- United States

- /

- IT

- /

- NYSE:TWLO

A Look at Twilio’s (TWLO) Valuation Following Profitable Q3 and Upgraded 2025 Outlook

Reviewed by Simply Wall St

Twilio (TWLO) shares soared nearly 20% after the company reported a profitable third quarter, reversing last year’s loss. Revenue climbed 15% compared to the prior year, and management raised its full-year growth outlook for 2025.

See our latest analysis for Twilio.

Twilio’s upbeat earnings and raised outlook sparked the recent surge, but it’s not just a one-day story. With a share repurchase program, fresh AI acquisitions, and expanding partnerships such as the Vodafone Spain deal, momentum has been building. While the 1-year total return stands at an impressive 46.5%, even after some bumps earlier in the year, the stock’s latest 26% one-month share price return points to renewed investor confidence in Twilio’s long-term prospects.

If this rebound has you thinking about other leaders in tech, now’s a perfect time to discover See the full list for free.

With Twilio’s stellar results and growth initiatives grabbing headlines, investors are left wondering if there is still value to uncover here, or if the recent surge has already factored in the company’s brighter future.

Most Popular Narrative: 3.9% Undervalued

Twilio’s last close of $129.97 sits just below the fair value of $135.25 estimated by the most closely followed market narrative. This hints at modest potential upside driven by recent business momentum and future projections.

Growing adoption of AI-powered communications and automation is fueling incremental demand for Twilio's programmable infrastructure and platform products (e.g., ConversationRelay, conversational intelligence). This is expanding the company's addressable market and driving higher-margin revenue growth, which supports future revenue and net margin expansion.

Curious what assumptions power this upbeat valuation? The narrative is built on bolder revenue growth, fatter margins, and big bets on long-term software adoption. What profit trajectory has analysts this excited? Read on for the full reveal behind these numbers.

Result: Fair Value of $135.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concerns remain that persistent low-margin messaging and regulatory challenges could limit Twilio’s margin gains and slow overall profit growth.

Find out about the key risks to this Twilio narrative.

Another View: What Do Sales Multiples Signal?

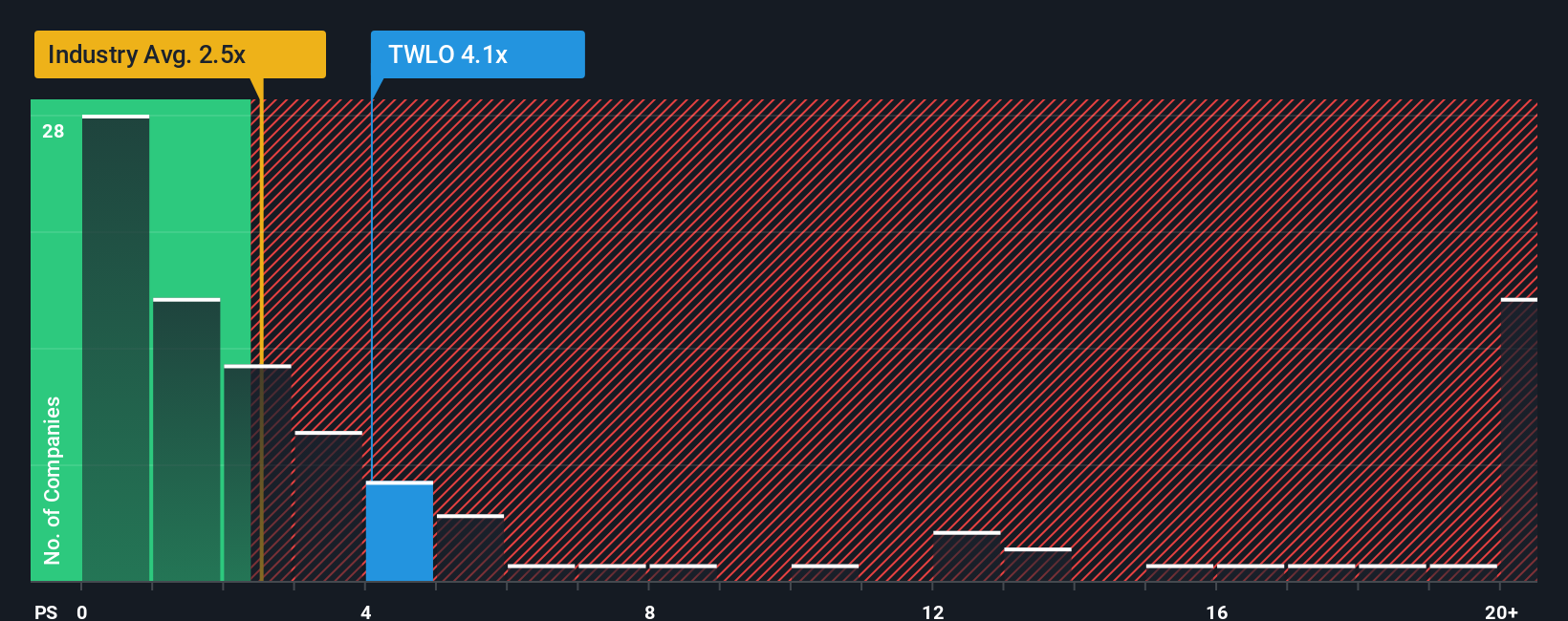

Looking at Twilio’s price-to-sales ratio offers an interesting contrast. At 4x, it is pricier than the US IT industry’s 2.5x average, but compares favorably to peer averages of 9x. The fair ratio is 5.2x, suggesting the market could shift. Does this difference point to a risky premium or a window of opportunity for value hunters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Twilio Narrative

If you see things differently or want to dig deeper into the numbers, you can build your own take on Twilio in just minutes. Do it your way

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to uncover other potential winners in today’s market. Expand your search and outpace the crowd with these tailored stock picks:

- Amplify your gains by targeting companies with standout yields. Start with these 20 dividend stocks with yields > 3% among leading options delivering over 3% returns.

- Stay ahead of the curve on transformative tech breakthroughs by spotting prime movers through these 28 quantum computing stocks as quantum computing heats up.

- Snap up possibly overlooked bargains with real upside using these 841 undervalued stocks based on cash flows to pinpoint stocks priced below their long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives