- United States

- /

- Software

- /

- NYSE:U

Unity Software (U): Examining Valuation After a Year of Strong Share Price Gains

Reviewed by Simply Wall St

Unity Software (U) has seen its stock fluctuate over the past month, with shares now trading near $36.72. Investors are paying close attention to recent financial results and ongoing business performance to gauge potential momentum.

See our latest analysis for Unity Software.

After a volatile year that included some big swings, Unity Software’s share price return now stands at almost 50% year-to-date. The total shareholder return over the past 12 months is an impressive 112%. Recent price moves reflect both renewed optimism about its growth prospects and some lingering caution as the company navigates current market conditions.

If Unity’s surge sparks your interest in the broader software and tech space, take the next step and explore See the full list for free.

But with Unity’s strong run so far this year and recent financial momentum, a key question remains: is there more value to unlock, or are investors already factoring in all of the company’s future growth?

Most Popular Narrative: 4.6% Undervalued

Unity Software's most prominent valuation narrative puts fair value at $38.48, modestly above the recent price of $36.72. This sets the stage for investor debate around Unity’s potential upside if execution is strong.

Unity's increasingly diversified revenue streams in non-gaming sectors decrease its riskiness and bolster its long-term growth potential. Significant restructuring progress with the new management addressing past missteps is evident by the rollback of the controversial runtime fee.

Curious about what powers this fair value? Discover which major changes in Unity’s business model and bullish financial assumptions are driving the price higher. There’s a twist that only the full narrative reveals.

Result: Fair Value of $38.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in advertising and gaming, or slower-than-expected progress in strategy, could quickly challenge Unity’s current long-term outlook.

Find out about the key risks to this Unity Software narrative.

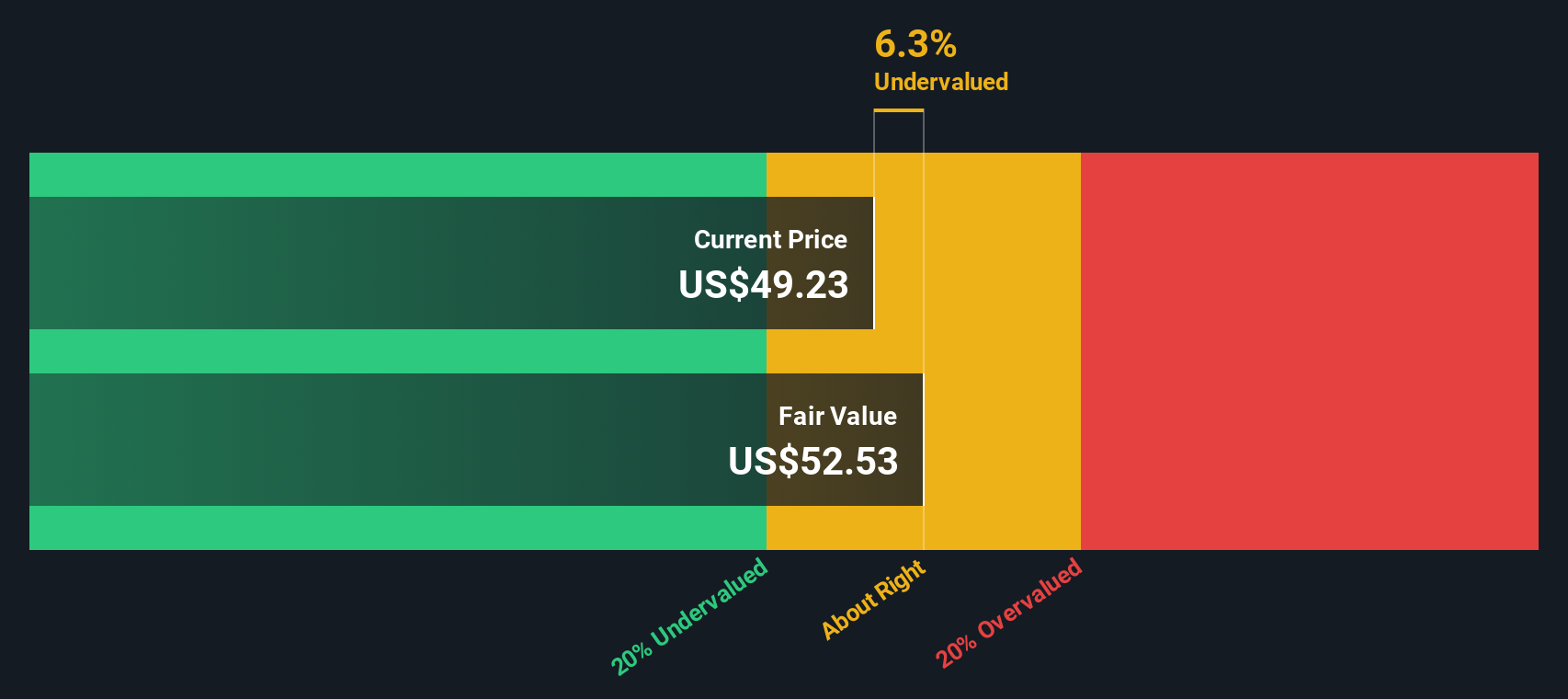

Another View: Our DCF Model Offers a Different Angle

While the popular narrative sees Unity Software as modestly undervalued, our SWS DCF model brings a different perspective. According to this discounted cash flow approach, Unity is actually trading slightly above its estimated fair value, suggesting more limited future upside than some might expect. Could this signal that recent optimism is already reflected in the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Unity Software for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Unity Software Narrative

If you’d rather dig into the numbers and see where your perspective leads, you can put together your own Unity Software narrative in just a few minutes. Do it your way

A great starting point for your Unity Software research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss out on other high-potential opportunities. Use Simply Wall Street's screener to find companies making moves in market-defining sectors before others catch on.

- Discover early-stage disruptors with strong financials by checking out these 3585 penny stocks with strong financials poised for significant upside.

- Take advantage of healthcare transformation and track breakthroughs driven by artificial intelligence through these 32 healthcare AI stocks.

- Increase your passive income with steady payers by analyzing these 16 dividend stocks with yields > 3% above 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion