- United States

- /

- Software

- /

- NYSE:WK

How Workiva's (WK) AI Platform Expansion May Shift Its Investment Narrative on Automation and Differentiation

Reviewed by Simply Wall St

- Earlier this month, Workiva announced a major expansion of its intelligent platform at the Amplify event, unveiling agentic AI, unified data automation, and a modernized controls experience tailored for CFO teams.

- This development aims to address rising data governance and regulatory complexities, with high-profile customers already leveraging the new AI-powered tools to accelerate performance.

- Let's explore how Workiva's agentic AI rollout could reshape its investment narrative, particularly around automation and platform differentiation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Workiva Investment Narrative Recap

Workiva’s investment story centers on its position as a provider of cloud-based reporting platforms for enterprises facing regulatory pressures and the growing demand for process automation. The recent Amplify news, with its agentic AI announcement, meaningfully supports the near-term catalyst of increased platform adoption, especially as major clients begin using these new features, but does not remove the ongoing risks tied to uncertain global regulation and partner quality.

Among several recent announcements, the release of agentic AI is most immediately relevant. This update directly targets customer pain points like workflow fragmentation, positioning Workiva’s platform as a differentiated, automation-focused solution ahead of competitors, and potentially driving broader enterprise adoption in the face of increasingly complicated compliance demands.

However, it’s important to recognize that even as Workiva drives innovation with AI-powered features, there remains the possibility that changes in European regulations might...

Read the full narrative on Workiva (it's free!)

Workiva's narrative projects $1.4 billion revenue and $37.9 million earnings by 2028. This requires 20.6% yearly revenue growth and a $104.5 million increase in earnings from -$66.6 million currently.

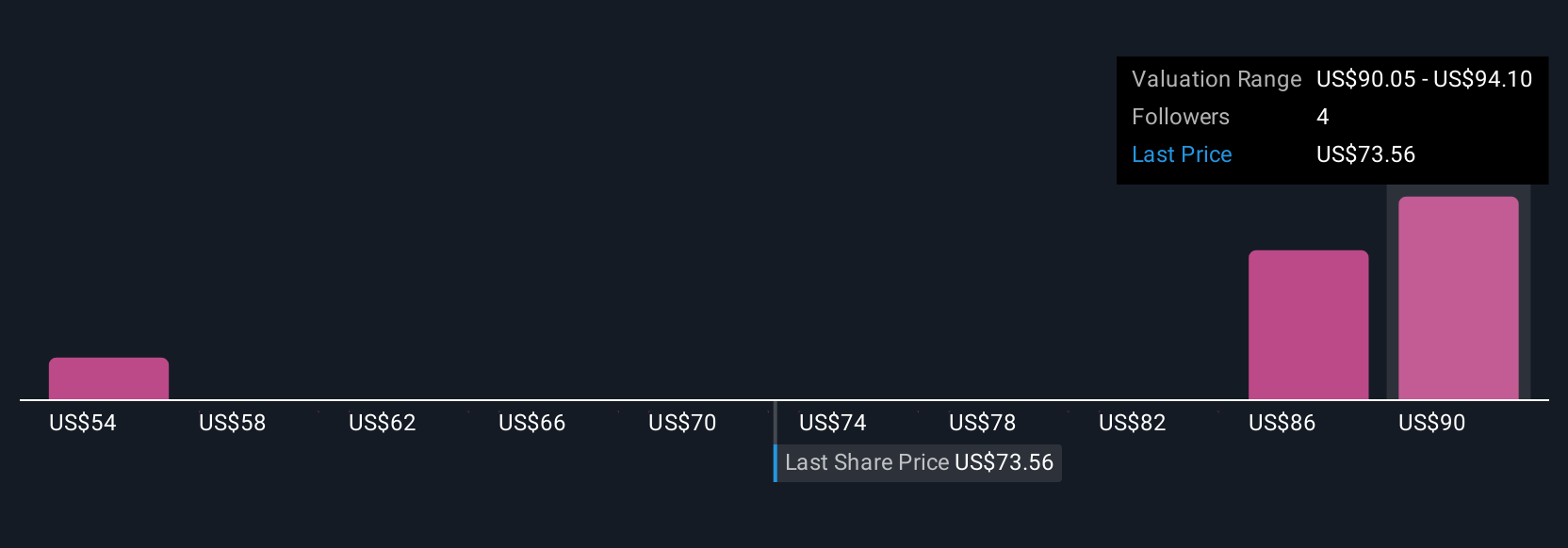

Uncover how Workiva's forecasts yield a $96.10 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Workiva’s fair value ranges from US$53.57 to US$140.75, showing wide variance in outlooks. While new AI capabilities could accelerate platform gains, unresolved regulatory shifts may still shape future performance in unexpected ways, explore the full range of viewpoints behind these estimates.

Explore 3 other fair value estimates on Workiva - why the stock might be worth as much as 77% more than the current price!

Build Your Own Workiva Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workiva research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Workiva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workiva's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives