- United States

- /

- Software

- /

- NYSE:ZETA

Astera Labs And Two More Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, driven by investor reactions to earnings reports and anticipation of tariff news, the focus remains on sectors like technology where chipmakers are leading rallies. In this context, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, aligning with current market optimism and resilience.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

| CoreWeave (NasdaqGS:CRWV) | 38.1% | 70.3% |

Let's uncover some gems from our specialized screener.

Astera Labs (NasdaqGS:ALAB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of approximately $9.75 billion.

Operations: The company's revenue segment is focused on semiconductors, generating $396.29 million.

Insider Ownership: 15.8%

Astera Labs demonstrates significant growth potential with a forecasted revenue increase of 24.8% annually, outpacing the broader US market. Despite recent insider selling, the company is expected to achieve profitability within three years, supported by innovative product developments like their Scorpio Smart Fabric Switches for NVIDIA platforms. Although trading below estimated fair value and showing volatile share prices recently, Astera's strategic advancements in AI and cloud infrastructure position it well for future growth.

- Get an in-depth perspective on Astera Labs' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Astera Labs' share price might be too optimistic.

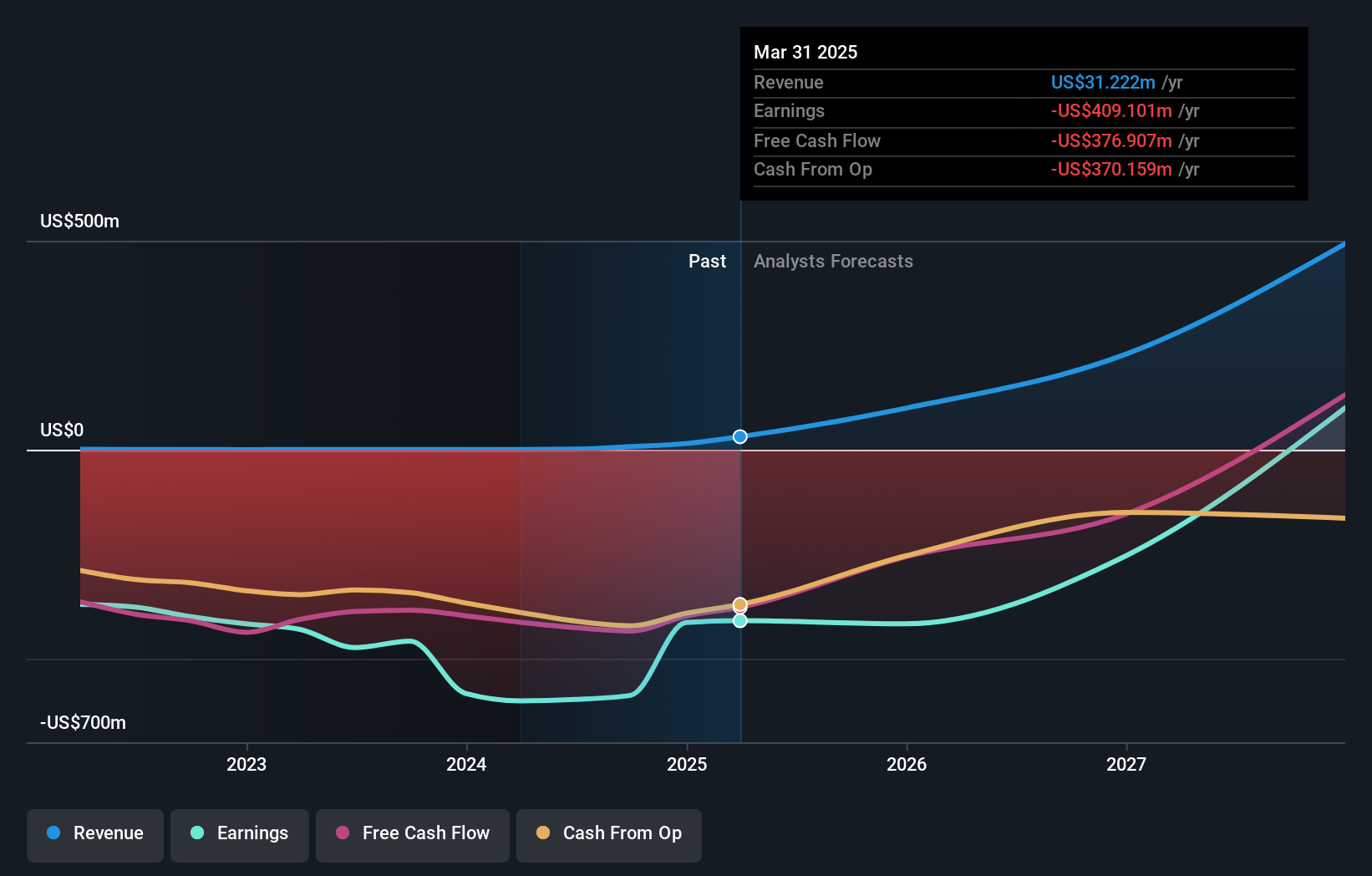

ImmunityBio (NasdaqGS:IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a commercial-stage biotechnology company focused on developing next-generation therapies to enhance the natural immune system against cancers and infectious diseases, with a market cap of approximately $2.37 billion.

Operations: The company generates its revenue from the biotechnology segment, amounting to $14.75 million.

Insider Ownership: 33.5%

ImmunityBio's significant insider ownership aligns with its robust growth prospects, as revenue is expected to grow at 48% annually, surpassing the US market. Recent FDA submissions for ANKTIVA indicate potential expansion in treatment options for bladder cancer, supporting future profitability within three years. Despite a volatile share price and past shareholder dilution, the company's innovative immunotherapy advancements and increased sales momentum underscore its strategic positioning in the biotech sector.

- Navigate through the intricacies of ImmunityBio with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that ImmunityBio's current price could be inflated.

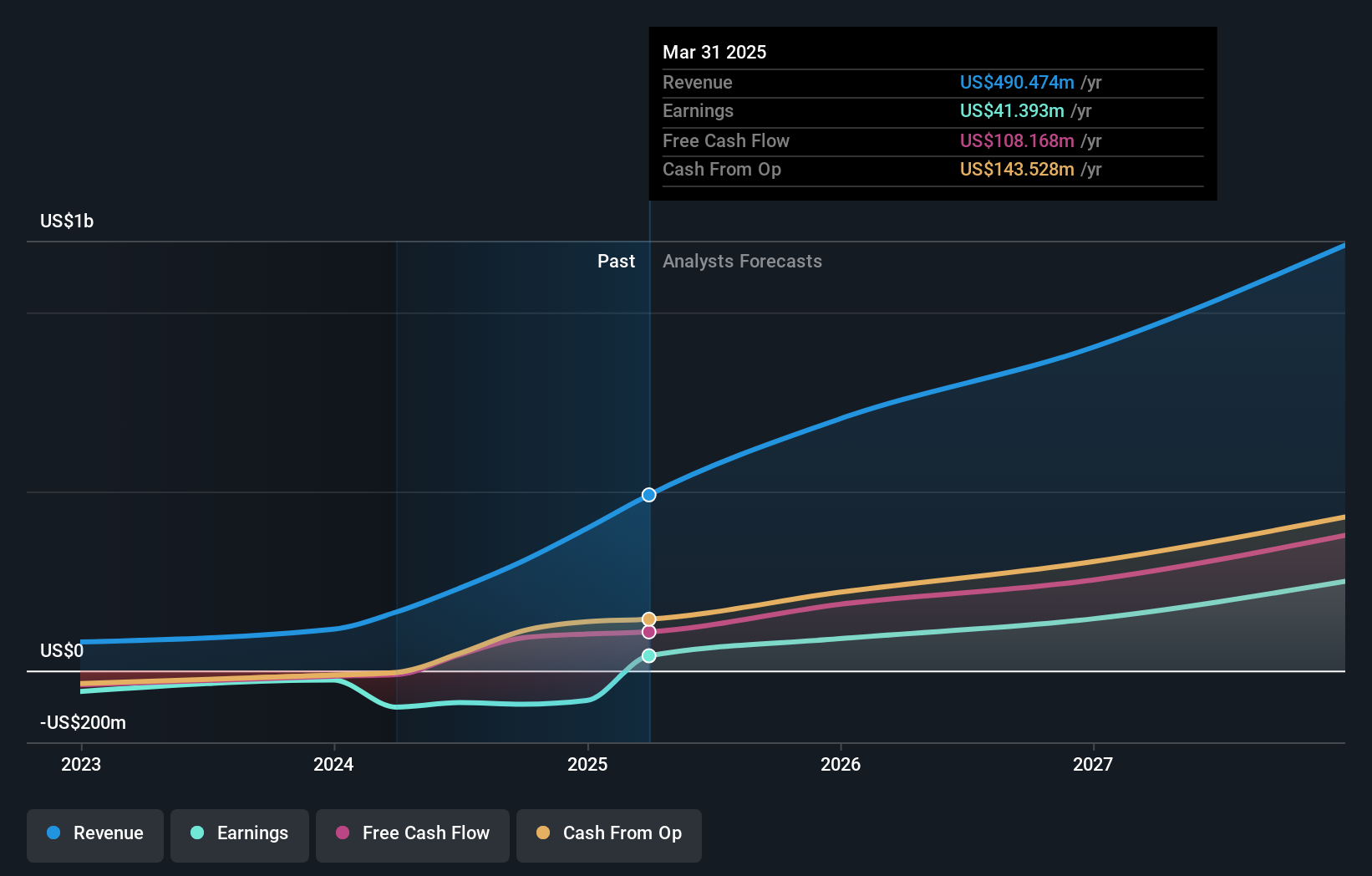

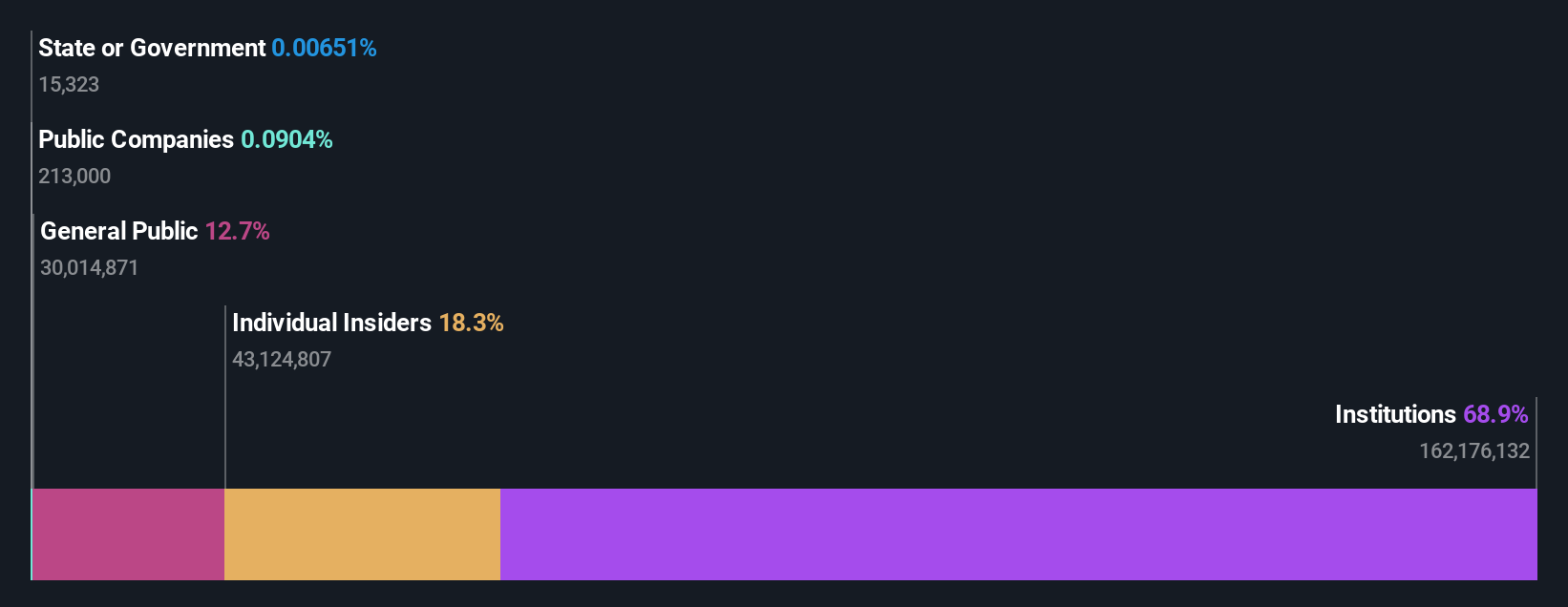

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $2.69 billion.

Operations: The company generates revenue of $1.01 billion from its Internet Software & Services segment, which focuses on providing consumer intelligence and marketing automation solutions.

Insider Ownership: 19.9%

Zeta Global Holdings demonstrates promising growth with expected revenue increases of 17.3% annually, outpacing the US market. The company's forecasted earnings growth of 136.4% per year and anticipated profitability within three years highlight its potential. Recent innovations, like the AI Agent Studio launch, enhance marketing capabilities and operational efficiency, supporting future expansion. Trading at a significant discount to fair value and having completed substantial share buybacks further solidify Zeta's strategic positioning amidst high insider ownership.

- Dive into the specifics of Zeta Global Holdings here with our thorough growth forecast report.

- Our expertly prepared valuation report Zeta Global Holdings implies its share price may be lower than expected.

Next Steps

- Reveal the 204 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives