- United States

- /

- Software

- /

- NYSE:U

Does Unity’s New Global Commerce and Android XR Support Shift the Bull Case for Unity (U)?

- Unity Software recently announced new enhancements to the Unity engine, allowing developers to manage global commerce and catalogs from a unified dashboard, and confirmed the general availability of Android XR support in Unity 6, expanding immersive experiences in collaboration with Google and Samsung.

- These releases streamline monetization across platforms and open new opportunities for developers to reach wider audiences as the digital commerce landscape grows increasingly complex.

- We'll examine how Unity's launch of unified global commerce and Android XR support shapes the company's investment narrative and future growth potential.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Unity Software Investment Narrative Recap

For investors, the appeal of Unity hinges on the belief that continued product innovation, especially in cross-platform tools and immersive technologies, will set the stage for improved revenue growth and, eventually, a path to profitability. The recent launch of unified global commerce and Android XR support promises to accelerate adoption and monetization opportunities, but does not materially shift the biggest short-term catalyst: how quickly and sustainably Unity’s new AI-powered ad and 3D creation platforms can scale. The main risk remains persistently high expenses and an unproven ability to convert topline momentum into net margin improvements.

Among the recent news, Unity’s announcement of Android XR support in Unity 6 is the most relevant, as it demonstrates Unity’s positioning at the intersection of gaming, immersive content, and device ecosystems. This integration with Android XR, backed by collaborations with Google and Samsung, directly supports Unity’s push to broaden its developer and user base, an important element in driving the scalable growth necessary to address profitability challenges.

Yet, even with expanding technical partnerships and new product rollouts, investors should be aware that Unity’s cost structure still puts pressure on…

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million earnings increase from current earnings of -$433.9 million.

Uncover how Unity Software's forecasts yield a $36.87 fair value, in line with its current price.

Exploring Other Perspectives

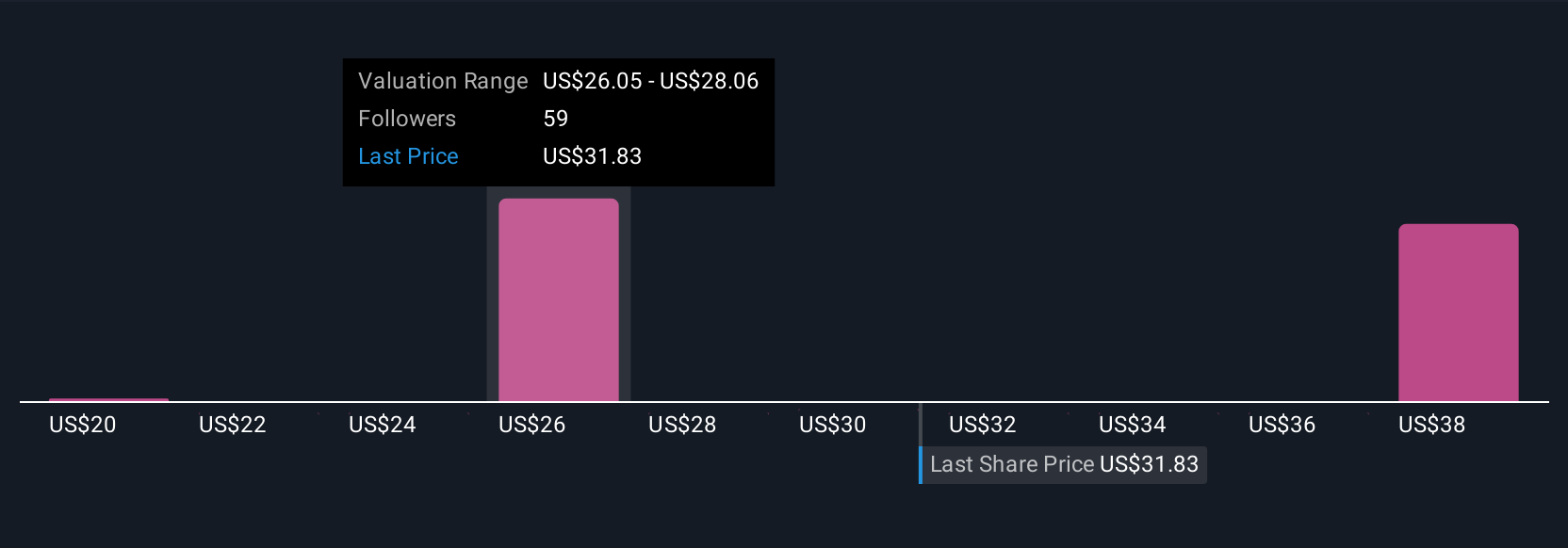

Simply Wall St Community members set fair values for Unity Software from US$20.31 to US$44 based on seven different analyses. While Unity’s expansion in immersive platforms may excite some, concerns about sustained operating losses remain key when comparing these varied viewpoints.

Explore 7 other fair value estimates on Unity Software - why the stock might be worth as much as 21% more than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to develop, deploy, and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.