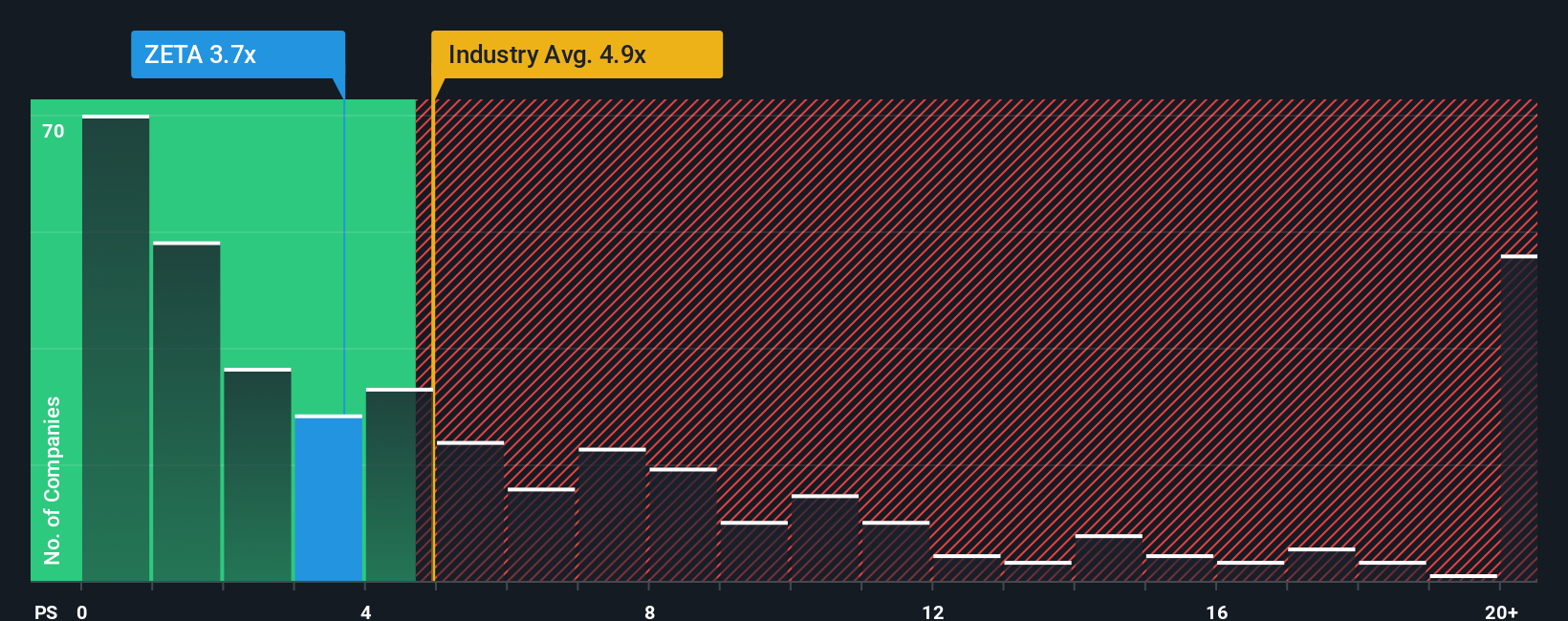

In spite of the firm bounce in price, Zeta Global Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.7x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.9x and even P/S higher than 11x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Zeta Global Holdings

How Has Zeta Global Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Zeta Global Holdings has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zeta Global Holdings.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Zeta Global Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. The latest three year period has also seen an excellent 123% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 19% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 16% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Zeta Global Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Zeta Global Holdings' P/S

The latest share price surge wasn't enough to lift Zeta Global Holdings' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Zeta Global Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Zeta Global Holdings.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.