- United States

- /

- IT

- /

- NYSE:NET

Top Growth Companies With Strong Insider Ownership For November 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a significant upswing, with major indexes like the Nasdaq and S&P 500 posting notable gains, investors are keenly observing growth companies that exhibit strong insider ownership. In such a buoyant market environment, stocks where company insiders hold substantial stakes can be appealing as they often signal confidence in the company's future prospects and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 133.7% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.5% |

We'll examine a selection from our screener results.

Roivant Sciences (ROIV)

Simply Wall St Growth Rating: ★★★★★☆

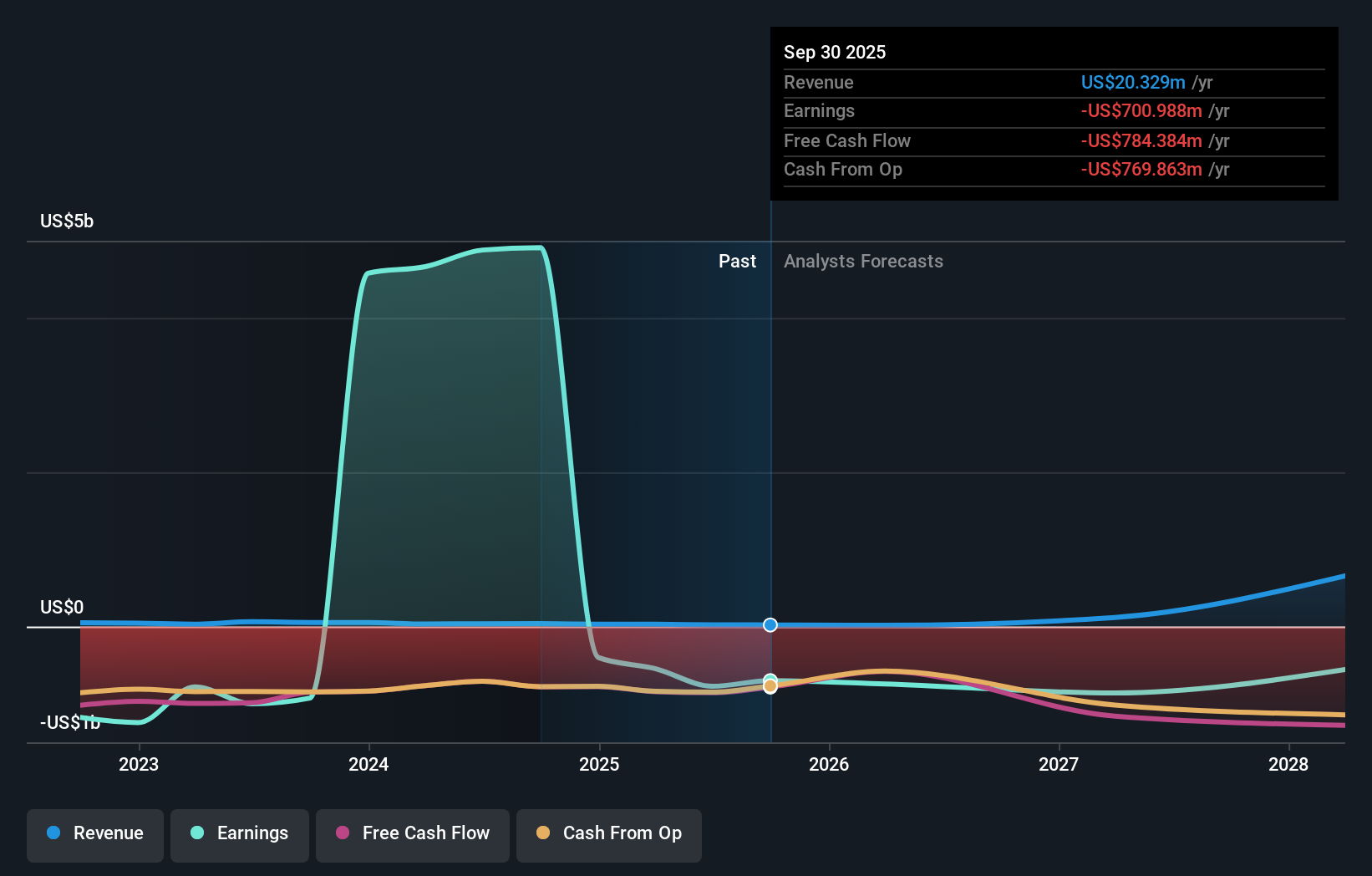

Overview: Roivant Sciences Ltd. is a clinical-stage biopharmaceutical company dedicated to discovering, developing, and commercializing medicines and technologies, with a market cap of $14.51 billion.

Operations: The company generates revenue of $20.33 million from its focus on the discovery, development, and commercialization of medicines and technologies.

Insider Ownership: 22.3%

Earnings Growth Forecast: 46.5% p.a.

Roivant Sciences is expected to achieve significant revenue growth, forecasted at 58.6% annually, outpacing the broader US market. Despite a current unprofitable status, profitability is anticipated within three years, aligning with above-average market growth expectations. However, recent financials revealed a net loss of US$113.52 million for Q2 2025 despite improved earnings compared to the previous year. Insider activity shows significant selling recently with no substantial buying in the past three months.

- Get an in-depth perspective on Roivant Sciences' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Roivant Sciences shares in the market.

Cloudflare (NET)

Simply Wall St Growth Rating: ★★★★★★

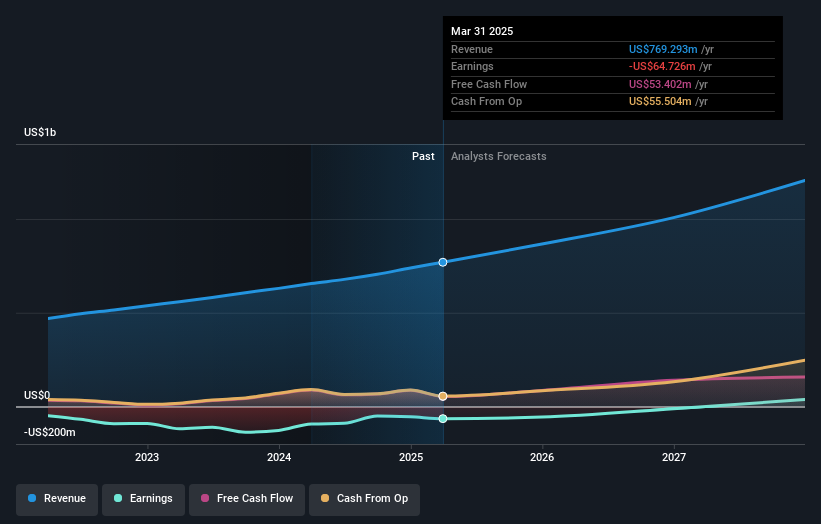

Overview: Cloudflare, Inc. is a cloud services provider offering a variety of services to businesses globally, with a market cap of $67.95 billion.

Operations: The company generates revenue from its Internet Telephone segment, which amounted to $2.01 billion.

Insider Ownership: 10.4%

Earnings Growth Forecast: 43.5% p.a.

Cloudflare exhibits strong growth potential with revenue expected to increase by 21.3% annually, outpacing the US market. The company reported Q3 2025 sales of US$562.03 million, a significant rise from the previous year, with a reduced net loss of US$1.29 million. Despite no substantial insider buying recently, insiders have sold fewer shares than bought in the past three months. Cloudflare's strategic partnerships and innovations in AI and agentic commerce enhance its competitive edge in the tech sector.

- Click to explore a detailed breakdown of our findings in Cloudflare's earnings growth report.

- According our valuation report, there's an indication that Cloudflare's share price might be on the expensive side.

Workiva (WK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workiva Inc. offers cloud-based reporting solutions across the Americas and internationally, with a market cap of $5.22 billion.

Operations: The company's revenue primarily comes from its data processing segment, which generated $845.52 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 124.7% p.a.

Workiva's revenue is forecast to grow at 14.7% annually, surpassing the US market average. The company reported Q3 2025 revenue of US$224.17 million and achieved a net income turnaround, highlighting its growth trajectory despite past losses. Recent leadership changes, with Michael Pinto as Chief Revenue Officer, aim to bolster global sales efforts. Investor activism has prompted calls for governance reforms and strategic evaluations amid concerns about financial performance and board composition stability.

- Unlock comprehensive insights into our analysis of Workiva stock in this growth report.

- In light of our recent valuation report, it seems possible that Workiva is trading behind its estimated value.

Next Steps

- Unlock our comprehensive list of 200 Fast Growing US Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success