- United States

- /

- Software

- /

- NYSE:TUYA

High Growth Tech Stocks in US to Watch for Potential Portfolio Boost

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed performances with major indices setting new records despite economic uncertainties, investors are keenly observing the tech sector's potential for high growth amidst fluctuating conditions. In such a dynamic environment, identifying stocks with robust innovation and adaptability can be crucial for those seeking to enhance their portfolios through exposure to promising technology companies.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.33% | 23.81% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.11% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Circle Internet Group | 27.85% | 82.08% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

| Zscaler | 15.74% | 40.36% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Procore Technologies (PCOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Procore Technologies, Inc. offers a cloud-based construction management platform and related services globally, with a market cap of approximately $10.92 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to $1.23 billion. Its cloud-based platform serves the construction industry by providing management tools and services internationally.

Procore Technologies, a player in the construction software sector, is poised for significant advancements with its recent strategic collaboration with AWS. This partnership aims to enhance Procore's AI and data analytics capabilities, crucial for driving efficiency in project delivery and risk management. With an expected revenue growth of 12% annually, outpacing the US market average of 9.8%, Procore is navigating towards profitability within three years. The appointment of Ajei Gopal as CEO promises robust leadership, given his track record at Ansys where he significantly boosted revenue and market value. Moreover, Procore's commitment to innovation is evident from its R&D investments which are integral to sustaining its competitive edge in the evolving tech landscape.

Tuya (TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. operates as an AI cloud platform service provider in the People’s Republic of China, with a market capitalization of approximately $1.55 billion.

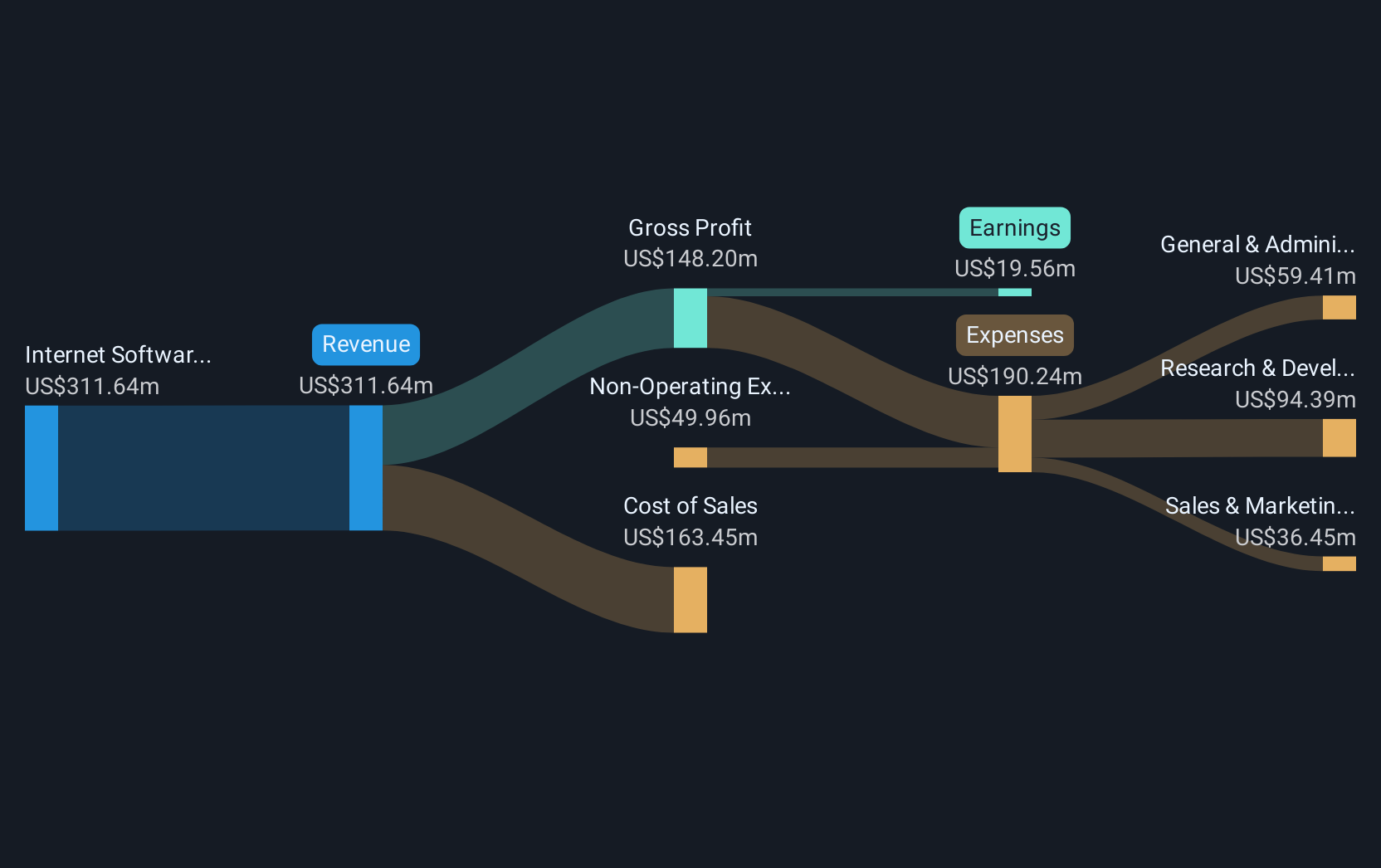

Operations: The company generates its revenue primarily from the Internet Software & Services segment, totaling approximately $318.49 million.

Tuya, a tech entity navigating the competitive landscape of smart device solutions, has demonstrated robust financial health with a recent shift to profitability. In the last fiscal period, Tuya reported a significant leap in net income to $23.6 million from a prior loss, alongside an uplift in sales to $154.82 million from $134.94 million year-over-year. This growth trajectory is complemented by an aggressive R&D stance, crucial for sustaining innovation and competitiveness in IoT and smart home markets. Moreover, Tuya's strategic presence at key global tech conferences underscores its commitment to expanding its market influence and staying abreast of industry trends, potentially shaping future growth avenues in high-tech sectors.

- Click to explore a detailed breakdown of our findings in Tuya's health report.

Explore historical data to track Tuya's performance over time in our Past section.

Zeta Global Holdings (ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software globally, with a market cap of approximately $4.60 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to $1.16 billion. It focuses on providing enterprises with a platform for consumer intelligence and marketing automation software across the United States and internationally.

Zeta Global Holdings, amidst a shifting digital landscape, recently unveiled its Generative Engine Optimization solution, targeting the evolving needs of AI-driven search environments. This strategic move aligns with industry trends where traditional search is diminishing, evidenced by a projected 25% decrease in traditional search engine queries next year. The company's proactive adaptation through innovation is underscored by its recent revenue guidance uplift to $1.26 billion for the year, marking a robust 25% growth rate. Additionally, Zeta's commitment to research and development is evident from its significant expenditure in this area, ensuring it remains at the forefront of technological advancements and competitive within the high-tech sector.

Next Steps

- Click through to start exploring the rest of the 66 US High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success