- United States

- /

- Software

- /

- NYSE:ZETA

Can DA Davidson’s AI Endorsement Reshape Zeta Global’s (ZETA) Competitive Edge in Marketing Tech?

Reviewed by Sasha Jovanovic

- Earlier this month, DA Davidson reaffirmed its Buy rating on Zeta Global Holdings after the company's launch of its new AI-powered Athena platform and updated growth outlook.

- This move highlights industry confidence in Zeta Global's innovation at the intersection of digital transformation and AI-enabled marketing automation.

- We'll explore how the launch of Athena and renewed analyst optimism may influence Zeta Global's investment narrative and growth prospects.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Zeta Global Holdings Investment Narrative Recap

To be a Zeta Global Holdings shareholder, you'd need to believe in the ongoing shift toward AI-powered marketing and the company's ability to carve out a lasting role in this competitive, rapidly changing space. DA Davidson's reaffirmed rating following the Athena AI platform launch doesn't materially change the biggest short-term catalyst, the rising demand for compliant, omnichannel AI marketing solutions, or the primary risk, which remains intensifying competition from much larger, established technology firms entering AI-driven marketing.

The recent launch of Athena likely stands out as the most relevant announcement, bringing advanced personalization and automation to Zeta's platform. By offering clients more integrated and efficient AI marketing tools, Zeta appears positioned to further differentiate itself amid evolving customer needs and the regulatory shifts increasingly defining digital advertising.

Yet, in contrast to these positive signals, investors should be aware of the ongoing threat posed by...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings is projected to reach $1.9 billion in revenue and $106.5 million in earnings by 2028. This outlook assumes annual revenue growth of 18.3% and a $143.1 million increase in earnings from the current level of -$36.6 million.

Uncover how Zeta Global Holdings' forecasts yield a $28.27 fair value, a 56% upside to its current price.

Exploring Other Perspectives

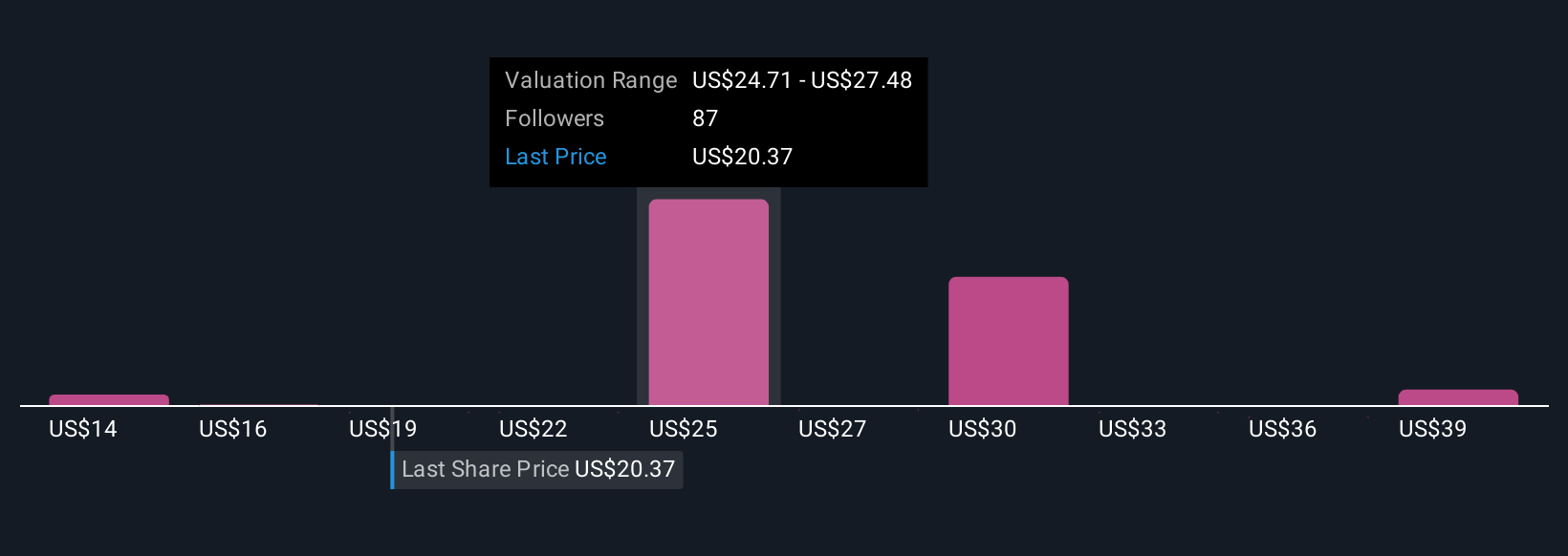

Thirty Simply Wall St Community members have priced Zeta Global between US$13.63 and US$41.34 per share, illustrating a broad valuation spread. While the market weighs AI-driven growth as a positive, the risk of shrinking pricing power from larger rivals looms, explore how different perspectives shape expectations for Zeta's future.

Explore 30 other fair value estimates on Zeta Global Holdings - why the stock might be worth 25% less than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives