- United States

- /

- Software

- /

- NYSE:U

Unity Results Highlight Vector Growth AI Push And Leadership Reset

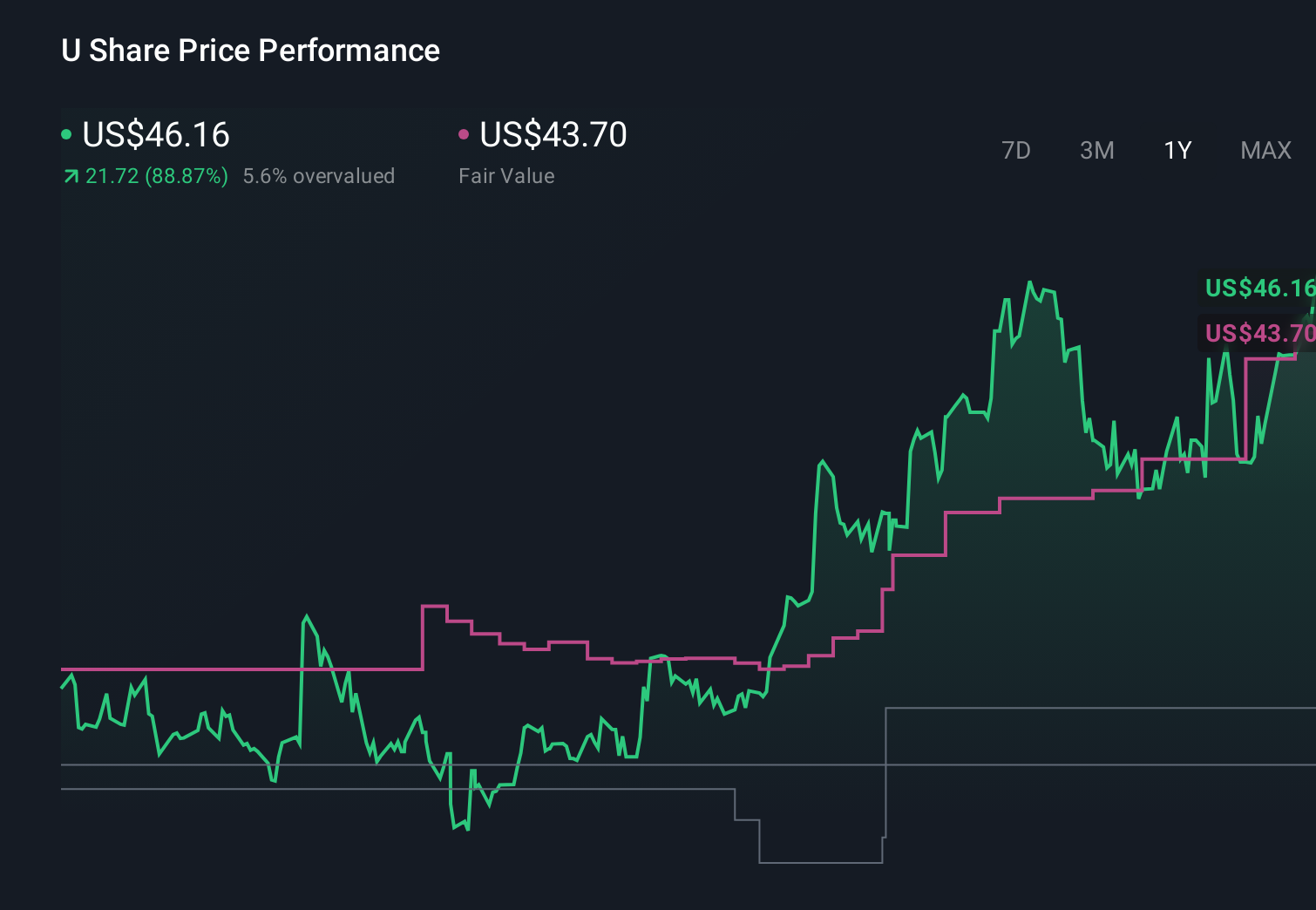

- Unity Software (NYSE:U) reported strong quarterly results, supported by its Vector advertising platform.

- Vector has now recorded three consecutive quarters of mid teen sequential revenue growth.

- Bernard Kim has been appointed to a key leadership role, while several founders and a long serving director have left the board.

- Unity is pushing ahead with AI integration and platform upgrades, alongside efforts to streamline operations.

Unity sits at the intersection of real time 3D content, gaming and advertising, so the performance of its Vector ad business matters for how you think about its broader ecosystem. The consistent mid teen sequential revenue growth in Vector over three quarters gives investors a concrete data point on how the monetization side of the story is developing.

At the same time, the leadership shake up and focus on AI tools signal that Unity Software (NYSE:U) is in a period of change that goes beyond a single quarter. For investors, the key questions now center on how governance shifts, AI efforts and operational simplification might influence Unity’s product mix and revenue drivers in the future.

Stay updated on the most important news stories for Unity Software by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Unity Software.

For Unity, the latest quarter is as much a leadership and direction story as it is a numbers update. Revenue of US$503.09 million for Q4 and a smaller net loss of US$89.96 million show a business that is still loss making but working to tighten up its model while leaning on Vector as a key growth engine. The new Q1 2026 revenue outlook of US$480 million to US$490 million sets expectations for a cooler start to the year, which helps frame how much of the recent Vector strength might be offset by softer trends elsewhere.

How This Fits Into The Unity Software Narrative

- The stronger quarter for Vector and renewed growth in Create align with the idea that AI powered tools and broader adoption of Unity’s engine can support revenue growth and gradually improve earnings stability.

- Ongoing losses of US$402.77 million for the full year and continued investment in AI tools and new markets highlight the execution and cost risks that the narrative already raises, especially as Unity pushes into non gaming verticals where adoption is less certain.

- The shake up in the board, including the arrival of Bernard Kim and founder departures, along with the planned retirement of the Chief Accounting Officer, adds a governance and execution angle that is not fully captured in the earlier focus on product rollouts and partnerships.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Unity Software to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Unity reported a full year 2025 net loss of US$402.77 million and continues to post quarterly losses, so the path to sustained profitability is still uncertain.

- ⚠️ Leadership turnover at both board and accounting levels introduces transition risk, particularly as Unity competes with larger players like Epic Games and Roblox with their own engines and ecosystems.

- 🎁 Vector has delivered three straight quarters of mid teen sequential revenue growth, which indicates that Unity’s AI powered ad tools are gaining traction with advertisers.

- 🎁 Create posted its fastest year over year growth in more than two years, including strong momentum in China, which supports the idea of a more diversified revenue base beyond a single region or segment.

What To Watch Going Forward

From here, investors may want to see whether Unity can keep Vector’s momentum while lifting overall margins, especially as the legacy IronSource ad network becomes less material. The company’s guidance for flat revenue in Grow Solutions and double digit growth in Create provides a reference point that investors can compare against future quarters. Leadership changes, including Bernard Kim joining the board and the search for a new Chief Accounting Officer, will influence how Unity sets priorities in AI powered tools, data usage, and cost discipline in comparison with competitors like Epic Games and Roblox. How consistently Unity delivers against its Q1 2026 guidance range of US$480 million to US$490 million will likely shape confidence in the broader multi year story.

To stay up to date on how the latest news affects the investment narrative for Unity Software, head to the community page for Unity Software to follow the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to develop, deploy, and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.