- United States

- /

- IT

- /

- NYSE:TWLO

Is Twilio’s Recent Rally and New Partnerships a Sign of Hidden Value in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Twilio is truly worth its current price, or if there's hidden value the market hasn't noticed yet? You're in the right place for answers.

- The stock has been on a rollercoaster, jumping 12.8% over the last month and up 39.9% in the past year. This signals renewed investor interest and growth potential.

- Recent headlines have focused on Twilio's strategic partnerships and product updates, as well as changes in its leadership team. These moves have added fresh momentum and sparked speculation about the company’s next direction.

- Right now, Twilio scores 3 out of 6 on our valuation checklist, indicating it is undervalued in half of the key areas we assess. Next, we will break down how investors typically value Twilio. At the end, we will share a smarter way to uncover potential opportunities others might miss.

Approach 1: Twilio Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by forecasting a company’s future cash flows and then discounting them back to their present value. This provides a data-driven estimate of what the business is intrinsically worth today, based on expected performance in coming years.

For Twilio, the most recent twelve months yielded Free Cash Flow (FCF) of $714 million. Looking ahead, analysts estimate FCF to rise steadily, with projections reaching $1.01 billion by 2026 and further growth to around $1.26 billion by 2029. While analysts typically only provide forecasts up to five years out, further projections have been extrapolated using internal calculations.

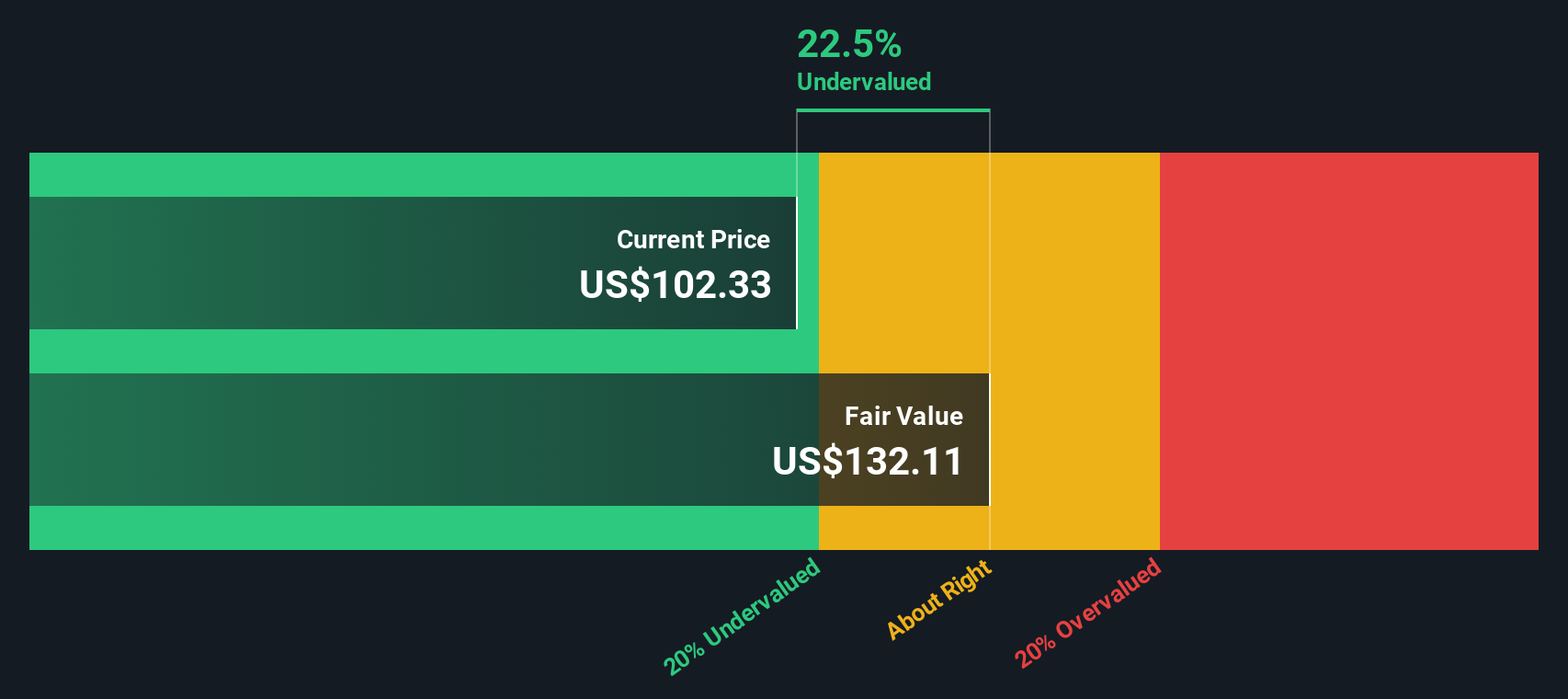

After running these forecasts through a two-stage DCF model, the estimated intrinsic value per share comes to $131. This figure is about 13.8 percent higher than the current market price, implying the stock is undervalued according to DCF methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Twilio is undervalued by 13.8%. Track this in your watchlist or portfolio, or discover 834 more undervalued stocks based on cash flows.

Approach 2: Twilio Price vs Sales

The Price-to-Sales (P/S) ratio is commonly used to value software companies like Twilio, especially when profits are minimal or volatile but revenue growth remains a key indicator of future potential. This metric is particularly helpful because it allows investors to compare how much the market is willing to pay for each dollar of revenue, providing insight into growth expectations even before sustained profitability is achieved.

In general, a company with faster expected growth or lower risks will warrant a higher P/S ratio, as investors are willing to pay a premium for that upside. On the other hand, higher risks or slower growth will typically result in a lower "normal" or "fair" P/S multiple.

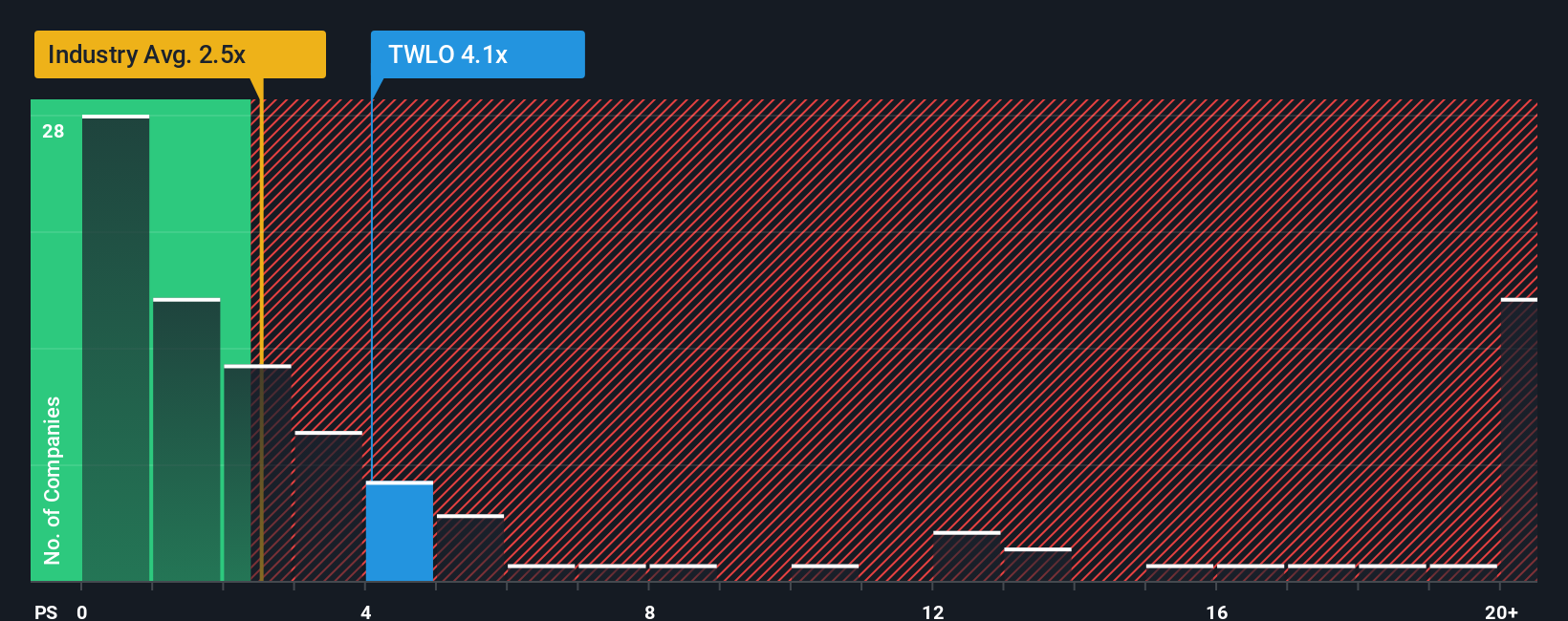

Currently, Twilio trades at a P/S ratio of 3.66x. That compares to an industry average of 2.66x and a peer average of 6.34x. However, raw comparisons do not tell the whole story. Many factors such as growth outlook, profit margins, competitive position, and company size should come into play when judging value.

This is where Simply Wall St's "Fair Ratio" becomes invaluable. The Fair Ratio, which stands at 4.67x for Twilio, is designed to factor in the company's expected earnings growth, industry context, profit margin, market cap, and risk profile. That makes it a much more tailored benchmark than simply using industry or peer averages, which can miss company-specific strengths or weaknesses.

Because Twilio's actual P/S is close to its Fair Ratio, only about 1x lower, the stock appears to be valued about right based on this approach.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Twilio Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story and perspective on a company like Twilio, paired with your own expectations for its future revenue, earnings, and profit margins. This bridges the gap between "the numbers" and your investment thesis by directly linking the company's background and catalysts to a concrete financial forecast and an up-to-date fair value.

Narratives are easy to create and visualize within the Simply Wall St Community page, trusted by millions of investors to make smarter stock decisions. By mapping your Narrative to a fair value, you can instantly compare that number to the current market price and see if Twilio looks undervalued, fully priced, or overvalued to you. Even better, Narratives update dynamically whenever new news, financial results, or major developments emerge, keeping your view relevant in real time.

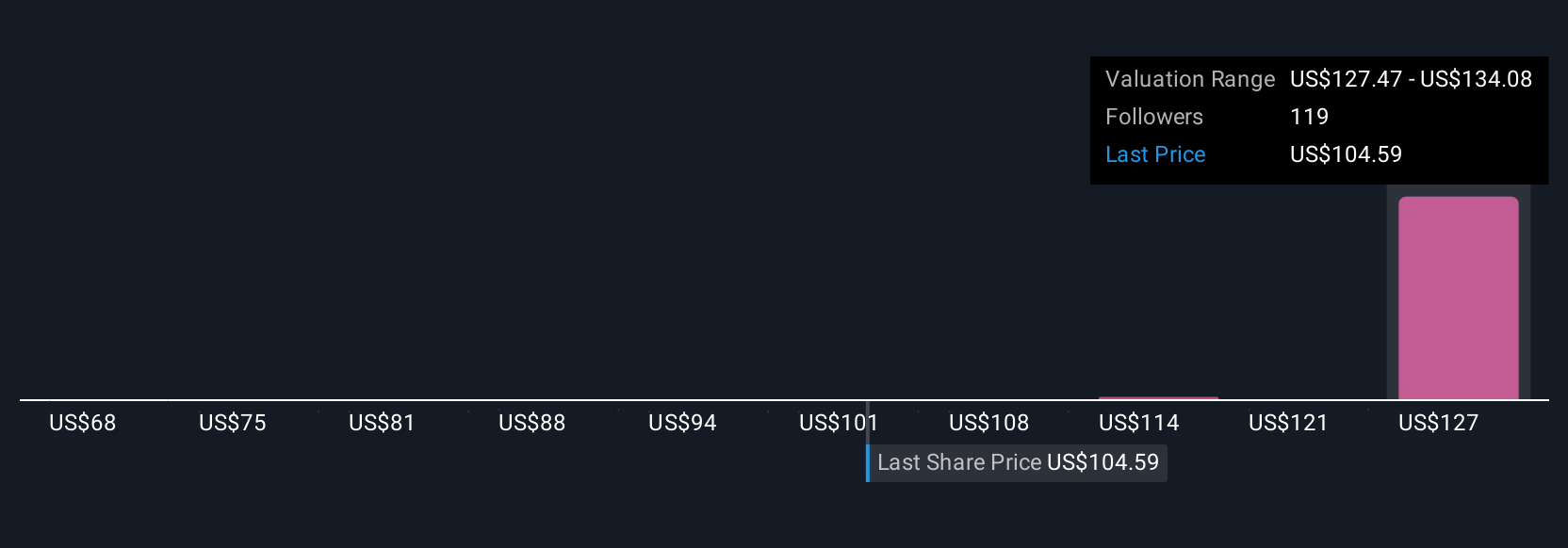

For example, some Twilio Narratives project a fair value as high as $130.88, assuming AI, global expansion, and product innovation will drive sustained earnings. Others take a much more cautious approach, seeing a fair value closer to $68, based on concerns about profitability and competitive risks. Narratives empower you to invest in the story and the numbers that make sense for you.

For Twilio, we will make it really easy for you with previews of two leading Twilio Narratives:

- 🐂 Twilio Bull Case

Fair Value: $130.88

Current discount to fair value: 13.8%

Forecast revenue growth: 7.9%

- AI-driven communications, product innovation, and global expansion are expected to fuel higher-margin revenue growth and customer engagement.

- Analysts project a near-doubling in profit margins within three years and substantial earnings growth, supporting a consensus price target notably above today’s share price.

- Risks include ongoing pressure on margins from low-margin messaging revenue, regulatory complexity, and fierce industry competition.

- 🐻 Twilio Bear Case

Fair Value: $68.00

Current premium to fair value: 66.1%

Forecast revenue growth: 24.1%

- Twilio lacks consistent profitability, a strong competitive moat, and currently trades at a valuation well above what value-focused investors, like Warren Buffett, would consider safe.

- The rapidly changing tech landscape and speculative nature of the business introduce significant uncertainty and risk for long-term conservative investors.

- Buffett-style investors may only reconsider if Twilio achieves sustained GAAP profitability or trades at a much lower valuation in the future.

Do you think there's more to the story for Twilio? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives