- United States

- /

- Software

- /

- NYSE:TDC

Teradata Corporation Just Missed Earnings And Its EPS Looked Sad - But Analysts Have Updated Their Models

Teradata Corporation (NYSE:TDC) missed earnings with its latest third-quarter results, disappointing overly-optimistic analysts. It wasn't a great result overall - while revenue fell marginally short of analyst estimates at US$459m, earnings missed forecasts by an incredible 46%, coming in at just US$0.09 per share. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent forecasts to see whether analysts have changed their earnings models, following these results.

Check out our latest analysis for Teradata

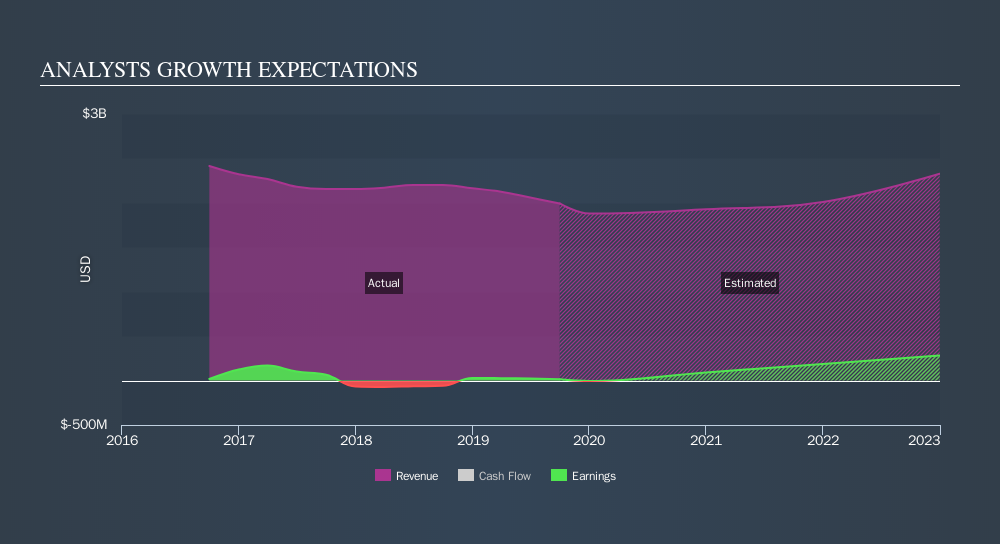

After the latest results, the consensus from Teradata's 17 analysts is for revenues of US$1.9b in 2020, which would reflect a small 3.3% decline in sales compared to the last year of performance. Earnings per share are expected to surge 351% to US$0.55. Before this earnings report, analysts had been forecasting revenues of US$2.0b and earnings per share (EPS) of US$1.23 in 2020. From this we can that analyst sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a pretty serious reduction to earnings per share estimates.

The consensus price target fell 22% to US$31.53, with the weaker earnings outlook clearly leading analyst valuation estimates. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Teradata, with the most bullish analyst valuing it at US$60.00 and the most bearish at US$19.00 per share. With such a wide range in price targets, analysts are almost certainly baking in outcomes as diverse as total success and probable failure in the underlying business. With this in mind, we wouldn't assign too much meaning to the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether analysts are more or less bullish relative to other companies in the market. One more thing stood out to us about these estimates, and it's the idea that Teradata's decline is expected to accelerate, with revenues forecast to fall 3.3% next year, topping off a historical decline of 6.2% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue decline 12% per year. So it's pretty clear that, while it does have declining revenues, analysts also expect Teradata to suffer worse than the wider market.

The Bottom Line

The biggest highlight of the new consensus is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Teradata. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider market. Analysts also downgraded their price target, suggesting that the latest news has led analysts to become more pessimistic about the intrinsic value of the business.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Teradata going out to 2022, and you can see them free on our platform here..

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives