- United States

- /

- Software

- /

- NYSE:YEXT

Yext (NYSE:YEXT) launches enhanced AI Review Generation tool to strengthen customer engagement

Reviewed by Simply Wall St

Take a closer look at Yext's potential here.

Key Assets Propelling Yext Forward

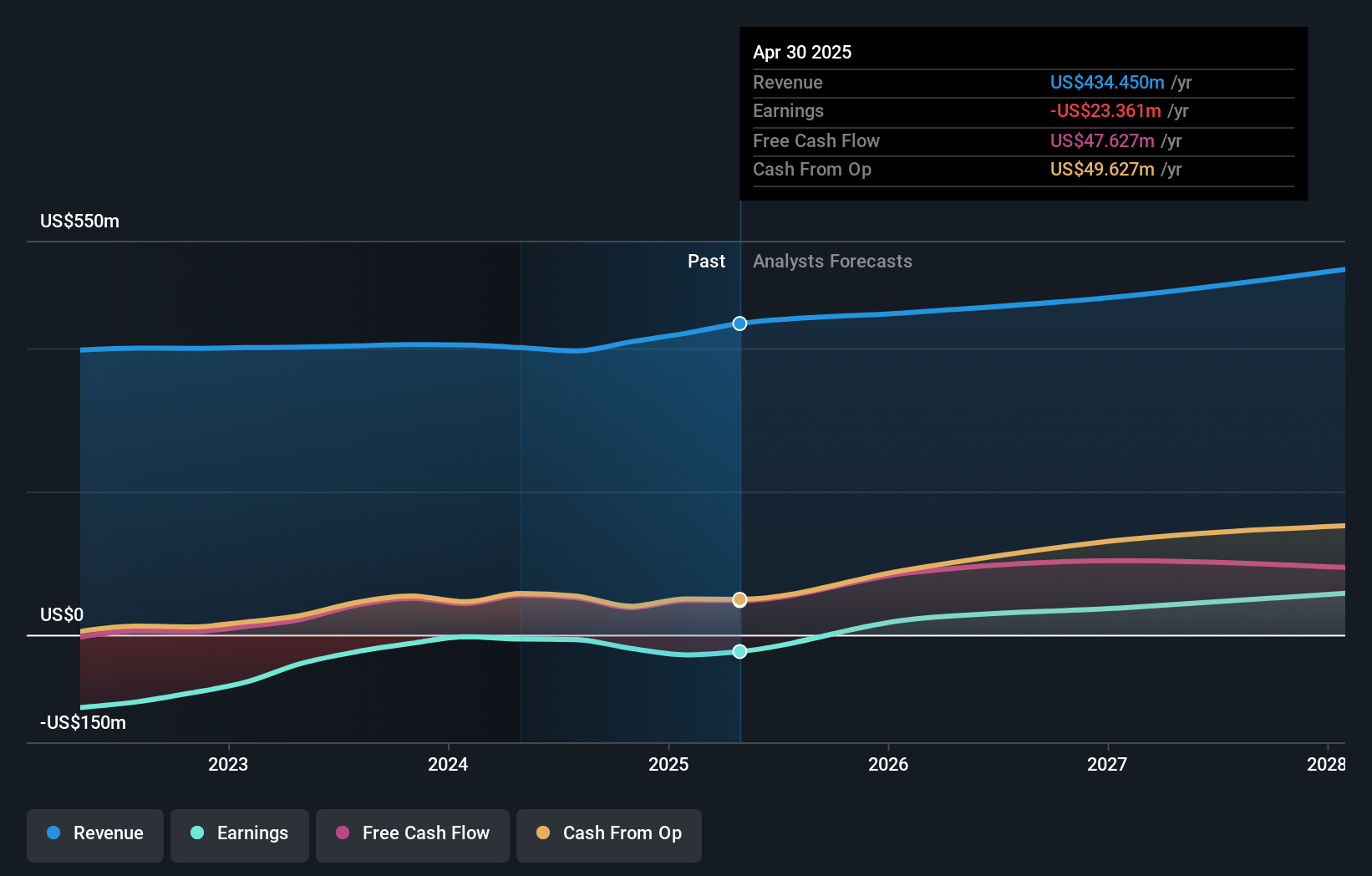

Yext is on a promising trajectory, forecasting profitability within the next three years, which is notably above the average market growth. This positive outlook is supported by cash flow growing at an impressive 50.2% annually, ensuring a stable financial runway. The company's debt-free status further strengthens its financial health, eliminating concerns over interest payments. Additionally, substantial insider buying over the past three months reflects strong internal confidence in Yext's strategic direction. The recent launch of the AI Review Generation solution, which integrates seamlessly with over 80 review platforms, underscores Yext's commitment to enhancing customer engagement and brand trust.

Vulnerabilities Impacting Yext

Yext faces challenges, such as its current unprofitability, with a return on equity of -4.09%. The company's revenue growth forecast of 5.4% per year lags behind the broader market's 8.9% growth rate. Furthermore, Yext's valuation is considered expensive compared to peers, although it trades below its estimated fair value. This mixed valuation perspective suggests potential investor caution. The resignation of Tamar Yehoshua from the board, while amicable, highlights potential gaps in leadership continuity.

Growth Avenues Awaiting Yext

Yext is poised to capitalize on significant growth opportunities, with earnings projected to increase by 45.74% annually. The company's strategic focus on technological advancements, such as the expanded AI Review Generation tool, positions it well to enhance its market presence. This tool not only boosts review volume and discoverability but also strengthens customer connections. Yext's proactive market expansion initiatives, including strategic acquisitions, aim to diversify its market share and leverage emerging opportunities.

Regulatory Challenges Facing Yext

Potential threats include economic headwinds that may unevenly impact growth across segments, as noted by CFO Darryl Bond. Regulatory challenges could also affect operational capabilities, requiring adaptive strategies. Moreover, competitive pressures remain a constant challenge, as highlighted by CEO Michael Walrath. These factors necessitate careful navigation to maintain Yext's market position and sustain growth momentum.

Conclusion

Yext is on a promising path, with a forecasted profitability within three years, driven by strong cash flow growth of 50.2% annually and a debt-free status that ensures financial stability. However, the company's current unprofitability and slower revenue growth compared to the market, coupled with its expensive valuation relative to peers, suggest a cautious approach from investors. Despite these challenges, Yext's strategic initiatives, such as the AI Review Generation tool and market expansion efforts, position it well for significant earnings growth of 45.74% annually. Navigating regulatory and competitive pressures will be crucial to maintaining its market position, but the internal confidence shown by substantial insider buying indicates a positive outlook for Yext's future performance.

Next Steps

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion