- United States

- /

- IT

- /

- NYSE:TWLO

Why Twilio (TWLO) Is Up 17.7% After Raising Revenue Outlook and Announcing Stytch Acquisition

Reviewed by Sasha Jovanovic

- Twilio recently reported third-quarter 2025 earnings, posting revenues of US$1.30 billion and a net income of US$37.25 million, and raised its full-year revenue growth outlook to 12.4%-12.6% from its previous guidance of 10%-11%.

- The company also announced the completion of a substantial share buyback and the planned acquisition of Stytch, Inc., signaling increased capital returns and expansion into identity solutions for AI agents.

- With Twilio raising its revenue forecasts, we’ll examine how these improved expectations may affect the company’s long-term outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Twilio Investment Narrative Recap

To be a Twilio shareholder today is to believe in its ability to capture the ongoing shift toward AI-powered, programmable communications and to gradually expand into higher-margin software and identity solutions. The recent swing to profitability and upgraded revenue guidance have provided a near-term catalyst, but margin pressure from a growing mix of low-margin messaging revenue and rising carrier fees remains the key risk that could limit long-term earnings growth.

Among Twilio's many recent announcements, the definitive agreement to acquire Stytch, Inc. is especially relevant. This move positions Twilio to further expand its offering in identity solutions for AI agents, potentially deepening customer engagement and capturing value from growing automation trends tied to its biggest catalysts.

In contrast, investors should also be aware of the persistent challenge of rising carrier fees eating into margins, especially as...

Read the full narrative on Twilio (it's free!)

Twilio's outlook anticipates $5.9 billion in revenue and $449.9 million in earnings by 2028. This requires 7.9% annual revenue growth and an increase in earnings of about $429.7 million from the current $20.2 million.

Uncover how Twilio's forecasts yield a $135.25 fair value, a 3% upside to its current price.

Exploring Other Perspectives

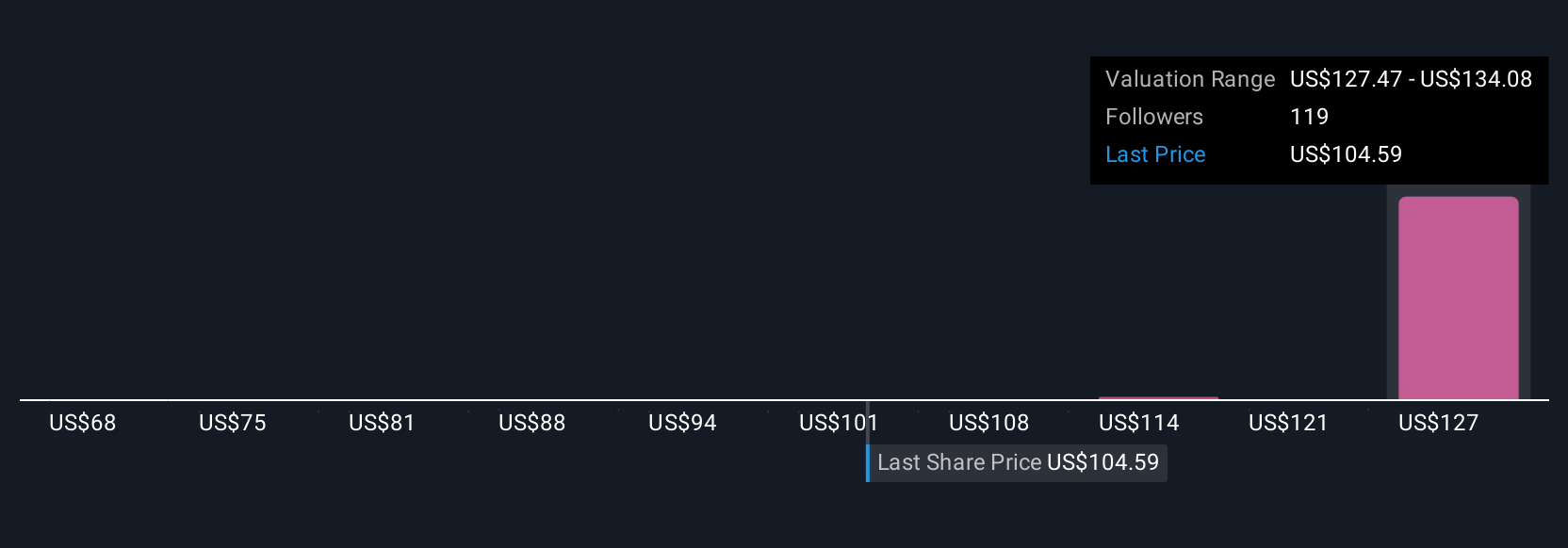

Six fair value estimates from the Simply Wall St Community range from US$68 to US$135.25. While some see significant upside potential, ongoing margin pressures from messaging revenue mix highlight the importance of questioning how Twilio can sustain earnings growth over time.

Explore 6 other fair value estimates on Twilio - why the stock might be worth as much as $135.25!

Build Your Own Twilio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twilio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twilio's overall financial health at a glance.

No Opportunity In Twilio?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives