- United States

- /

- IT

- /

- NYSE:TWLO

Is Now the Right Time to Reassess Twilio After Its Recent 55.6% One Year Rally?

Reviewed by Bailey Pemberton

If you have been tracking Twilio lately, you know the stock has kept everyone guessing. Maybe you are wondering if now is the time to double down or finally take some profits off the table. After all, Twilio’s share price recently closed at $110.82, up an impressive 4.3% just in the past week and 7.1% over the last month. The yearly return is even more eye-catching at 55.6%. However, longer-term investors are still nursing wounds from a 61.6% drop over five years.

So what has sparked this recent momentum? Analysts and investors have noticed that Twilio's evolving strategy, especially as the company sharpens its focus on customer engagement and retools its product roadmap, has led to a renewed sense of optimism. News of fresh partnerships and a streamlined cost structure have also helped shift risk perceptions, fueling short-term gains. While there are still concerns about profitable growth, the market seems to be warming up to Twilio’s prospects again.

With all these moving parts, valuation has become the hot topic. Twilio currently sports a value score of 3 out of 6, meaning it ranks as undervalued in half of the key valuation checks used by analysts. But what exactly goes into that score, and does it tell the whole story? Up next, I will break down these different valuation approaches, showing how each one paints a unique picture of Twilio’s worth. And stick around, because I will share a smarter way to interpret all this data before we wrap up.

Approach 1: Twilio Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting all future cash flows and then discounting them back to today's dollars. This provides a present value of the business and gives investors a way to judge whether a stock is trading above or below its calculated intrinsic worth.

For Twilio, the DCF model uses a “2 Stage Free Cash Flow to Equity” approach. In the last twelve months, the company generated $714.3 million in free cash flow. Analyst estimates chart this growing steadily, with projections reaching $1,007.4 million by 2026 and $1,264.2 million by 2029. Beyond that, further growth is projected using conservative assumptions, bringing free cash flow estimates to approximately $1.62 billion by 2035. All figures are in US dollars.

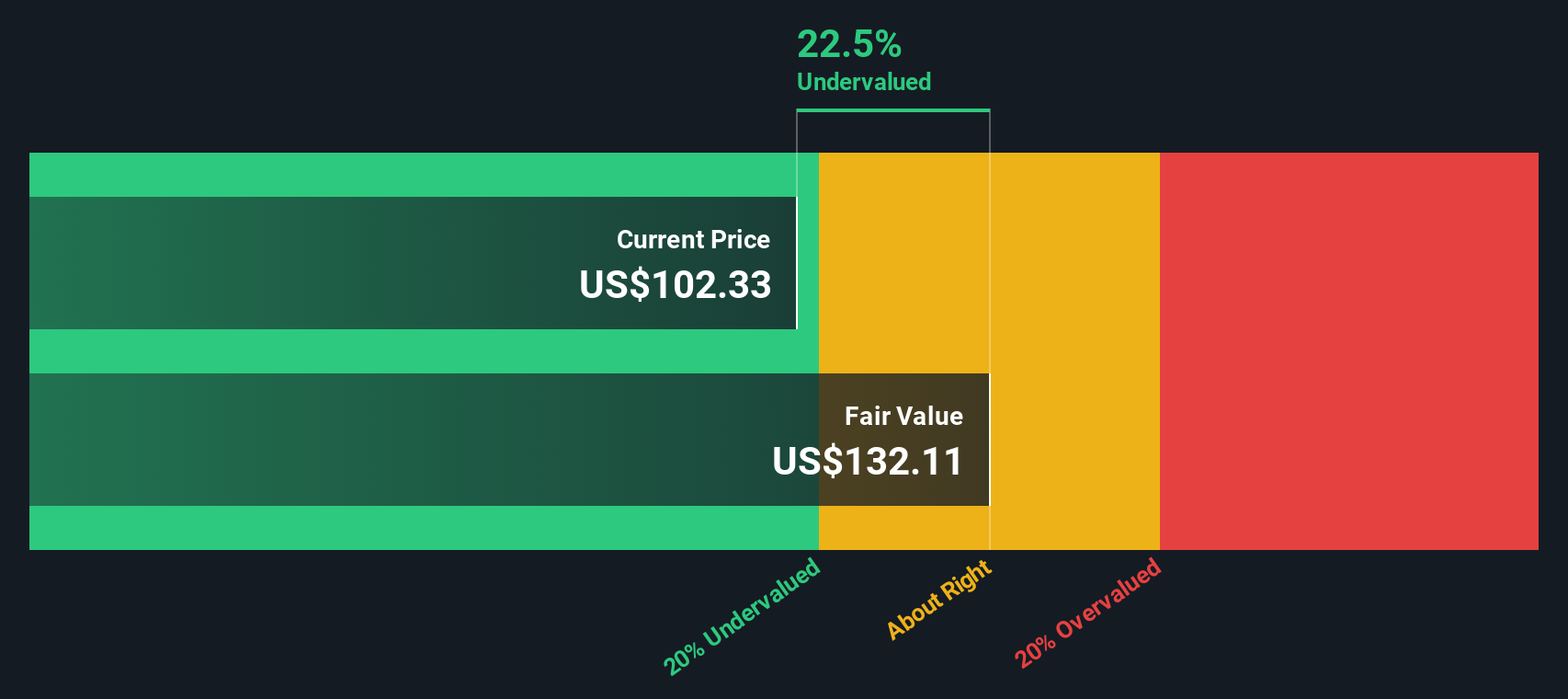

The calculation results in an intrinsic value of about $132.15 per share, which sits 16.1% above Twilio’s recent closing price. This suggests the market might be undervaluing Twilio relative to its long-term cash generation potential, based on these forecasts and assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Twilio is undervalued by 16.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Twilio Price vs Sales

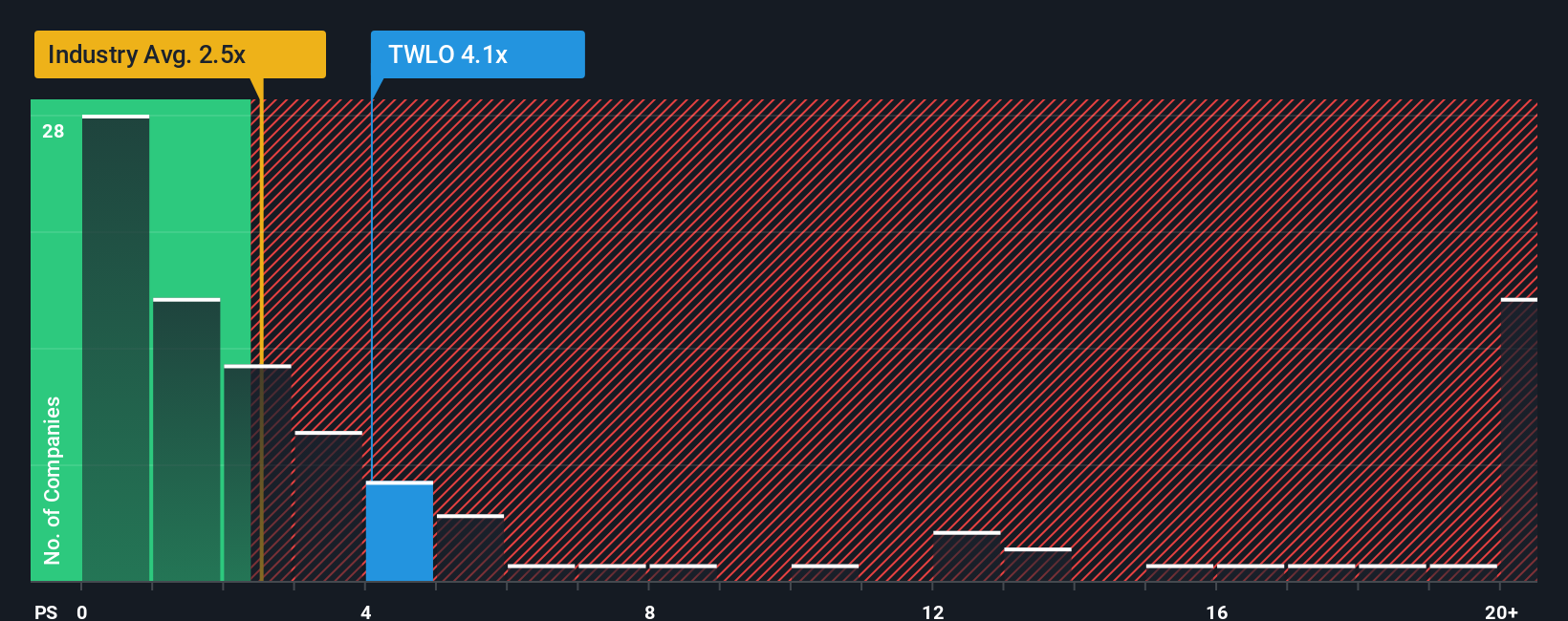

The price-to-sales (P/S) ratio is a popular valuation metric for companies like Twilio, where profitability may not yet be consistent but revenue growth is strong and central to the business model. By measuring how much investors are willing to pay for each dollar of sales, the P/S ratio helps you compare companies regardless of their profitability. This makes it especially useful for high-growth technology firms.

Twilio is currently trading at a P/S ratio of 3.60x. For context, the average P/S across the IT industry is 2.78x, while the average P/S among Twilio’s listed peers is significantly higher at 6.69x. A P/S ratio above the industry average can reflect higher growth expectations or lower perceived risk, but it can also signal heightened risk if not supported by fundamentals.

This is where Simply Wall St’s Fair Ratio is relevant. Unlike a simple comparison against peers or the industry, the Fair Ratio considers Twilio’s earnings growth potential, industry positioning, profit margins, market capitalization and specific risk factors. It sets an expectation for a fair multiple by factoring in much more than headline growth. Right now, Twilio’s Fair Ratio is 4.67x compared to its actual 3.60x P/S, suggesting the stock is priced below where it could reasonably trade given its outlook and risk profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Twilio Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, the way you connect its business model, future plans, and the latest news or events to a set of key assumptions, like revenue growth, profit margins, and ultimately fair value. Instead of just looking at analyst forecasts or static models, a Narrative lets you build your own perspective, linking Twilio’s evolving strategy or new product launches with the numbers that matter most to valuation.

Narratives make it easy to track your thinking and see how changes in the real world might move your fair value up or down. As new news or earnings are released, your Narrative’s valuation updates automatically, helping you decide whether Twilio’s current share price is above, below, or right in line with your expectations. Best of all, Narratives are available right now in Simply Wall St’s Community page, where millions of investors share and compare their views every day.

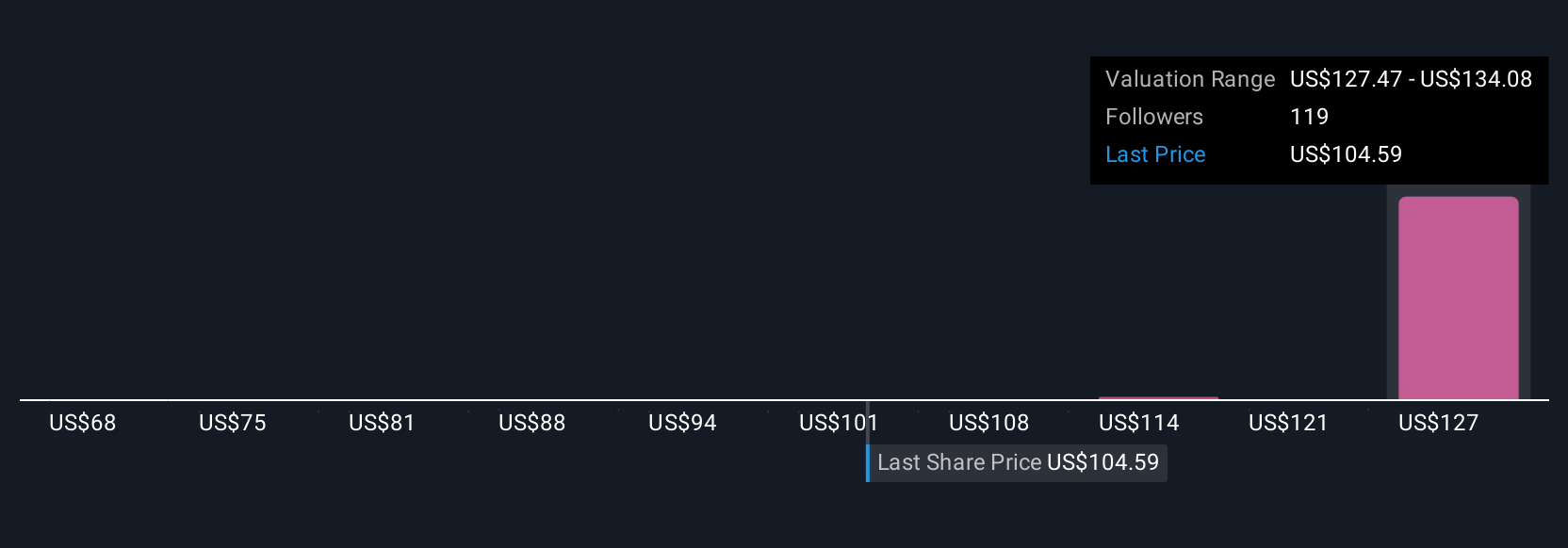

For Twilio, this means you might find one Narrative forecasting a fair value of $68 based on slower software growth and persistent risk, while another sees a fair value of $131 thanks to strong AI-driven expansion and margin improvements, allowing you to choose the view that matches your own convictions.

For Twilio, we'll make it really easy for you with previews of two leading Twilio Narratives:

Fair value: $130.88

Undervalued by approximately 15%

Forecast revenue growth: 7.85%

- Twilio’s expansion in AI-powered and omnichannel communication tools is driving higher-margin, sustainable revenue growth by deepening customer engagement and broadening its market.

- Ongoing product innovation, greater international focus, and tighter operational discipline are improving customer retention, diversifying revenue streams, and expanding profit margins and cash flow.

- Key risks include margin pressure from low-margin revenues, regulatory requirements, fierce AI and cloud competition, and potential challenges in shifting the business mix toward higher-margin software.

Fair value: $68.00

Overvalued by approximately 63%

Forecast revenue growth: 24.14%

- Twilio lacks a track record of consistent profitability and has less predictable earnings, making it unattractive to more conservative, value-focused investors.

- The company's tech-centric model operates in a fiercely competitive and rapidly evolving sector with a less durable competitive moat than classic value stocks.

- Current valuation does not offer a clear margin of safety, and the investment case appears overly speculative for risk-averse, long-term investors.

Do you think there's more to the story for Twilio? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives