- United States

- /

- Software

- /

- NYSE:TUYA

Improved Revenues Required Before Tuya Inc. (NYSE:TUYA) Stock's 26% Jump Looks Justified

Despite an already strong run, Tuya Inc. (NYSE:TUYA) shares have been powering on, with a gain of 26% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

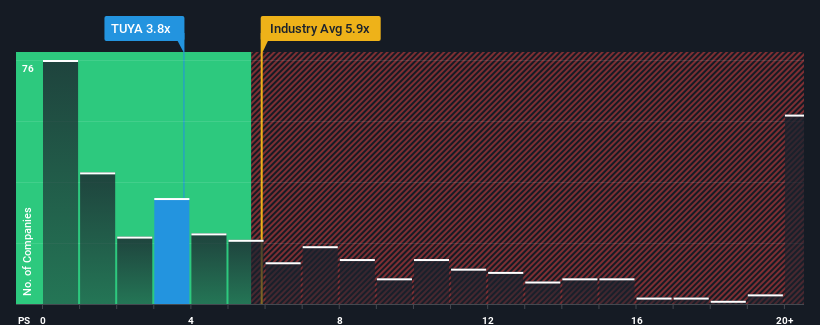

Although its price has surged higher, Tuya may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.8x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.8x and even P/S higher than 13x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Tuya

What Does Tuya's P/S Mean For Shareholders?

Recent times have been advantageous for Tuya as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tuya.Is There Any Revenue Growth Forecasted For Tuya?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tuya's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 3.2% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 19% as estimated by the seven analysts watching the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Tuya's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Tuya's P/S?

Tuya's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Tuya maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Tuya with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives