- United States

- /

- Software

- /

- NYSE:TDC

Teradata (TDC) Margin Expansion Reinforces Bull Case Despite Weak Growth Outlook

Reviewed by Simply Wall St

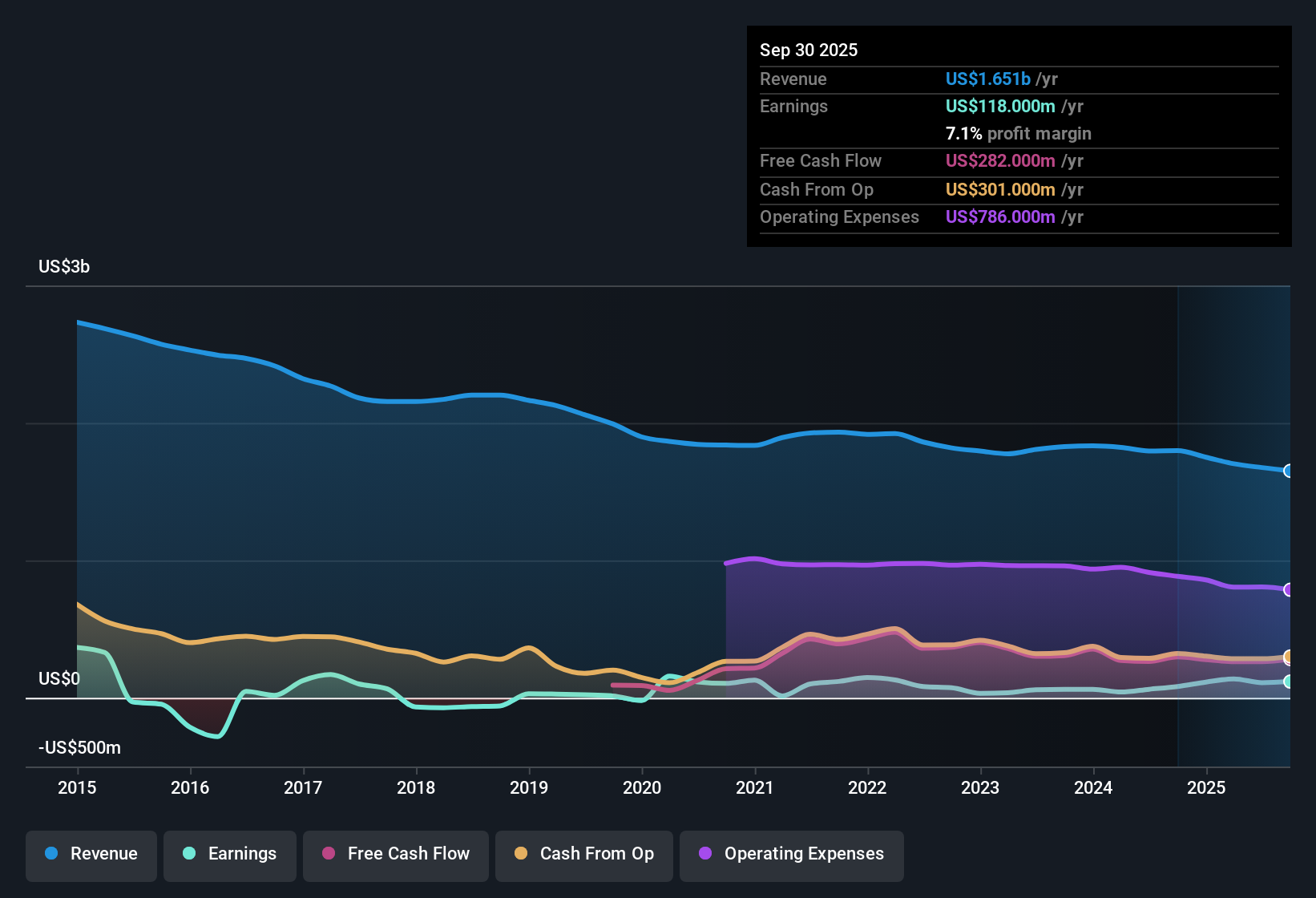

Teradata (TDC) delivered earnings growth of 77.4% over the past year, a sharp turnaround from its five-year average annual decline of 2.4%. Net profit margins hit 6.6%, up from 3.5% a year prior, signaling clear progress in profit quality. While these gains stand out, forecasts for annual revenue and earnings growth remain muted versus the broader US market, setting up an interesting dynamic for investors now seeing the stock trade at $27.46, which is well below its $56.90 fair value estimate.

See our full analysis for Teradata.Next up, we’ll weigh these results against the most widely followed narratives, spotlighting where Teradata’s story matches market expectations and where it might diverge.

See what the community is saying about Teradata

Margin Expansion Beats Peer Trends

- Profit margins reached 6.6%, nearly doubling from last year's 3.5%. Analysts predict margins will moderate to 6.2% over the next three years, signaling that margin gains may be peaking even as they currently outpace the company's own long-term averages.

- Consensus narrative notes that ongoing organizational streamlining and an increasing mix of recurring revenue should promote continued margin improvement and operating leverage.

- Recent focus on higher-margin product innovation and strategic partnerships is expected to further enhance profitability beyond short-term trends.

- Still, the narrative acknowledges persistent top-line pressures and rising competition could limit further expansion. Sustaining these higher margins hinges on defending share in a tightening market.

Recurring Revenue Faces Headwinds

- Analysts expect Teradata's annual revenue growth to slow to just 0.6% per year, much weaker than the US market's 10.5%. They project actual total revenue will even decline by 0.9% annually for the next three years.

- Consensus narrative identifies that, while the hybrid cloud platform and enterprise AI demand are expanding Teradata's addressable market, cloud ARR growth has relied more on migration within the existing base rather than net-new wins.

- The decline in services revenue, down 19 to 20% year-over-year, points to structural pressures that may reduce operational flexibility and limit upside from recurring revenue streams.

- Ongoing competitive threats from hyperscale and open-source solutions could challenge retention, margin stability, and reinforce these revenue headwinds.

Valuation Implies Deep Discount to DCF

- Teradata trades at $27.46, a 52% discount to its DCF fair value of $56.90, and has a price-to-earnings ratio of 23.6x compared to peer and industry averages above 35x.

- Consensus narrative contends that, despite slow growth expectations, the current valuation may present a compelling risk-reward tradeoff for patient investors willing to look past near-term headwinds.

- Even with analyst price targets set at $25.22, below the market price, some see improved earnings quality and operating leverage as not fully appreciated in the valuation.

- However, for the market to rerate the stock closer to DCF fair value, Teradata must demonstrate clearer evidence of sustainable sales growth against industry competitors.

- For investors debating if Teradata's valuation gap is opportunity or trap, the full consensus narrative digs deeper into how margin gains and structural challenges play out over the next cycle. 📊 Read the full Teradata Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Teradata on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these figures tell a different story to you? In just a few minutes, you can build and share your own perspective. Do it your way.

A great starting point for your Teradata research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite margin improvements, Teradata faces slowing top-line growth, recurring revenue pressures, and ongoing competition that threaten longer-term consistency.

If you’re looking for companies with proven performance and fewer growth headwinds, focus on steady long-term performers using stable growth stocks screener (2083 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives