- United States

- /

- Software

- /

- NYSE:U

Unity Software (U) Surges 72% Over Last Quarter

Unity Software (U) recently announced a global partnership with Globant, joining the Unity Service Partner Program to deliver advanced interactive solutions, a significant step that may have reinforced market confidence. This announcement is a key event coinciding with Unity's impressive 72% gain in its share price over the last quarter. While broader market indices have also been climbing, benefiting from favorable policy expectations and rate cut hopes, Unity's partnership with Globant to focus on industries like digital twins, automotive, and healthcare could have added an extra layer of investor optimism and contributed to their notable market outperformance.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

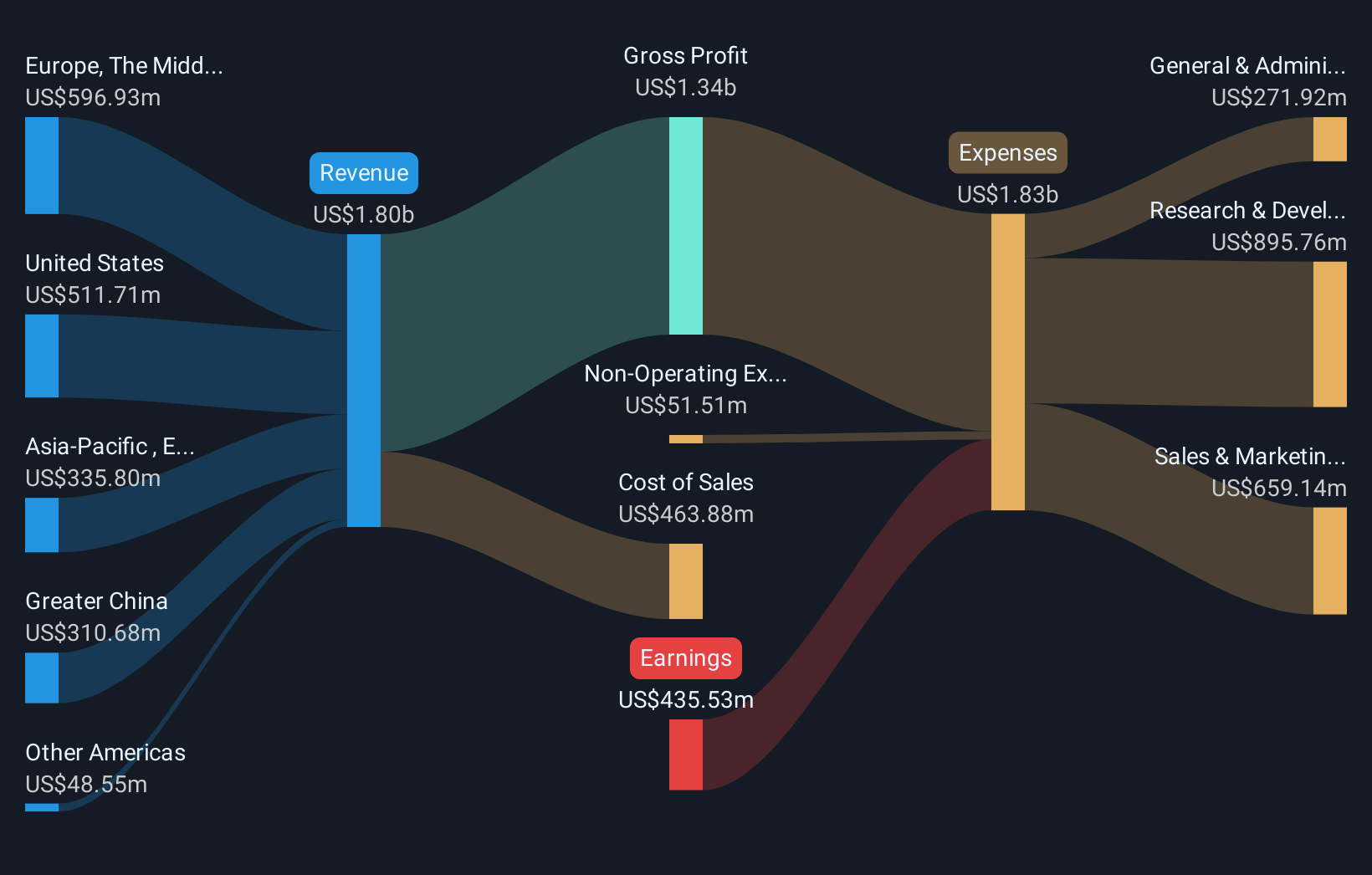

Unity Software's recent partnership with Globant represents a meaningful expansion of its interactive solutions capabilities, potentially enhancing its AI-driven revenue streams and margins. This focus on areas like digital twins, automotive, and healthcare could effectively broaden Unity's market reach and diversify its revenue sources. Over the past year, Unity's total return was very large, indicating substantial investor confidence and outperforming broader market indices which returned 19.1% during the same period. However, concerns remain as analysts forecast the company to remain unprofitable over the next three years despite expected annual revenue growth of 8.7%.

The announcement with Globant could positively impact future revenue projections by solidifying Unity's position in high-growth sectors. Analysts maintain varying opinions on the stock's fair value, with a current consensus price target at US$34.75 per share. Despite the price target being below the current share price of US$43.10, the collaboration might contribute to improved sentiment and possibly reassessments of Unity's valuation as new projects materialize. Despite the impressive total returns, the market remains cautious, as evidenced by the lower price targets, indicating there could be risks to sustaining this pace of growth.

Assess Unity Software's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion