- United States

- /

- Software

- /

- NYSE:ZETA

Contract-Driven Cloud Momentum Might Change The Case For Investing In Zeta Global Holdings (ZETA)

Reviewed by Sasha Jovanovic

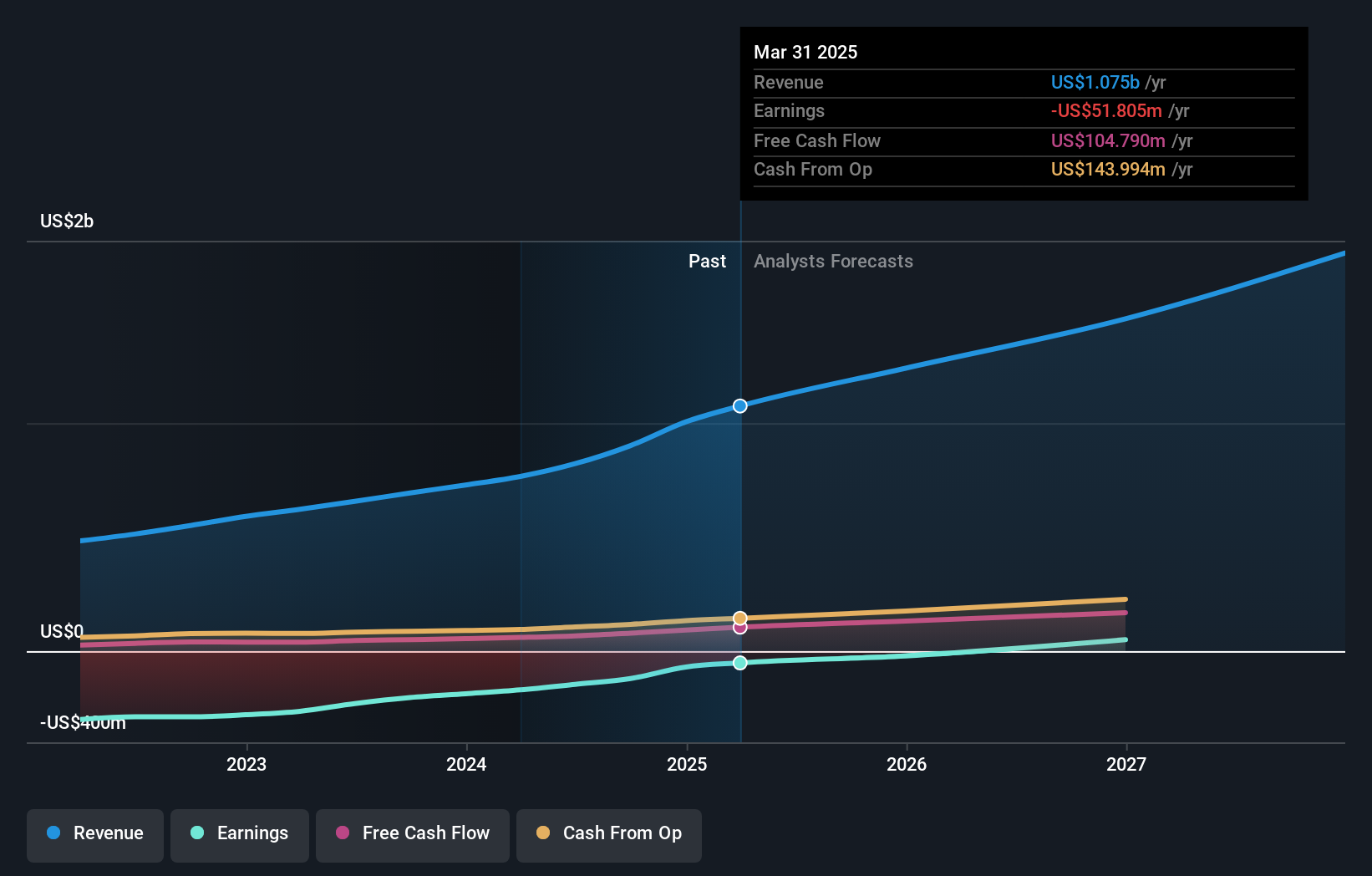

- Zeta Global Holdings recently reported strong momentum in its data-driven marketing cloud business, as ongoing contract wins built on average billings growth of 36.4% over the last year and underpin expectations for revenue to increase 31.6% in the coming 12 months.

- This combination of larger customer commitments and projected market share gains suggests Zeta Global’s platform is becoming increasingly embedded in clients’ marketing operations, reinforcing the company’s competitive position in data-rich, privacy-compliant personalization.

- We’ll now examine how this contract-driven growth outlook, underpinned by robust billings momentum, could influence Zeta Global’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Zeta Global Holdings Investment Narrative Recap

To own Zeta Global, you need to believe its data-driven marketing cloud can keep winning share while moving closer to consistent profitability. The latest billings and revenue growth outlook supports the near term catalyst of continued top line expansion, but it does not materially change the key risk that ongoing GAAP net losses could weigh on investor confidence if spending stays high.

The recent decision to raise 2025 and 2026 revenue guidance ties directly into this growth story, reinforcing that management expects the contract momentum and higher billings to convert into higher reported sales. At the same time, the updated guidance still embeds losses, so investors watching this announcement may focus on whether Zeta can eventually translate its expanding revenue base into durable earnings.

Yet behind this growth narrative, investors should be aware that persistent GAAP net losses could still...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings' narrative projects $1.9 billion revenue and $106.5 million earnings by 2028. This requires 18.3% yearly revenue growth and a $143.1 million earnings increase from $-36.6 million today.

Uncover how Zeta Global Holdings' forecasts yield a $29.67 fair value, a 62% upside to its current price.

Exploring Other Perspectives

Thirty Simply Wall St Community fair value estimates for Zeta range from US$14.28 to US$41.34, highlighting very different views on upside. You will want to weigh these against the risk that ongoing net losses and high spend could pressure sentiment and delay any rerating in the share price.

Explore 30 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion