- United States

- /

- Software

- /

- NYSE:WK

Does Workiva’s Recent 22% Slide Signal Opportunity or Risk for 2025 Investors?

Reviewed by Bailey Pemberton

- Wondering if Workiva stock is a hidden value play or overpriced in today’s market? You’re not alone, as investors are increasingly turning their attention to its valuation.

- Workiva shares have seen a 4.2% dip over the last week and are down 22.1% year-to-date, but the stock is still up 4.7% over the past year. This shows both volatility and resilience, making for an intriguing valuation story.

- Recent headlines have focused on Workiva’s continued investment in its cloud platform and expansion into ESG reporting, both of which have influenced market sentiment. Analysts and industry observers have highlighted these developments as potential catalysts for future growth or, conversely, sources of added risk.

- Right now, Workiva clocks in with a valuation score of 3 out of 6, which tells us there’s value in some areas but possible overvaluation in others. We’ll break down how this score is calculated using standard valuation approaches, followed by an introduction to a more comprehensive way to gauge the company’s worth.

Find out why Workiva's 4.7% return over the last year is lagging behind its peers.

Approach 1: Workiva Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to present value. This process involves assessing what Workiva is expected to earn each year in the future, adjusting for the time value of money, and summing these values to determine what the business might really be worth today.

Workiva’s most recent reported Free Cash Flow is $102.7 million. Analyst forecasts project that by 2029, annual Free Cash Flow could reach $297.7 million. While detailed analyst forecasts are only available for the next five years, longer-term projections rely on extending these trends, as performed by Simply Wall St’s DCF calculation.

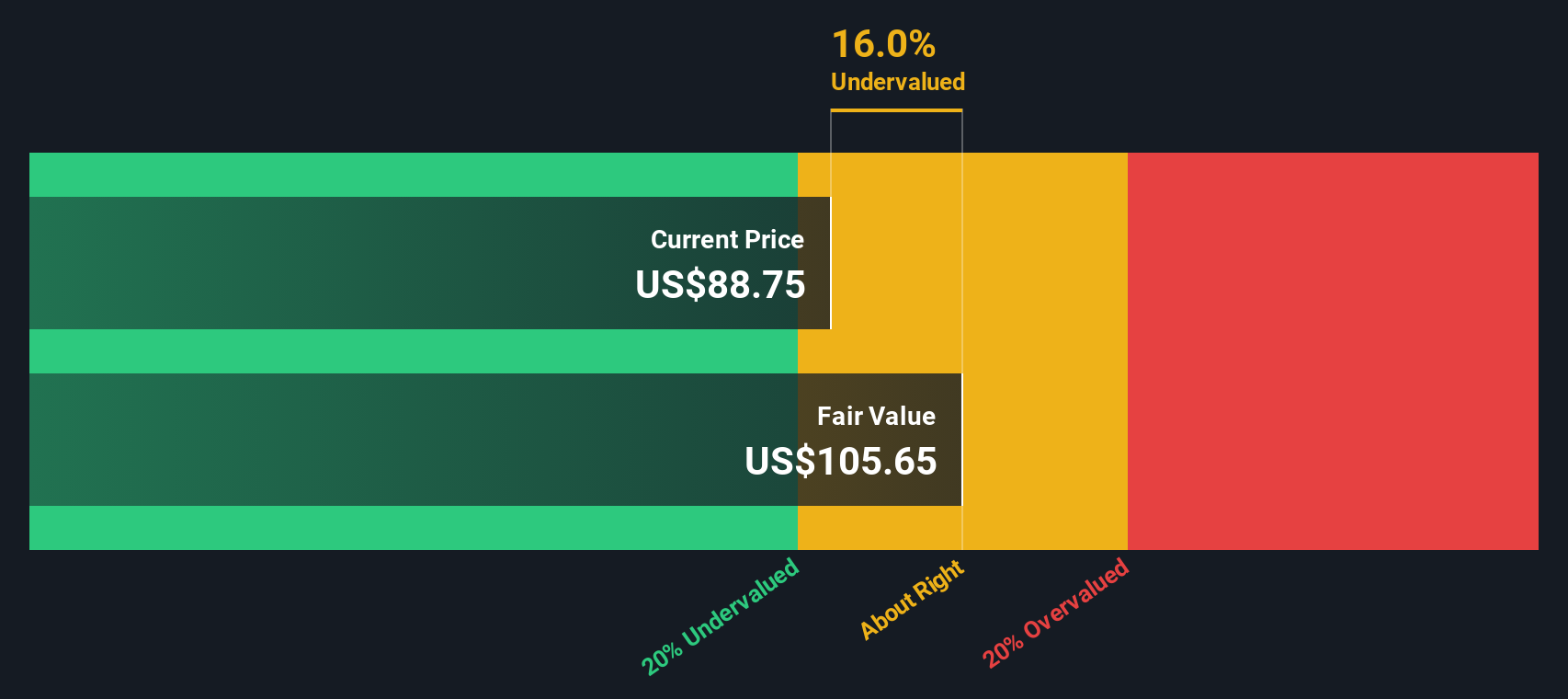

Based on these cash flow projections, the DCF model estimates Workiva’s fair value at $105.94 per share. According to this calculation, the stock’s current price suggests it is trading at a 19.9% discount to its intrinsic value. This implies the shares may be undervalued when assessed using cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Workiva is undervalued by 19.9%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Workiva Price vs Sales

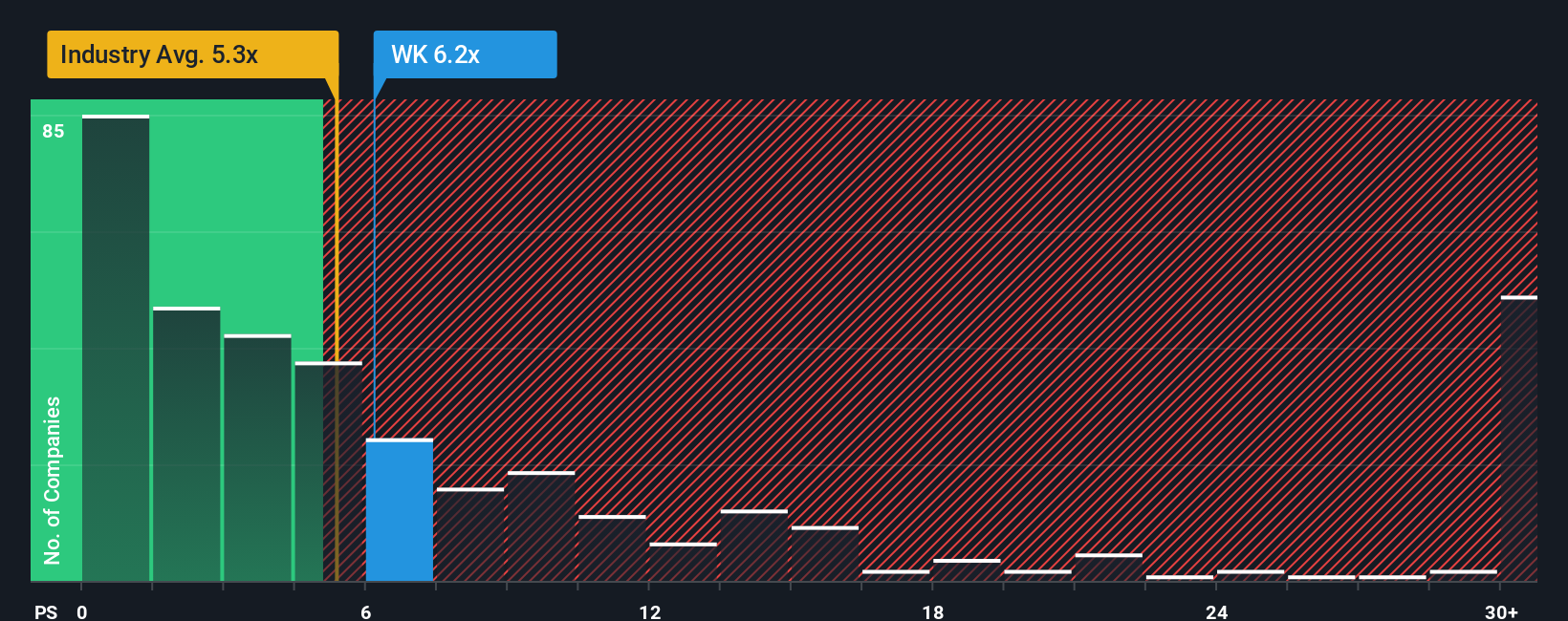

For companies like Workiva that are still ramping up profitability, the Price-to-Sales (PS) ratio is often the preferred way to assess valuation. This metric is useful because it compares the company’s market value to its actual sales, offering clarity when earnings may be negative or inconsistent due to investments in future growth.

Growth expectations and company-specific risks play a big role in what qualifies as a “normal” or “fair” PS ratio. Companies with higher projected growth and lower risk often justify higher multiples. Those facing industry headwinds or elevated risk should trade at a discount.

Workiva currently trades at a PS ratio of 5.89x. In comparison, the average PS ratio for the Software industry is 5.25x, and the company’s peer group sits at 6.27x. At first glance, this suggests the stock’s valuation is in line or perhaps slightly favorable relative to its direct rivals.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For Workiva, the Fair PS Ratio is calculated at 6.65x. This figure is tailored to the company’s specific growth outlook, profit margin, risk profile, sector, and market cap, going beyond the surface-level averages. By blending all of these factors, the Fair Ratio provides a more meaningful benchmark for investors aiming to identify genuine value or risk of overvaluation.

Given that Workiva’s actual PS ratio (5.89x) is somewhat below its Fair Ratio (6.65x), the stock appears to be undervalued when judged by this more complete approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Workiva Narrative

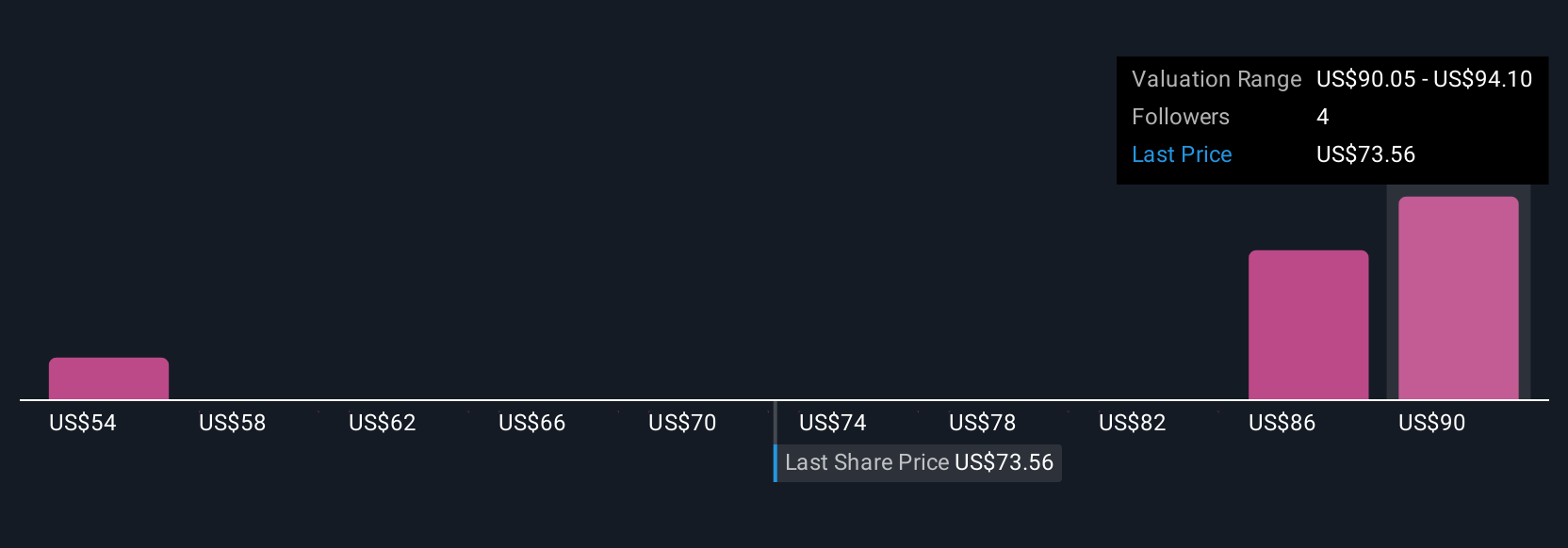

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story and perspective about a company, connecting your expectations for its future revenue, earnings, and margins to a financial forecast and, ultimately, a fair value.

Narratives allow investors to go beyond just numbers by linking what they believe is most important, such as new products, changes in regulation, or competitive advantage, directly to calculations of what a company might be worth. This bridges the gap between a company’s story and a concrete financial valuation, empowering you to make more confident buy or sell decisions.

On Simply Wall St’s Community page, Narratives are accessible and easy for anyone to create or explore, regardless of investing experience, and millions of investors have already adopted them. What makes Narratives so powerful is that they update automatically when news breaks, earnings are released, or key company metrics change, helping you stay up-to-date with the latest insights and valuations.

For Workiva, some investors in the Community see significant upside based on rapid adoption of its sustainability reporting platform and forecast a fair value as high as $105 per share. Others worry about regulatory risks or slow international growth and see fair value closer to $85, demonstrating how Narratives reflect diverse views and help guide smarter investment decisions as the story unfolds.

Do you think there's more to the story for Workiva? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives