- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Square, Inc.'s (NYSE:SQ) ROE is High but it Comes at a Cost

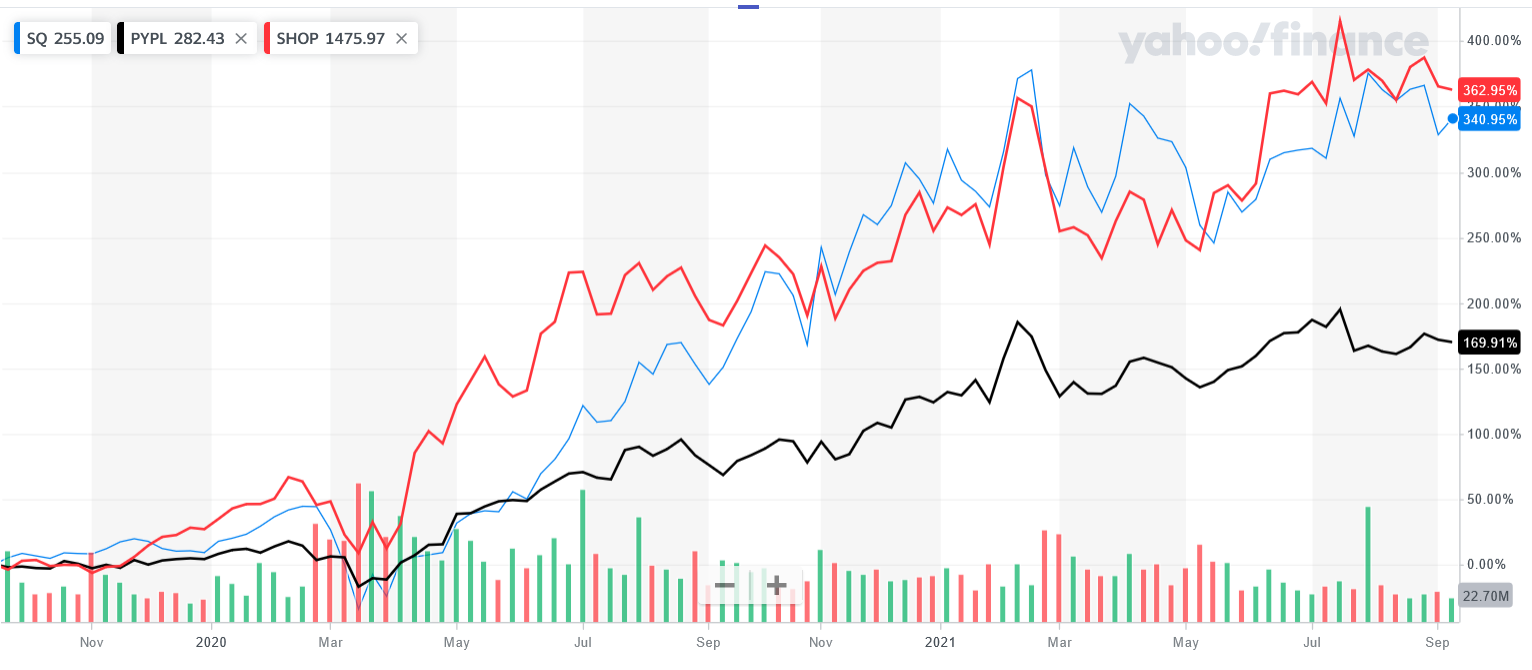

It is no secret that Square, Inc . (NYSE: SQ)did very well lately, outperforming its peers and the broad market. While the company remains growing, it is facing challenges from both the current and new competitors.

In this article, we will look at the return on equity (ROE) and see where it stands at the current valuation.

View our latest analysis for Square

Trying to Stay One Step Ahead

Amazon is allegedly working on a new point-of-sale (POS) system that can be old to third-party sellers. This system will handle both online and offline transactions and integrate with services like Prime and Flex. While the company keeps silent about the project so far, it will allow them to compete with established players like Square, Shopify ( NYSE: SHOP ), or PayPal ( NASDAQ: PYPL ).

Meanwhile, Square just announced that the sellers would be able to accept payment through Cash App Pay. This will allow a new contactless payment method for online and in-person transactions, as customers will scan the seller's QR code at the checkout. This option is adding variety for over 70 million active customers and will further reduce the cashout friction.

Hedgeye, a research platform known for their entertaining market-related comics , added Square as a top bullish idea – quoting the business model suitable for the current macro environment, disruptive potential, and a proven track record of successful execution.

Defining ROE

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money.

In other words, it is a profitability ratio that measures the rate of return on the capital provided by the company's shareholders.

How Is ROE Calculated?

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Square is:

21% = US$573m ÷ US$2.7b (Based on the trailing twelve months to June 2021).

The 'return' is the profit over the last twelve months. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.21 .

Does Square Have A Good ROE?

By comparing a company's ROE with its industry average, we can quickly measure how good it is.Importantly, this is far from a perfect measure because companies differ significantly within the same industry classification.

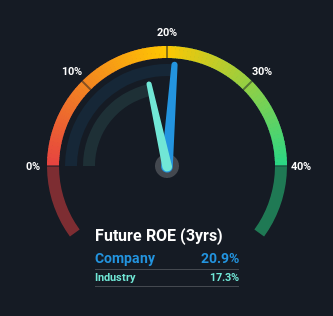

As you can see in the graphic below, Square has a higher ROE than the average (17%) IT industry.

That's what we like to see.However, bear in mind that a high ROE doesn't necessarily indicate efficient profit generation.Aside from changes in net income, a high ROE can also be the outcome of high debt relative to equity, indicating risk.

You can see the 4 risks we have identified for Square by visiting our risks dashboard for free on our platform.

The Importance Of Debt To Return On Equity

Most companies need money (from somewhere) to grow their profits.That cash can come from issuing shares, retained earnings, or debt.

In the first two cases, the ROE will capture this use of capital to grow.In the latter case, the debt used for growth will improve returns but won't affect the total equity.Thus the use of debt can improve ROE, albeit with an additional risk in the case of turmoils.

Combining Square's Debt And Its 21% Return On Equity

It's worth noting the high use of debt by Square, leading to its debt to equity ratio of 2.07.While its ROE is respectable, it is worth keeping in mind that there is usually a limit on how much debt a company can use.

Debt does bring additional risk, so it's only really worthwhile when a company generates decent returns.

Conclusion

Return on equity is a helpful indicator of the ability of a business to generate profits and return them to shareholders.In our books, the highest quality companies have a high return on equity, despite the low debt.

For example, PayPal ( NASDAQ: PYPL ) has a slightly higher ROE (23.3%) while simultaneously having a lower debt-to-equity ratio. You can check more details on our platform. Meanwhile, Shopify ( NYSE: SHOP ) has an ROE of 24.2% and a minuscule debt-to-equity ratio .

But ROE is just one piece of a bigger puzzle since high-quality businesses often trade on high multiples of earnings.Profit growth rates versus the expectations reflected in the price of the stock are vital to consider.

So it may be worth checking this free report on analyst forecasts for the company .

If you would prefer to check out another company with potentially superior financials, then do not miss this free list of interesting companies with a HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026